barclaycard

Latest

This reusable coffee cup has contactless payments built in

The UK's love of takeaway coffee is causing a huge waste problem, with less than 1 percent of disposable coffee cups being recycled. But Costa thinks it has a solution that will not only get you your daily caffeine hit faster but also help you do your bit to save the planet. The soon-to-be Coca-Cola subsidiary is launching a reusable cup with its own detachable contactless chip powered by Barclaycard's payment tech.

Barclaycard wants you to dine and dash legally

Barclaycard is testing a new payment service that could mean the end to waiting for your bill at a restaurant. It's called Dine & Dash, but in this version, dashing doesn't mean skipping out on your tab. Instead, with this service, restaurant-goers would download the Dine & Dash app and just tap their phone on the Dine & Dash device at their table once they arrive. They would then order their meals and eat as usual, and once they were done, they could just leave. When the Dine & Dash app registers that the diners have left the restaurant, it will check them out and close the bill, issuing payment from whatever payment option was loaded into the app by the diner.

Timex's new watch collection includes contactless payment straps

Barclaycard's various bPay accessories give previously inert objects the ability to make contactless payments, regardless of where you bank. Last year saw the introduction of the bPay Loop, a contactless card alternative that clings to watch straps. Understandably, though, you might not want to ruin the aesthetics of your neat dress watch with a brash rubber sidekick, but Barclaycard and Timex have now teamed up for a more elegant solution.

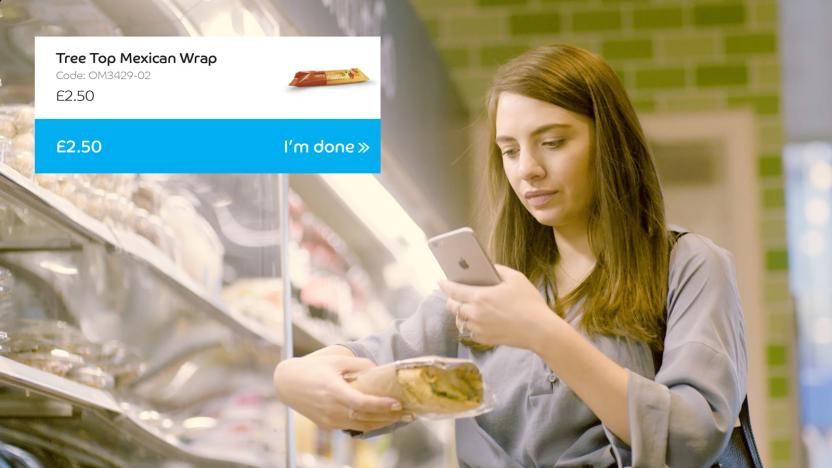

Barclaycard’s ‘Grab+Go’ swaps store checkouts for an app

With nigh-immediate grocery deliveries becoming more and more accessible, there's less incentive to pop down to your local shop to pick up the essentials. But Barclaycard is working on a way to make the in-store experience more convenient by allowing customers to dodge the checkout queue and pay for their basket with their smartphone. The "Grab+Go" app basically turns your device's camera into a barcode reader. When you're done combing the isles and scanning your haul, you simply checkout inside the app and your purchases are charged to a linked card. It then generates a digital receipt that the merchant also has access to, in case they suspect your bag is hiding a few undocumented items.

Barclays helps put bPay contactless chips in phone cases

Alongside its bPay wearables and key fob, Barclays (or more specifically, Barclaycard) brings contactless payments to other things by way of a simple NFC sticker. This looks most at home stuck to the back of a smartphone, but now the bank has partnered with cover merchant Case Station for some slightly more elegant, albeit bulkier solutions. After teaming up with a clothing brand on a jacket with a contactless chip hidden in the cuff, Barclays' new ally is now offering a range of protective, fully personalised cases with built-in bPay for popular phones from the likes of Apple, Samsung and LG.

Barclaycard brings NFC payments to its Android app

Android Pay still isn't available in the UK, so Barclays has decided to fill the void with it own NFC-enabled contactless payments. The new functionality is part of the Barclaycard app, specifically for credit card customers with a supported Android handset. Once everything is set up, you'll be able to make purchases up to £30 "with just a touch" and, in some stores, buy goods up to £100 by jamming in your PIN code too. Barclays has long championed its own mobile payments technology. The company's bPay platform, which can be linked to most major credit or debit cards, is now available in wristbands, key fobs, stickers and even a Lyle & Scott jacket. Furthermore, the bank is one of the few in the UK that still doesn't support Apple Pay -- an omission that continues to frustrate iPhone and Apple Watch owners. Barclays says support will arrive "very early in the New Year," although a firm release date remains elusive.

Barclaycard to launch NFC payments on Android ahead of Apple Pay

Since Apple Pay launched in the UK, several banks have been dragging their heels when it comes to supporting the contactless payment platform. Lloyds and Halifax begun a gradual roll-out just last week, casting renewed shade on Barclays, which appears to be more interested in its bPay gear (and jacket) than throwing iPhone and Apple Watch users a bone. The banking giant said some time ago it'll eventually play nice with Apple Pay, but it's decided in the interim to turn its attention to Android users. Its credit card arm, Barclaycard, announced today that from November, its Android app will begin supporting NFC payments. These payments won't be limited to the (recently raised) £30 contactless cap, too, with transactions of up to £100 allowed with PIN authentication (similar to Apple Pay).

Barclaycard steps up its contactless game with three new NFC devices

If you didn't know, Britain now prefers cashless payments to notes and coins. Contactless cards play a big part in the shift away from cash, but as technology evolves, smartphones and wearables are beginning to influence matters too. Barclaycard has long supported contactless technology, via its PayTag NFC sticker or bPay bracelet, but the credit card provider recently pulled the products and warned that something new was coming. Indeed, Barclaycard is back with three "new" wearable bPay payment devices: a wristband, fob and sticker.

Londoners can now give to charity by paying for travel with a contactless card

More Londoners than ever are using contactless payments to get around the capital, and now, a new initiative called "Penny for London" is asking commuters to add charitable donations to their daily routine, too. The idea is that every time you use a contactless card to pay for travel, you also put aside a nominal amount -- between 1p and 10p -- for charity. Then, at the end of the each month, Penny for London charges the accumulated total to the same card, and forwards the money on to the Mayor's Fund for London, Cash for Kids, The Prince's Trust and other charitable organisations. To get involved, all you need to do is register the card you use to travel on the initiative's website, where you can also keep track of your donations, set up caps and change other preferences. While Barclaycard is responsible for developing the "micro-donation" system, any Visa or Mastercard can be used. The hope is other retailers that accept contactless payments will also sign up to participate in the initiative, but for now, at least you can feel like you're embarking on cramped, uncomfortable Tube journeys for a good cause.

Samsung Galaxy S III gets Quick Tap mobile payments system from Orange and Barclaycard, works with most UK bank accounts

We've barely heard from Orange's Quick Tap payments system in over a year, but now the UK phone network has decided to dump the underwhelming Tocco Lite and add its mobile payments service to the NFC-capable Galaxy S III. Tying into any British MasterCard, Visa, Debit or credit card, you'll be able to pay up to £20 from your account without the need for PIN entry. New users on Orange SIM-toting Galaxy S IIIs will also pick up a 50 quid bonus when they activate the feature, which kicks off this Wednesday. Check the press release below for all the details.

Chase, Capital One and Barclaycard join as launch partners for Isis mobile payment service

The Isis mobile payment service backed by AT&T, T-Mobile and Verizon may have been a bit overshadowed by Google Wallet in recent months, but it's still on track for a "mid-2012" trial launch in Austin, Texas and Salt Lake City, Utah, and it's now gotten a boost from a trio of new financial partners. Chase, Capital One and Barclaycard confirmed today that they'll each support the NFC-based service and let folks load their credit, debit and prepaid cards into their Isis Mobile Wallet, joining existing partners Visa, MasterCard, Discover and American Express. Unfortunately, any specific launch details beyond that still remain a bit on the light side, with Isis only promising that a national rollout will follow sometime after the initial trial launch.

Isis adds Visa, MasterCard, American Express to mobile payment lineup

Isis hasn't shown us much more than a logo and a black and white rendering of its NFC-powered mobile payment system, but the outfit proved today that it has all of its ducks -- or, rather, major credit card companies -- in a row. According to the group -- a collaboration between AT&T, T-Mobile, and Verizon -- Isis will launch with Visa, MasterCard, Discover, and American Express on board. Back in May, we reported that the credit card alternative was shaking up its initial, Discover-only platform to let the competition in. Since then, the Goog's swept in with Google Wallet (backed by Sprint), which also counts MasterCard as a partner. Google's already got a head start, with Wallet trials underway in New York and San Francisco, but the internet giant might just need the lead, considering the list of heavy hitters Isis has lined up for its 2012 debut.

Orange and Barclaycard launch 'Quick Tap' NFC mobile payments in the UK

Yay for the UK, it's now one step closer to catching up to the Japan of last decade. Mobile carrier Orange is today launching the UK's first mobile phone contactless payment service, dubbed Quick Tap, for purchases up to £15. It works on MasterCard's PayPass system and requires you to have a Barclays debit or credit card or, alternatively, a credit card from Orange itself. Gemalto is providing the SIM-based NFC compatibility, with Samsung's entirely unrevolutionary Tocco Lite being the (admittedly affordable) launch handset. Then you just need to trust the Quick Pay app to be as secure as promised and you'll be ready to go off and use your phone as a payment terminal at over 50,000 locations, including joints run by McDonald's, Eat, Pret A Manger, Subway, and Wilkinson. A quick intro video and a more expansive press release follow after the break.

Isis NFC payment system gets its first market in Salt Lake City, Utah, launches in 2012

Like 3D on high-end HDTVs, NFC-based payment systems seem set to invade our mobile lives whether we like them or not. Isis, a collaborative venture between AT&T, T-Mobile, Verizon and a bunch of banking big timers, has today announced the first market for its rollout of a contactless payment scheme, and it's none other than Salt Lake City, Utah. That'll surely raise eyebrows in locales that may consider themselves more tech-savvy, but we reckon starting off with a city of a smaller scale might be good for getting this "mobile wallet" system off the ground. And then there's the added benefit of Isis snagging a deal to enable compatibility with the entire Utah Transit Authority footprint. If all plans are executed properly, that should mean that by summer 2012 the good people of SLC will be able to NFC their way around town with just their smartphone in hand, while also swiping it through checkouts like some form of highly advanced techno-humans.