JackMa

Latest

China's richest man Jack Ma will retire on Monday (updated)

In an interview with the New York Times Jack Ma revealed his plan to step down as executive chairman of Alibaba -- often referred to as China's Amazon -- on Monday. He co-founded the Chinese internet retailer in 1999 and built it into an empire currently worth $420 billion and making the former English teacher China's richest man worth about $40 billion. According to the paper current CEO Daniel Zhang is a "candidate" to replace Ma, who plans to pursue philanthropy in education. Monday is his 54th birthday, and the Chinese holiday Teacher's Day, making the announcement particularly timely.

Amazon Prime arrives in China to further challenge Alibaba

With over 63 million people already paying for Prime, Amazon is now expanding its subscription service to one of the largest marketplaces in the world: China. The retailer has announced that mainland users can now enjoy free, unlimited shipping on millions of domestic items, as well as others from the special "overseas orders" category. As part of a promotion that lasts until February, Amazon is offering the membership for $188 yuan (around $30) for the first year. Once this rate ends, Prime will cost 388 yuan (about $60) every 12 months.

Alibaba founder says fake goods have 'no place' on his site

Alibaba founder Jack Ma has written an editorial for the Wall Street Journal, restating his stance on pirated goods. Last week, while speaking at an investor conference, the WSJ quoted Ma as saying that counterfeit products are "of better quality and better price than the real names." However, the chairman has now taken to the paper to say that his statement was taken out of context, and that hooky goods have "no place on Alibaba." Indeed, Ma says that his company has "zero tolerance" for "those who rip off other people's intellectual property," adding that copycat goods is "akin to thievery."

Alibaba founder: Fake goods can be better than the real deal

If you use a contract factory in China to produce your goods, don't be surprised if high-quality fakes pop up online. That's the feeling of Alibaba founder and executive chairman Jack Ma, who stands accused of effectively endorsing counterfeit goods while speaking at an investor event. The Wall Street Journal quotes the executive as saying that "the fake products today are of better quality and better price than the real names." It's a big issue for Alibaba, since its consumer-facing retail portals have something of a reputation for being the place to go when you want a knock-off device.

China smashes sales records during its version of Black Friday

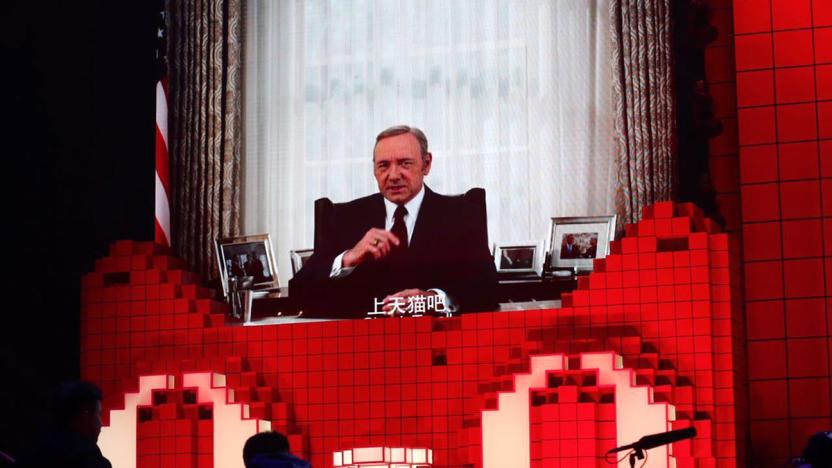

In the US there's Black Friday, but in China, they get all their big online shopping discounts on November 11 aka "Singles Day" instead. As of 4:28am ET today, Alibaba's Tmall, the Chinese equivalent of Amazon, has already made over $11 billion which broke last year's record of $8.97 billion. As reminded by our friends over at TechCrunch, both numbers from that platform alone beat the entire US' online sales of last year's Thanksgiving and Black Friday combined. It's no wonder Alibaba could afford to hire Frank Underwood Kevin Spacey and James Bond Daniel Craig to kick off this year's party.

Alibaba IPO makes it worth $231 billion, more than Amazon and eBay combined

We'd heard that the US IPO for Chinese company Alibaba could be among the biggest ever, and it did not disappoint. Closing at a stock price of $93.89, it raised $21.8 billion for the company and is the biggest IPO in US history. According to Bloomberg, it could become the biggest ever (topping Agricultural Bank of China's $22 billion IPO in 2010) if underwriters make use of an option to buy more shares, which market observers expect they will. Now that Alibaba has joined the club of recent tech IPOs like Facebook and Twitter and it has cash to throw around, many wonder if it will start acquiring smaller companies the way its Silicon Valley rivals have lately. Despite being mostly unknown in the US Alibaba is massive in China, operating sales platforms described as similar to Amazon, eBay and Paypal, and Reuters says it controls more than 80 percent of online sales there. Jack Ma (pictured above) founded the company in his apartment in 1999 and is now China's richest man, personally worth some $18 billion as of market close, according to the Wall Street Journal. [Image credit: PETER PARKS/AFP/Getty Images]

Alibaba's massive IPO plans shift the focus from Silicon Valley to China

The recent big tech IPOs of companies like Facebook, Twitter and Tesla could all soon be dwarfed by a company with roots far outside Silicon Valley. Chinese e-commerce giant Alibaba Group just filed documents for its own offering (choosing to trade its stock in the US over Hong Kong) and while its value has not been determined, it could result in the biggest IPO ever when it's all said and done. Alibaba built its empire on a number of online sales platforms described as a blend of Amazon, eBay and Paypal, and its reach is starting to include the US, thanks to investments in companies like Lyft.

Alibaba spins out Aliyun team with $200 million investment, pep talk

You can imagine that the team building Alibaba's Aliyun mobile OS must have hurt feelings following Google's accusations that Aliyun is just a corruption of Android. Alibaba chief Jack Ma is keen to restore some of that wounded pride, at least on the surface. The CEO has used a since-confirmed staff memo to spin out Aliyun as a separate entity that will "safeguard the healthy growth" of the platform and Alibaba's mobile strategy. It's not solely an instance of tough love, either: Alibaba is putting $200 million into the new firm and will use executive Wang Jian as a link between the two sides, having him serve as the CTO for both companies. With that in mind, Ma's ultimate intentions aren't clear. While the separation may be a sign of a tighter focus on software, it also reduces the impact for Alibaba if anything drags Aliyun down -- and either motivation would be helpful for a company devoted to the web before anything else.

Yahoo to sell back half of its Alibaba stake for $7.1 billion

It's been a bit of a sour year for Yahoo -- it's seen the departure of one of its founding fathers, suffered through a patent dispute with Facebook and lost its new CEO in a sea of scandalous accusations. Yikes. At least former head honcho Scott Thompson's negotiations to sell the firm's stake in Alibaba seem to be going through -- the two firms just announced plans to redistribute about half of Yahoo's 40-percent stake in said Chinese tech giant. Under the current agreement, Alibaba will purchase 20-percent of its fully diluted shares back from the Silicon Valley company, netting Yahoo $7.1 billion in compensation. Yahoo will also be permitted to sell an additional 10-percent of its stake in a future IPO, or else require Alibaba to purchase it back at the IPO price. Despite Yahoo's stake changing hands, the companies will still be working together -- Yahoo has cleared Alibaba to continue to operate Yahoo! China (which was acquired by the latter back in October 2005) under the Yahoo! brand for up to four years -- in exchange for royalty payments, of course. Finally, Alibaba will license various patents to Yahoo moving forward. What's next? Well, Alibaba CEO Jack Ma did let it slip at AsiaD that he's considered buying Yahoo as a whole, and repurchasing the firm's assets in Asia could be a step in that direction. Read on for the official press release in all its financial glory.