bank

Latest

Apple is reportedly ending its partnership with Goldman Sachs

It leaves the Apple Card's future uncertain.

Apple Wallet can now show UK users their bank account balances

Apple has launched a new iPhone Wallet feature that lets UK users see their current account balance, along with recent deposits and payments.

The UK is considering starting a digital currency

The Bank of England and HM Treasury are jointly exploring a central bank digital currency that would co-exist alongside traditional cash and deposits.

The Cash app's parent company is now running its own bank

Square Financial Services is bringing financing for Square sellers in-house.

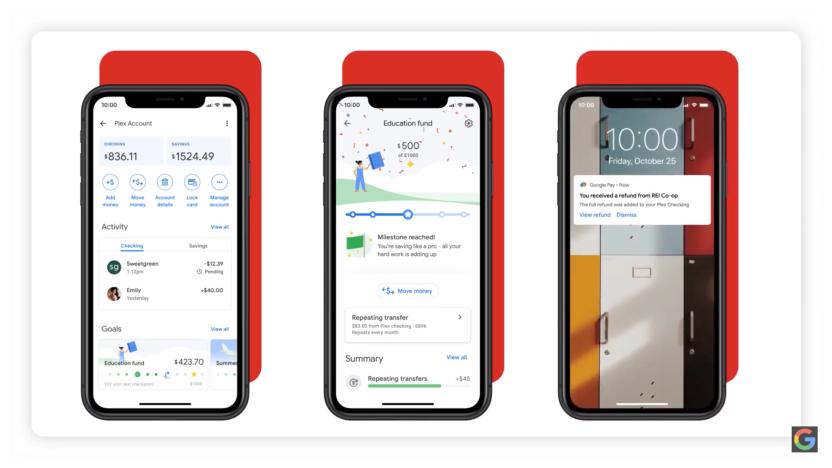

Google teams up with Citibank on mobile-first accounts

In addition to revamping its Pay app, Google also announced new Plex banking accounts today.

Central banks to question Facebook over Libra cryptocurrency

Facebook is about to undergo further scrutiny of its Libra cryptocurrency, and it may have to answer some difficult questions. Officials speaking to the Financial Times said that Libra representatives are meeting with officials from 26 central banks (including the Bank of England and the US Federal Reserve) in Basel, Switzerland on September 16th. The European Central Bank's Benoît Coeuré is expected to chair the gathering, which will question Facebook over the digital money's "scope and design."

Monzo's app-only banking is coming to the US

You might not have heard of Monzo in the US, but there's a good chance your British friends have when the digital bank has racked up over 2 million customers in its short history. And now, it's coming to the US... in a manner of speaking. Monzo has unveiled plans to roll out service to the US in the "next few months," including the mobile app and a Mastercard debit card. It'll build the audience slowly by connecting with hundreds of people at a time at events before it conducts a wider-scale launch. However, don't expect it to function as a bank at first. It'll be closer to a money transfer service akin to Venmo or Apple Pay Cash.

FBI warns banks about ATM cash-out scheme

The FBI is warning banks about a fraud scheme called an ATM cash-out, Krebs on Security reports. With this type of heist, attackers typically compromise a bank or payment card processor with malware, disable fraud controls and withdraw large sums of money -- sometimes millions of dollars -- with cloned bank cards. The FBI reportedly sent an alert to banks last week. "The FBI has obtained unspecified reporting indicating cyber criminals are planning to conduct a global Automated Teller Machine (ATM) cash-out scheme in the coming days, likely associated with an unknown card issuer breach and commonly referred to as an 'unlimited operation'," said the notice.

Facebook might let you chat with your bank over Messenger

Facebook wants to incorporate your banking info into Messenger and has approached companies like JPMorgan Chase, Wells Fargo, Citigroup and US Bancorp over the past year, the Wall Street Journal reports. People familiar with the discussions told the publication that Facebook has sought data on card transactions and checking account balances and has proposed giving its users access to banking information such as account balances and fraud alerts through Messenger. The move comes as Facebook tries to boost engagement and banks grapple with how to reach more customers digitally. Since the original WSJ report, Facebook has clarified that while it may partner with banks so financial institutions can use Messenger for customer support, it doesn't have any interest in going beyond that.

Wells Fargo says hundreds lost homes after computing 'error'

Software mistakes are normally little more than inconveniences, but they had particularly serious consequences for some Wells Fargo customers. An SEC filing from the bank has revealed that a "calculation error" in its mortgage loan modification underwriting tool led to about 625 customers either being denied loan changes or not receiving offers when they would have qualified. Roughly 400 of those customers eventually lost their homes to foreclosure, Wells Fargo said. The bank stressed in a statement to CNN Money that the bug didn't necessarily cause the foreclosures, but it certainly didn't help.

Chase now offers phone-based withdrawals at 'nearly all' ATMs

It took a long, long time, but Chase's phone-based ATM withdrawals are finally widespread. The bank has expanded its card-free access to "nearly all" of its ATMs across the US, giving you one less reason to panic if you leave your wallet at home. As before, you can get in by tapping a device with a Chase debit or Liquid card linked to Apple Pay, Google Pay or Samsung Pay, and then entering your PIN code. It's functionally equivalent to using your regular card, so you're not facing the usual limits that come with making tap-to-pay purchases.

What to keep in mind before switching to a mobile-first bank

The day I got my first-ever paycheck, I scrawled my signature on the back, went to the bank, dropped it off with a kindly teller and left with a deposit slip and a smile on my face. A few years after that, a Canadian financial titan bought my bank and started managing it differently. That made the decision to embrace an upstart, mobile-first bank -- Simple, in this case -- that much easier. I can't pretend that the idea of trusting my money to a startup wasn't a little worrisome, but the appeal of novel features and Silicon Valley speed quickly won me over and I haven't looked back. You might enjoy making the switch too, but before you pull the trigger, here are a few questions to ask yourself.

ATM 'jackpotting' hacks reach the US

For some ATM thieves, swiping card data involves too much patience -- they'd rather just take the money and run. The US Secret Service has warned ATM makers Diebold Nixdorf and NCR that "jackpotting" hacks, where crooks force machine to cough up large sums of cash, have reached the US after years of creating problems in Asia, Europe and Mexico. The attacks have focused largely on Diebold's front-loading Opteva ATMs in stand-alone locations, such as retail stores and drive-thrus, and have relied on a combination of malware and hardware to pull off heists.

Open Banking is here to change how you manage your money

After completing a review of the retail banking sector back in the summer of 2016, the UK Competition and Markets Authority (CMA) concluded that stagnation had set in. It found that hardly anyone switches banks each year, and the huge financial institutions don't put a lot of effort into retaining or competing for business. Among a number of reforms the CMA put into motion was "Open Banking," which requires all the big banks to make your financial data accessible in a standard format. The deadline to comply with the open banking initiative passed over the weekend, and several key names have missed the launch. It's now officially up and running, however, and it promises to completely change how you choose and use all kinds of financial services.

Russian hackers steal $10 million from ATMs through bank networks

The recent rash of bank system hacks goes deeper than you might have thought -- it also includes stealing cash directly from ATMs. Researchers at Group-iB have published details of MoneyTaker, a group of Russian hackers that has stolen close to $10 million from American and Russian ATMs over the past 18 months. The attacks, which targeted 18 banks (15 of which were American), compromised interbank transfer systems to hijack payment orders -- "money mules" would then withdraw the funds at machines.

UK banks can now clear cheques in a day

Although the future of payments is digital, thanks to contactless and mobile, physical methods like cheques are still remarkably popular. For years, recipients have needed to wait up to five days for their signed piece of paper to clear, but that's all about to change. Thanks to a new image-based processing system implemented by the Cheque and Credit Clearing Company, cheques can now be cleared in a day.

Digital bank Monzo now supports Android Pay

Monzo, the British "bank" with a coral-coloured card and a clever savings app, has added support for Android Pay. It's only available for users with current accounts, however. Monzo started with a simple pre-paid card, forcing customers to transfer money from an existing bank account to take advantage of its app-based smarts. In April, however, it was approved by the UK authorities to act, well, like a real bank and offer proper accounts. Since then, it's slowly been inviting pre-paid card owners to switch over (the company says all users should be transferred in the next six weeks.)

Affirm’s app lends you money to buy things online

Paypal co-founder Max Levchin launched Affirm back in 2012 to extend credit for folks to buy things online. Today, his company has extended that feature to a mobile app, functionally creating a virtual credit card for anyone who wants to trust a tech company instead of banks.

EU raids banks over attempts to block financial tech rivals

You'd think that governments were waging a war against financial technology given reports of crackdowns and tighter regulation, but the opposite is true in Europe. EU officials have confirmed that they recently raided the offices of bank authorities in multiple countries, including the Netherlands and Poland, to investigate antitrust "concerns" that banks are stifling tech-driven newcomers. The banking establishment is allegedly preventing fintech companies from accessing account info despite customers granting permission, pushing people back to conventional services.

HSBC app will let you manage accounts from multiple banks

HSBC is readying a mobile app that will allow customers to manage multiple accounts from different banks. "HSBC Beta" will support 21 money-keepers at launch, including Santander, Lloyds and Barclays, so users can review their current account, loans, mortgages and savings simultaneously. It's the first time a major UK bank has offered such a service. In August 2016, the Competition and Markets Authority declared that all banks would need to adopt "Open Banking" by early 2018, allowing this sort of functionality. Clearly, it's made a difference, though HSBC is keen to stress that it was working on the technology before the ruling.