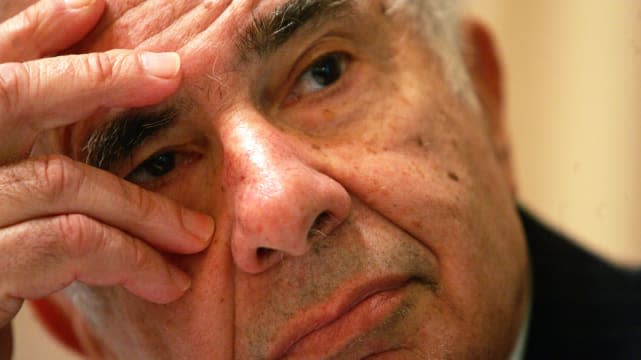

Carl Icahn's open letter to Tim Cook

Activist shareholder and invstor Carl Icahn is back at work poking at Apple, this time in a letter to Tim Cook published on the Shareholders' Square Table website. The short version? "Dear Tim, Remember all of those shares of Apple stock I bought? Speed up your stock repurchase plan by buying them back from me."

Of course, there's much more than that to the letter from Icahn, his son Brett Icahn, and David Schechter. For example, a breakdown of how each Apple product line is performing both now and how Icahn expects the products to do in the future, as well as forecasting that Apple will get into UltraHD Television in FY 2016. Icahn goes so far as to forecast that Apple's going to sell "12 million 55" and 65" TV sets in FY 2016 and 25 million in FY2017". That should make Piper Jaffray's Gene Munster ecstatically happy.

So why the interest in the company's future fortunes? Icahn makes his case that Apple stock is currently undervalued - the price of a share of Apple today was just over US$101, and Icahn thinks the company is actually worth about double that: $203 per share. And what he's doing is asking Apple to buy back his shares, of course at a premium over the current market price - that's what a tender offer is.

Icahn, who owns 53 million shares of AAPL, would like for Cook to communicate "to the rest of the board our request for the company to make a tender offer, which would meaningfully accelerate and increase the magnitude of share repurchases." This, of course, will benefit Icahn hugely: "We feel compelled to do so because we forecast such impressive earnings growth over the next few years, and therefore we believe Apple is dramatically undervalued in today's market, and the more shares repurchased now, the more each remaining shareholder will benefit from that earnings growth."

The letter is well thought out, peppered with statements from Wall Street analysts, and optimistic about Apple's fortunes for the future. But there's a bit of "we know better than you" snarkiness throughout, ending with "To be totally clear, this letter is in no way intended as a criticism of you as CEO, nor is it intended to be critical of anything you or your team are doing from an operational perspective at Apple. Quite to the contrary, we could not be more supportive of you and your team, and of the excellent work being done at Apple, a company that continues to change the world through technological innovation."

So why tinker with a finely-oiled machine? Because Icahn can easily help his 53 million shares gain value just by publishing a "friendly letter" like this. It will be fascinating to see what response, if any, is forthcoming from Cupertino.