mobilepayments

Latest

US banks will launch their Venmo competitor in October

In an attempt to add a little hipness to personal banking, a consortium of US banks has been quietly working on its very own Venmo competitor. While the details of the service are currently a little thin at the moment, the Wall Street Journal reports the banks have landed on a name: "Zelle." As in: "Hey, I forgot to bring cash for this pizza, can I just zelle you some dough?"

Will LG's payment card succeed where others have failed?

A new report out of the Korea Herald revives the rumor that LG's going to try something different with its own foray into mobile payments. As we reported earlier this year, the company has been working on a system that uses a standalone digital credit card rather than an NFC chip inside your smartphone. Apparently the Korean conglomerate had planned to launch the product at the start of the year, but held off to foster better relations with banks. But given how other attempts at reinventing the credit card have gone, is LG really going to crack a winning formula?

Walmart Pay arrives in 14 more states (update)

When Walmart talked about a wide national release of its mobile payment service before the start of July, it wasn't kidding around. Walmart Pay has launched in 14 more states on top of a slew of rollouts earlier in the month -- it's not quite ubiquitous (we count 33 states plus Washington, DC), but it's close. This latest deployment includes heavily populated states like California, New York and Washington, so you're far more likely to use your Android phone or iPhone to shop at the big-box retail chain.

Android Pay Day offers UK discounts for mobile payments

Now that Android Pay is available in the UK, Google wants to make sure people are actually using it. The company has come up with a promotion called Android Pay Day, which offers discounts every month on the Tuesday before your next pay slip. The scheme kicks off today with two deals; firstly, in Starbucks, you can get two-for-one on Frappucinos; the second is a £5 voucher (ANDROIDPAY5 for new users, ANDROIDPAY2.5 for existing customers) that you can redeem inside the Deliveroo app, provided you select Android Pay as your payment method at checkout.

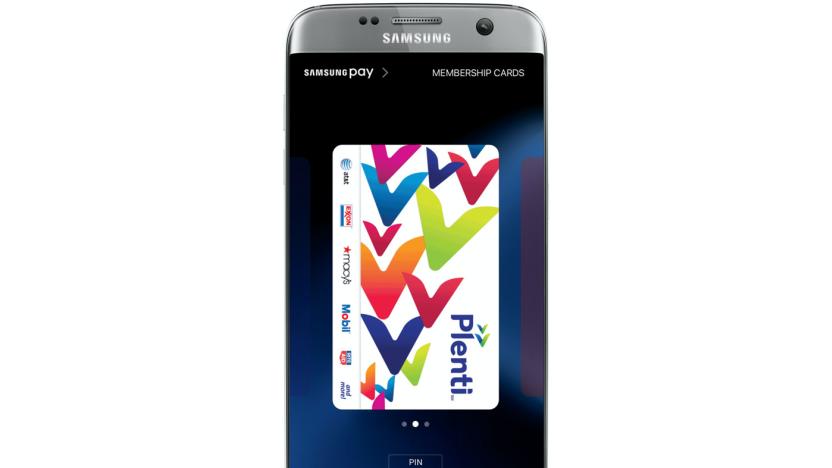

Samsung Pay now works with your loyalty cards in the US

Samsung Pay can substitute for your credit and debit cards, but those probably aren't the only hunks of plastic you're looking to replace. What about the points program card for the grocery store, or the discount card for the pharmacy? Relax. Samsung Pay now supports loyalty and membership cards in the US, so you can make the most of those price drops and freebies without bulking up your wallet.

Google launches Android Pay in the UK

As promised, Google has brought Android Pay to the UK. The app is now live in the Google Play Store, meaning anyone with a compatible credit or debit card can link their bank account and start making payments. The Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, M&S Bank, MBNA and Nationwide Building Society are all on board at launch, however it might take a little while before your particular bank is up and running. Oh, and don't expect Barclays to support Android Pay any time soon. It's a little preoccupied with its own Android app.

Barclays offers its own app as an Android Pay alternative

When Barclays confirmed it wasn't planning to support Google's Android Pay service when it launches in the UK, it said it would instead focus on the development of its own platform. Turns out that customers won't have to wait long to see what the bank has planned, after it confirmed today that it will roll out a new version of its banking app with support for "Contactless Mobile" in June.

Apple Pay finally becomes useful in Canada

Apple Pay technically launched in Canada back in November, but it might as well have been non-existent -- you could only use a directly-issued American Express card, which isn't all that common in the country. At last, though, things are opening up. Apple has announced that its tap-to-pay service is now available through a much, much wider range of providers. Right now, you can use it through heavyweights CIBC and RBC (both credit and debit cards) as well as smaller providers ATB (initially MasterCard-only) and Canadian Tire (MasterCard). The other big three (BMO, Scotiabank and TD) aren't ready yet, but they've all committed to letting you pay with your iPhone or Apple Watch in the months ahead.

Samsung team-up aims to improve your mobile payments

If you've ever tried paying with your phone at a store, you know that the experience is often only as good as the payment reader -- a sketchy terminal could lead to you pulling out a credit card in embarrassment. Samsung thinks the industry can do better, though. It's partnering with some of the larger point-of-sale device makers (such as Verifone and Ingenico) to guarantee "maximum compatibility and universal acceptance" for Samsung Pay. The hope is that this will boost the adoption of mobile payments simply by giving you a better time when you tap-to-pay, with fewer errors that make you rethink the whole concept.

New York's NFC payments for public transit are five years away

The move toward a more futuristic modern New York City is going to be a slow one. The MTA recently opened up the bidding process (PDF) for replacing Gotham's existing MetroCard readers with NFC terminals for busses and trains, but the contracts are expected to last 69 months. So if you were hoping to tap your phone to hitch a ride sometime soon, that won't happen until deep into 2021 at the earliest.

Facebook preps in-store purchases for Messenger

Facebook already lets you send money to friends through its Messenger app, but it appears the social network has much loftier ambitions for financial transactions. The Information reports that Menlo Park is preparing to offer its chat app as another way to pay for things thanks to a feature for in-store purchases. Based on code for the iOS app, Facebook is working on a way for you to use Messenger to pay for goods in person. As The Information notes, this would put Zuckerberg & Co. in the mobile payments fray that includes Apple Pay, Android Pay and several others.

Barclays isn't planning to support Android Pay in the UK

If UK bank Barclays hadn't angered mobile customers enough over its delayed rollout of Apple Pay, a new announcement today looks take things up a notch. After Google declared that it will bring rival payment service Android Pay to the UK in the coming months, Barclays has gone on record to say it has no plans to support the platform. In a statement sent to Techradar, the company said: "At this stage we are not planning on participating in Android Pay in the UK."

Android Pay is coming to the UK 'in the next few months'

While iPhone users have been enjoying Apple Pay, Android adopters in the UK have been left twiddling their thumbs, or experimenting with alternatives like Barclays' bPay. Android Pay launched in the US last September, but Google has said little about a global rollout. Well, today that's finally changing. The search giant says its service will launch in Britain "soon," or specifically "in the next few months." It certainly won't be this month, anyway. Payments are handled over NFC, meaning the app will work anywhere that contactless payments are currently accepted. That includes Boots, Costa Coffee and the Tube network in London.

Apple leads the (tiny) mobile payment world

It's no secret that the mobile payment space is becoming increasingly crowded, but who's out in front? If you ask Crone Consulting, it's Apple... although Cupertino might not have much to crow about. The analyst group estimates that Apple Pay is the market leader, with 12 million iPhone owners making tap-to-pay purchases at least once a month. Android Pay and Samsung Pay are distant seconds with 5 million active users apiece. However, Crone is quick to note that both of these rivals are roughly half a year old -- they're catching up quickly to an incumbent that's been around for a year and a half.

Google kicks off a public pilot for Hands Free mobile payments

Heads up, Silicon Valley residents: the days of pulling out your credit card to pay for Big Macs are numbered. Google just announced that the pilot program for its Hands Free payments scheme has gone live for certain stores in San Francisco's South Bay, so all you'll have to do is tell the cashier you're "Paying with Google." We're trying to figure out if there's a cap to how many people can sign up, but for now, it looks like all local residents need is an Android device running 4.2 or newer, or an iPhone 4S and newer.

Samsung Pay racks up 5 million users in half a year

Samsung Pay is off to a promising start... if you ask Samsung, at least. The company reports that Samsung Pay picked up 5 million users in its first six months, handling over $500 million in purchases over that time frame. There's a "strong adoption rate" in both South Korea and the US, Samsung adds. That doesn't sound like a big number on a global scale, but Samsung is teasing a 2016 expansion that now includes Canada alongside already-announced arrivals in Australia, Brazil, China (now due in March), Singapore, Spain and the UK. The future sounds bright, then, although the figures leave some unanswered questions about whether or not Samsung can keep the momentum up.

Visa reveals its stake in rival Square (updated)

Visa has purchased 10 percent of Square's trading shares according to documents seen by the WSJ. Square is best known for its smartphone-attached readers that make it easy for merchants (and even panhandlers) to accept credit cards. The company was started and is still headed by Twitter CEO Jack Dorsey. Though Square's Jack Dorsey revealed that Visa had taken a piece of it several years back, the credit card giant only recently revealed the amount of the stake. Visa recently launched Visa Developer, software that will help merchants accept Visa payments more easily.

Smart strap brings payments to your Pebble smartwatch

Right now, you have slim pickings if you want to pay for things from your wrist: there's the Apple Watch, an upcoming Swatch model, eventual Samsung Gear S2 support and... that's about it. However, Fit Pay might just widen the field a bit. It's crowdfunding the Pagaré smart strap, which brings NFC-based tap-to-pay support to any Pebble Time smartwatch -- yes, including the Round. It should work at most shops that accept Apple Pay or Android Pay (it uses a similar, token-based system), and it shares familiar security measures, such as disabling access when you remove your timepiece. You don't even need to bring your phone once you've set things up.

Visa wakes up to the sound of the internet

If you had to name the pre-eminent internet payments platform, you'd probably say PayPal -- a fact that sends Visa executives into a frenzy. That's why the big V has announced that it's embracing this new-fangled interweb thing that it's just now heard about. The firm has announced the launch of Visa Developer, a way to open up the financial giant's infrastructure to anyone who wants to use it. If you're a company that wants to sell stuff, you can hook your products up to Visa's back end and get all of its skills with very little effort.

Barclaycard brings NFC payments to its Android app

Android Pay still isn't available in the UK, so Barclays has decided to fill the void with it own NFC-enabled contactless payments. The new functionality is part of the Barclaycard app, specifically for credit card customers with a supported Android handset. Once everything is set up, you'll be able to make purchases up to £30 "with just a touch" and, in some stores, buy goods up to £100 by jamming in your PIN code too. Barclays has long championed its own mobile payments technology. The company's bPay platform, which can be linked to most major credit or debit cards, is now available in wristbands, key fobs, stickers and even a Lyle & Scott jacket. Furthermore, the bank is one of the few in the UK that still doesn't support Apple Pay -- an omission that continues to frustrate iPhone and Apple Watch owners. Barclays says support will arrive "very early in the New Year," although a firm release date remains elusive.