securities and exchange commission

Latest

Activision Blizzard will pay $35 million to settle SEC charges over its handling of complaints

The SEC claimed that Activision Blizzard didn't have adequate processes to fully document and review workplace misconduct complaints.

SEC charges 11 people over 'textbook' $300 million crypto Ponzi scheme

Smart contract platform Forsage is actually just a regular ol' pyramid scheme, according to the agency.

Elon Musk is trying to get out of an SEC deal to have lawyers approve his tweets

He's appealing a ruling that upheld the 2018 agreement.

Whistleblower group says Meta misled investors over misinformation

It's been accused of making 'material misrepresentations' of efforts to fight climate change and COVID-19 misinformation.

Nikola will pay $125 million to settle SEC fraud charges

Founder and former CEO Trevor Milton is still facing fraud charges.

Activision Blizzard says it's cooperating with investigations into workplace practices

Meanwhile, Blizzard's chief legal officer just left the company.

SEC opens investigation into Activision Blizzard's workplace practices

The Securities and Exchange Commission has opened a “wide-ranging” investigation into Activision Blizzard.

Nikola founder Trevor Milton indicted on fraud charges

Milton allegedly lied about 'nearly all aspects' of the EV business.

Man charged for allegedly selling insider trading tips on the dark web

Apostolos Trovias faces up to 45 years in prison if convicted of money laundering and securities fraud.

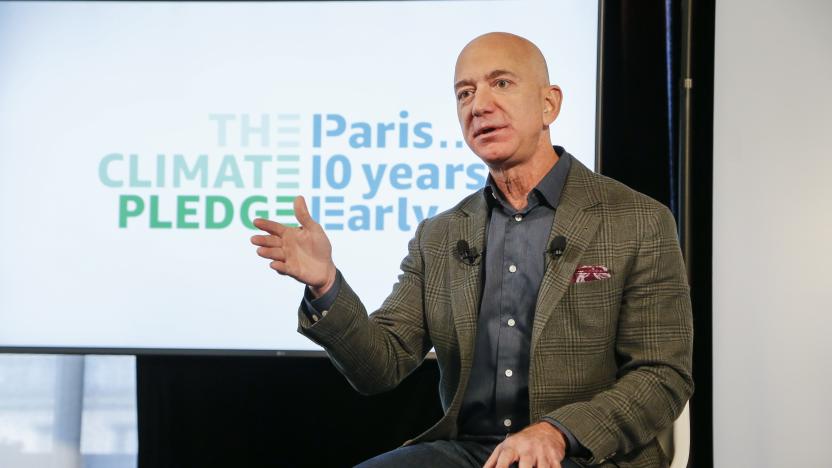

Tech giants call on the SEC to require climate impact reports from companies

Alphabet, Facebook, Amazon, Intel, eBay, Salesforce and Autodesk asked the agency to leverage global standards.

US court agrees with SEC that Kik's $100 million coin offering violated the law

A US district judge for the Southern District of New York has agreed with the Securities and Exchange Commission’s assessment that Kik’s $100 million initial coin offering (ICO) in 2017 was a securities sale. Judge Alvin Hellerstein has granted SEC’s motion for summary judgment, ruling that Kik violated the Securities Act when it sold its tokens called “Kin” without the blessing of the SEC.

Steven Seagal settles with SEC over undisclosed bitcoin promotions

It seems that martial artist and actor Steven Seagal isn't above the law. In 2017, he touted the initial coin offering (ICO) for Bitcoiin2Gen (B2G), a digital currency that sounded shady right from the start. Seagal didn't disclose the fact that he was paid by B2G to encourage his fans to buy into the bitcoin, which is required by law when a currency qualifies as a security. (B2G didn't even bother to register as a security, which resulted in the state of New Jersey issuing it a cease-and-desist order.) The actor has agreed to pay $157,000 in disgorgement plus a $157,000 penalty.

VW and its former CEO charged with defrauding investors in diesel scandal

The US Securities and Exchange Commission (SEC) announced that it is charging Volkswagen and its former CEO Martin Winterkorn for defrauding US investors during the company's "Dieselgate" scandal. The agency accused the company and its top executive of issuing more than $13 billion in bonds and securities in the US despite knowing that more than half a million vehicles in the market failed to meet emissions standards.

Lyft officially files to go public

Lyft has revealed its financial details for the first time as it prepares for an initial public offering. Like rival Uber, it first filed the paperwork confidentially in December, and now its S-1 is public through the Securities and Exchange Commission. Lyft lost $911 million in 2018, but doubled revenue to $2.1 billion from 2017. It had $8.1 billion in bookings over the year, up from $4.6 billion in 2017. Lyft didn't state how much it's looking to raise in the IPO -- it left a placeholder figure of $100 million in the filing. It plans to go public on Nasdaq under the "LYFT" ticket symbol.

Apple planning a $5 billion bond offering

Thanks to the fun and excitement of financial accounting, even companies with $178 billion in cash need to incur some debt every once in a while. That's exactly what Apple has in store for the near future, filing a bond sale prospectus with the Securities and Exchange Commission in the amount of $5 billion. That amount isn't actually listed in the prospectus; the Associated Press reported the amount earlier today. What will Apple do with that little pile of debt? Probably fund the capital reinvestment program that has been buying back shares of Apple stock and paying quarterly dividends to shareholders. Goldman, Sachs & Co. and Deutsche Bank Securities will handle the bond sale, which is coming at a time when the U.S. bond market is suffering and 30-year bonds are at a record low. Apple has issued other bond offerings in the past, including a $17 billion six-part offering in 2013. At the time, that offering was the largest ever for a US corporation. Another $12 billion bond sale was offered in 2014, and the company made a Euro bond offering late in 2014.

SEC subpoenas the Rhode Island Commerce Corporation over 38 Studios lawsuit

After the last bit of immature name-calling over the 38 Studios debacle, it must be nice to finally put this whole mess to bed for good so we can... oh, wait. No, it appears that the drama regarding the dead studio continues as the Securities & Exchange Commission has issued a subpoena for the Rhode Island Commerce Corporation regarding its lawsuit against Curt Schilling and the other executives of 38 Studios pre-closure. The subpoenas request both depositions and exhibits pertaining to the ongoing court case against the management of the former studio. The RICC, formerly known as the Economic Development Corporation, was the organization responsible for selling bonds to facilitate the $75 million loan to the now-defunct gaming studio and has been under investigation by the SEC following the company's bankruptcy and dissolution. Neither the SEC nor the RICC is discussing any further details regarding the investigation.

Apple R&D expenditures up 32% in 2013

As part of the Apple earnings folderol earlier this week, the company today filed a Form 10-K with the US Securities and Exchange Commission. There's some good news in there for those who want the company to continue to innovate with new and improved products: Apple spent 32 percent more on research and development in 2013 -- US$4.5 billion -- than it did in 2012. The company revealed that R&D expenses, when compared to net sales, actually remained fairly constant. Since net sales have ballooned, so have R&D costs. Much of the growth in R&D expenses was attributed to additional personnel. Apple's filing states that, "The Company continues to believe that focused investments in R&D are critical to its future growth and competitive position in the marketplace and are directly related to timely development of new and enhanced products that are central to the Company's core business strategy. As such, the Company expects to make further investments in R&D to remain competitive." Also in the 10-K were these tidbits: The company had 80,300 full-time equivalent employees as of September 28, with more than half (42,800) being employed in the retail operations. At the end of the company's 2013 fouth quarter, the company occupied about 19.1 million square feet of building space, most of that in the US and about 63 percent of it leased. Apple owns 1,428 acres of land, which we calculated to be roughly 9.5 percent of the size of Manhattan Island.

The Daily Grind: Should government regulate crowdfunding?

Earlier this week, the US Securities and Exchange Commission proposed rules for regulating public equity crowdfunding that could hit as early as February of next year. If adopted, these rules could affect kickstarters and similar ventures dramatically, according to Forbes. Notably, the regulations would cap crowdfunding investment revenue at $1 million dollars per year, limit individual contributions according to income, eliminate most advertising, and require management through a registered brokerage. The rules are intended to allow crowdfunding ventures to legally sell shares and accept investors, not just rely on donations as we see in the typical MMO kickstarter. But as Forbes argues, the rules won't necessarily have the intended effect as typical project creators can't actually afford to meet the regulations since that's why they were using crowdfunding in the first place. We wonder whether Congress and the SEC will target donation-driven crowdfunding next. It seems to me that at least in MMOland, a lot of studios would struggle, whether they're Star Citizen with 24 million bucks raised to date or Baby's First MMO Startup with two part-time employees and a cat running PR. Then again, kickstarter frauds aren't unheard of, and a lot of people have seen their donations-that-sure-sound-like-investments go down the toilet. What's your take? Should the SEC be regulating crowdfunding ventures the way it would any other investment or fundraising method? [Our original question assumed that Kickstarter donations would be affected. Updates to the SEC proposal have made it clear this is not the case, so we have updated the premise here accordingly, though the question still stands.] Every morning, the Massively bloggers probe the minds of their readers with deep, thought-provoking questions about that most serious of topics: massively online gaming. We crave your opinions, so grab your caffeinated beverage of choice and chime in on today's Daily Grind!

SEC investigating Rhode Island's 38 Studios deal

The 38 Studios epilogue continues with the U.S. Securities and Exchange Commission investigating the $75-million loan provided by the state of Rhode Island to the defunct studio. WPRI reports the SEC probe is examining the taxpayer-backed loan the R.I. Economic Development Corporation (EDC) gave to former Red Sox pitcher Curt Schilling's failed operation. Neither the SEC nor EDC would comment on the specifics of the investigation. EDC spokesperson Melissa Czerwein told WPRI that lawyers were retained to deal with the SEC inquiry and the organization won't "discuss ongoing matters related to 38 Studios and maintains a level of confidentiality as requested by the SEC." Rhode Island taxpayers have begun paying back the loan, which Governor Lincoln Chafee (who inherited the debacle from the previous administration) said the State had a "moral obligation" to do. To the best of our knowledge, Rhode Island continues to hold on the Amalur intellectual property.

HP adds another 2,000 to the chopping block, cutting 29,000 jobs by 2014

Looks like May's Hewlett-Packard layoff numbers were about 2,000 short of reality, as the American hardware company adjusted its previous 27,000 estimate to 29,000 in a recent SEC 10-K filing spotted by ZDNet. Those employees represent approximately eight percent of HP's entire workforce, and the restructuring saves the company $3 to $3.5 billion per year -- money it badly needs following last quarter's losses. HP says that 3,800 employees were affected as of July 31, 2012 -- just over 13 percent of the restructuring total. It's unclear how many more will be affected by year's end, if any.