Bitcoin's terrible 2018 doesn't bode well for the future of crypto

Regulation, factionalism -- has the bubble burst?

If someone approaches you saying that they have a way to get rich, quick, without any effort, then they're scamming you. If you don't believe me, then ask yourself this: If someone gave you a winning lottery ticket, would you hand it over to someone on the street? People get itchy when it comes to paying their taxes, let alone handing out bagfuls of cash on the sidewalk.

That didn't stop some people from ploughing cash into cryptocurrencies in search of a fast buck. I mean, I get it: Savvy operators were hoping to wait a few weeks, see the value rise and get out. But in order to get out, you need a mark with pockets deep enough to buy your stake and take on the risk for themselves. Sadly, for those looking to make a quick buck, 2018 was the year that people wised up, regulators got their act together and disharmony warned everyone else away.

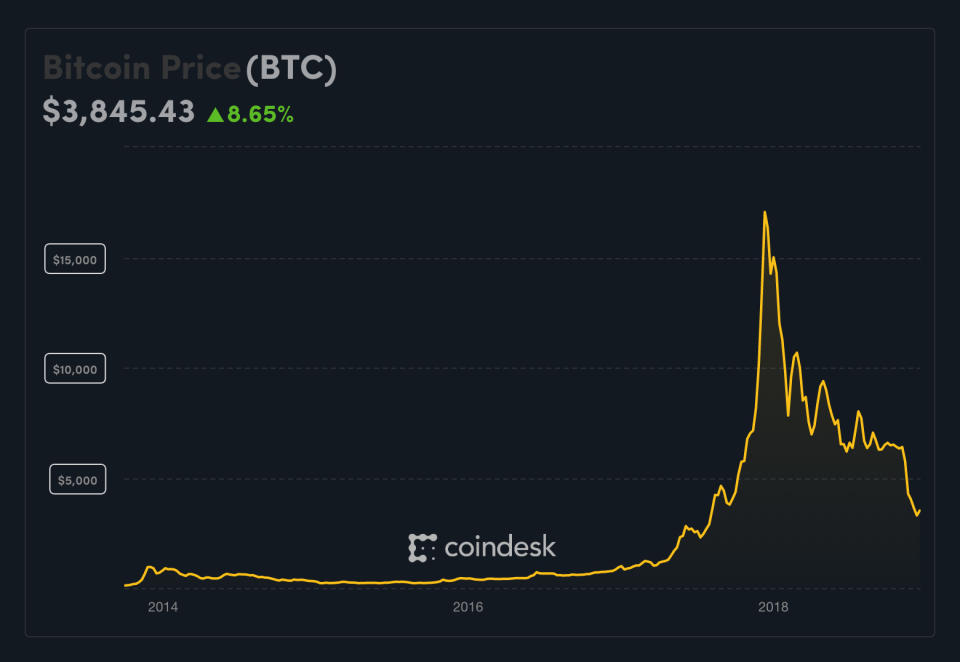

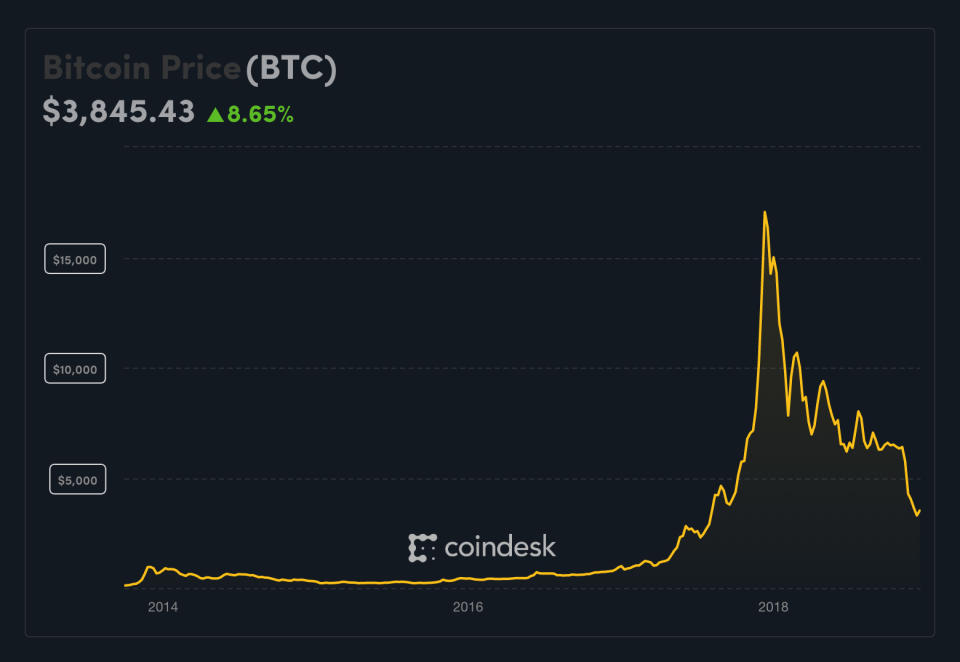

This year was one big cryptocurrency crash that left a trail of blood across the industry. Bitcoin, the pioneer, saw its value drop from $19,352 on December 17th, 2017, to just $3,360 on December 12th, 2018. Ethereum fell from $1,405 on January 10th to $88.71 on December 12th. Other ventures, like Bitcoin Cash and Ripple, too, saw slides in their value against the dollar.

As all the major cryptocurrencies saw their values collapse, several crypto-focused startups were forced to close. Earlier in December, Bloomberg reported on a number of companies that, by holding assets in crypto, were pretty quickly wiped out. And with values (and potential returns) diminishing, few investors were willing to hand over more cash to keep them afloat.

This has been felt by the mining companies, which spent big on equipment and resources to set up their crypto-mines. In November, CoinDesk reported that up to 800,000 mining machines had been shut down due to the falling price. Big names, like the US company Giga Watt, collapsed still owing millions to creditors like the local utility. After all, mining is famously energy hungry and potentially climate troubling.

True believers say that this isn't evidence of a bubble bursting, just a correction that we often see in currency markets. All you need to do is keep HODL-ing -- refusing to sell your assets no matter the fluctuations in the market -- and waiting for the rebound and even greater riches. But it's hard not to wonder if any rally will be minor and if the times when 1 BTC cost close to $20,000 are over.

True believers say that this isn't evidence of a bubble bursting, just a correction that we often see in currency markets.

It feels different this time, with the SEC making clear that it sees Initial Coin Offerings (ICOs) as under its jurisdiction. ICOs are, like IPOs, ways for people to raise money on the back of an offering, with the coins being traded. Thanks to Ethereum, rolling out your own ICO is easy enough that it's been a target for people with less-than-honorable intentions. According to one study by the Satis Group, around $1.3 billion had been invested in fraudulent ICOs by July of this year.

Even the legitimate offerings have no guarantee of a long life, however, and another study found that "good" coins often collapse after a few months. In September, a New York court ruled that some ICOs came under securities law, with several more cases being waged. SEC chief Jay Clayton told CNBC that "if you want to do any IPO with a token, come see us." But if crypto falls under the aegis of government regulation, then what's the point of it?

The crypto community hasn't helped, with paranoia over the potential fortunes at stake causing fractures and infighting. Bitcoin, for all of its sophistication, was so poorly engineered that the more popular it grew, the less usable it became. This was true as far back as 2016, when block sizes were artificially kept small, apparently to appease Chinese miners. Refusing to deal with the issue caused a chronic slowdown in validation speed that made it ever more useless as a functional currency.

One solution was to create a splinter version (called a hard fork) of Bitcoin that removed this technical limit apparently favored by vested interests. Rather than one Bitcoin-branded currency, you had two: Bitcoin and Bitcoin Cash. Sadly, much like the running joke about the liberation groups in Monty Python's Life of Brian, communities without a strong center are prone to factionalism.

In November 2018, Bitcoin Cash was itself forked between Bitcoin Cash ABC and Bitcoin SV (Satoshi's Vision). The former, ABC, is a movement led by Roger Ver and Jihan Wu, while the latter, SV, is fronted by Craig Wright and Calvin Ayre. The only name you're likely to know is Wright's, who (kinda) claims that he is Bitcoin's pseudonymous creator, Satoshi Nakamoto.

The two versions of Bitcoin Cash have prompted a war of words, with factions putting their hash power behind one of the two tribes. And according to a CoinDesk report from late November, outright war may be coming. Wright, who was accused of defrauding former partner David Kleiman, said that the SV miners may launch an attack on ABC. The fork also neglected to include a way to protect people's coins, meaning that their money is kinda in the balance.

Technology is a slave to what's fashionable, and cryptocurrencies may have burned up all the things that made them exciting. After all, if there were people who embraced crypto because it was a repudiation of the financial establishment, how did they feel when Wall Street joined in? Maybe, too, folks matured and realized that they'd have to give up on buying drugs and laundering money in favor of a nice, quiet life.

Investment banks have all embraced crypto, as have a number of companies looking to steal some of its fashionable shine. Remember when Kodak, a brand itself devalued to Weimar levels, slapped its name on a questionable mining rig? The company Long Island Iced Tea tried to juice its value by changing its name to Long Blockchain. And that worked for a time, until the SEC started asking questions about why exactly it was doing what it was doing.

We live in an age when people are looking for a solution to what they perceive as degeneracy. Many of these solutions push for individualism, monetarism and the destruction of governments rather than a desire to live in a functional society. They espouse fringe ideas on how much freedom an individual must have that are troubling if left unaddressed.

In 2013, an Engadget editor wrote that Bitcoin was a bubble waiting to burst, based on a discredited economic principle that had no use beyond buying contraband. It has evolved to become a store of value, but only the diehards would risk investing their money now, having been burned so badly. And it is still too slow, unreliable and expensive to work as a functional day-to-day currency.

Proponents like cryptocurrencies because they offer freedom from taxation and regulation, handing power to so-called sovereign individuals. The end goal is to live in a world where the laws and protections that enable a working society are gone. Then only the strong, the savvy and the least scrupulous will survive in the perpetual desert that the world will become.

Bitcoin was never more than a vehicle for tax evaders and grifters to burn carbon in the hope of scoring a hot new Lambo. It represents all of our worst excesses, and it does so at a huge cost both to the people and our planet. Perhaps now that the investment has dwarfed the potential return, this collective hysteria will end. At least until the next one comes along.