JiaYueting

Latest

Faraday Future's EV dreams live on with (another) bailout

Now that Faraday Future has parted ways with its last partner, Chinese real estate firm Evergrande, money seems to be flowing in again. After getting a $600 million injection from mobile gaming company The9 Limited, Faraday announced that it has scored another $225 million in bridge financing via a funding round led by Birch Lake Associates. The cash will be used to bring the company flagship FF91 EV to market and reassure jittery suppliers that the company is still on sound footing.

Faraday Future had the worst year possible for an EV startup

Stop me if you've heard this one before: Faraday Future is almost out of cash. At the tail end of 2017, the much-hyped EV startup was sliding toward financial oblivion. But then a crucial round of funding from a then-mysterious benefactor gave the team a lifeline. Faraday planned to finish its first car, the FF 91, and start production before 2019. Like Tesla, the company wanted to usher in a new wave of electric, autonomous and "seamlessly connected" vehicles. But unlike its closest rival, Faraday hasn't spent the past year building and shipping transformative cars. Instead, it's been fighting the investor that decided to bail it out.

Faraday Future wants out of key financial deal

Things have mostly been looking up for Faraday Future lately, at least on the surface: it has a line of cash, testing has been in full swing, and it even started building pre-production electric cars at its US plant. The situation might not be quite as comfortable as it seems, though. A stock exchange filing has revealed that Faraday Future is pushing for arbitration that would cancel a deal to sell a 45 percent stake in the EV startup to China's Evergrande Health Industry Group. Faraday chief Jia Yueting accused Evergrande of not fulfilling its end of the bargain, which includes both buying the company with the 45 percent stake (Season Smart) for $860.2 million and paying two $600 million installments in 2019 and 2020.

Faraday Future may have received a $1.5 billion lifeline

To say Faraday Future has had a rough time would be an understatement between its financial crisis, executive exodus and CEO troubles. However, things might be looking up for the electric car maker. A Business Insider source has claimed that an unnamed Hong Kong backer has promised a $1.5 billion investment, $550 million of which is "already in the bank." That only goes so far with an automaker, but it's reportedly enough to speed up development of the FF91 and get it on the market by the end of 2018.

LeEco founder ordered to return to China to answer debts

The Chinese tech giant LeEco might have once been dubbed the "Netflix of China," but that lofty acclaim has made its fall from grace all the more brutal. Now, the company's founder, Jia Yueting, has been ordered to return to China by the country's Securities Regulatory Commission by the end of the month in order to face the company's incredible debts.

Inside LeEco's spectacular fall from grace

With additional reporting by Chris Ip and Richard Lai. Behind the doors of the five-star Bohao Radegast Hotel in Beijing's central business district on Monday, troubled Chinese tech conglomerate LeEco held an extraordinary shareholder's meeting to elect new directors. Outside, some two dozen protesters set up tables and held up signs asking to be paid what they were owed for services rendered. According to multiple reports, they had come from 20 cities all over China and were reportedly due about 33 million yuan (around $5 million) in all. Many of them demanded to see Jia Yueting, but the company's billionaire founder and public face was nowhere to be seen. LeEco's fall from grace has been spectacular. Once hailed as the "Netflix of China," the daring startup and its then-outspoken founder were bold enough to challenge Tesla and criticize Apple as "outdated." But in recent months, the company has faced a series of setbacks, and may be reaching its breaking point. Jia stepped down as chairman and CEO in May, while the company continues to fend off unhappy vendors who are protesting outside its Beijing headquarters. On the other side of the Pacific, LeEco has also massively scaled back its American operations, laying off hundreds of workers in the process, while facing two lawsuits from US TV maker Vizio. Faraday Future, a futuristic car company with close ties to LeEco, recently canceled its plans to build a $1 billion plant in Nevada as well. This is the tale of a company that grew too quickly. It shows how a ravenous appetite for growth without a solid financial foundation can cause a business to topple. Simply tracing LeEco's cash flow is a Herculean task, since its financial activity is obscured by a dizzying organizational structure comprising a publicly listed holdings company, privately owned organization and dozens of subsidiaries. It's incredible that LeEco was able to continue operations for as long as it did without getting into any real legal trouble. But since 2016, it has been slammed with several lawsuits. Manufacturing partners in Asia, including Zhejiang Haosheng Electronic Technology, Compal Electronics and Truly International Holdings have sued for outstanding debt. The most recent significant case was Vizio's $100 million claim for a failed $2 billion acquisition. From interviews Engadget conducted with unpaid vendors, former employees and investors, some of whom spoke on the condition of anonymity out of concern for their careers, it became apparent that LeEco's future may be in serious trouble.

LeEco's assets frozen by Chinese court as debts mount

Chinese firm LeEco's financial situation is deteriorating rapidly. A Shanghai court has frozen $180 million in assets owned by co-founder Jia Yueting, his wife Gan Wei and three subsidiaries, according to Chinese news site Tencent and the Financial Times. The order was carried out on behalf of the China Merchants Bank, reportedly because of missed interest payments by LeEco's mobile, watch and other divisions.

Chinese tech giant LeEco can’t stop losing money

Chinese tech company LeEco has been busy over the past decade, producing everything from TVs to electric cars (or at least, trying to). But now, the conglomerate is in trouble: They are in a cash crunch and haven't been able to raise enough money to ease the burden.

LeEco CEO steps down but stays in charge

To put it mildly, LeEco has had its fair share of trouble lately. It ran low on cash due to aggressive growth, backed out of its Vizio takeover and threw its weight behind Faraday Future's electric cars despite some overly ambitious plans. Clearly, the company is stretching itself too thin -- and CEO Jia Yueting knows it. He's stepping down from the CEO role at his publicly listed company (Leshi Internet Information & Technology Corp) in the name of focus. He'll devote his attention to aspects like "core product innovation," "strategic planning" and his chairman role at Leshi. In other words, he won't split his attention like he did before.

Faraday Future could be out of business by February

Last we heard, Faraday Future was going through a rough patch in regards to building its manufacturing facility in Nevada. Now, it appears the electric vehicle company's troubles are worse than anticipated. The key theme, across report from Buzzfeed News, Jalopnik and The Verge is money. Specifically, a lack thereof. Faraday has a heap of unpaid bills, lawsuits from vendors and a landlord in addition to losing senior employees. Owed cash is in the hundreds of millions, and it looks like if the company can't secure more funding after CES next month, Faraday Future will be done for by February.

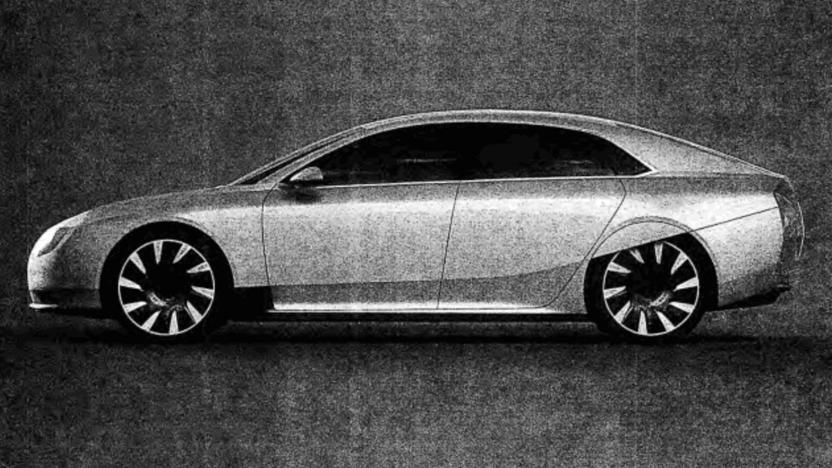

Tesla rival's EV outed by public records request

Atieva is a Chinese company building an EV for the US market, and we're now getting a first look at its "Atvus" sedan, thanks to a public records search by Recode. The vehicle bears a passing resemblance to the Tesla Model S, with a Citroën-esque rear-wheel cover thrown in. The company has also developed an impressive drive train in a Mercedes test mule van, with a 0 to 60 acceleration time of under three seconds (see the video below). What's perhaps most interesting about Atieva, though, is its tangled ownership web, as the Guardian reported earlier this year.