PublicOffering

Latest

Virgin Galactic is going public to fund its expensive tourist spaceflights

Space tourism company Virgin Galactic has announced that it will go public via a merger with an investment firm. Its new partner, Social Capital Hedosophia (SCH), will invest $800 million in exchange for a 49 percent stake and take Virgin Galactic public later in 2019 -- a first for a spaceflight company.

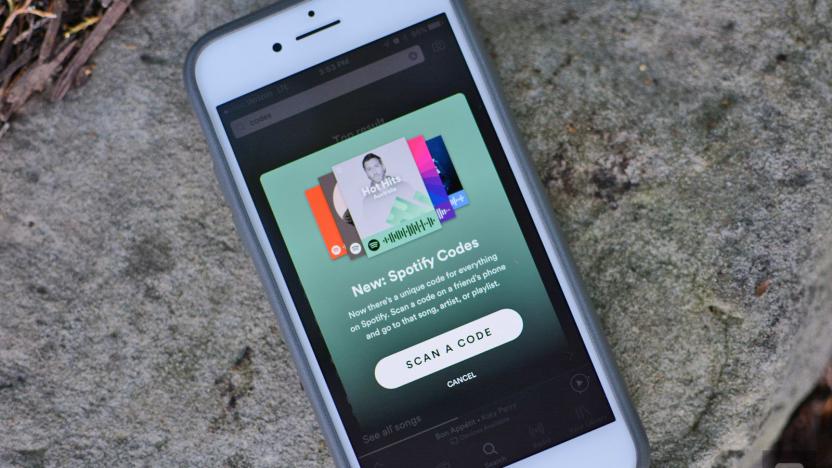

Spotify's public filing reveals key stats about the streaming giant

Spotify quietly signaled its intention to become a publicly traded company in December of last year, even though several lawsuits over licensing were looming. Now the streaming service has filed for a direct listing on the New York Stock Exchange, an alternative to the more typical initial public offering (IPO) that offers the company a savings on underwriting fees and a dilution of existing shares.

Facebook updates S-1, adds Q1 earnings, revenue up 45% over last year

Facebook just filed an amended S-1 (that all important document that officially announces its public offering plans) with some new financial info. Now included in the charts and graphs is everything you wanted to know about Q1 of 2012 at Facebook (but were afraid to ask). The new SEC filing reveals that revenues are way up at the social network over last year (a whopping 45 percent higher than Q1 of 2011), but down slightly from last quarter (six percent), settling at a more than respectable $1.058 billion. Of the cash it took in, $872 million of it was ad revenue, which is down from Q4 of 2011 ($943 million) but up significantly from Q1 of last year ($731 million). Facebook was even able to slap a per-user amount on its 900 million active monthly members -- $1.21 -- that's the average revenue for each person with an account at the site. Of course, membership has continued to grow, with 532 million stopping by daily, up from 372 million just a year ago. As for that Instagram purchase, it looks like the widely reported $1 billion figure wasn't entirely accurate -- at least not when talking cold, hard cash. Only $300 million was turned over in immediately spendable currency, the rest of the deal involved 23 million shares of common stock. If you're a sucker for financials hit up the source link.

Tesla Motors IPO coming 'any day' now, says report

Word on the street -- and by that we mean Reuters -- is that Tesla's looking to go public with the company "any day." The luxury electric car make, whose Roadster still goes for a cool $109,000, would be the first US auto company to offer an IPO since Ford way back in 1956, says MSNBC. Quite a notable event, indeed, but earlier comments by Tesla investors (via Autoblog Green) suggest "any day now" might be any time between now and September 2010.