M-Pesa

Latest

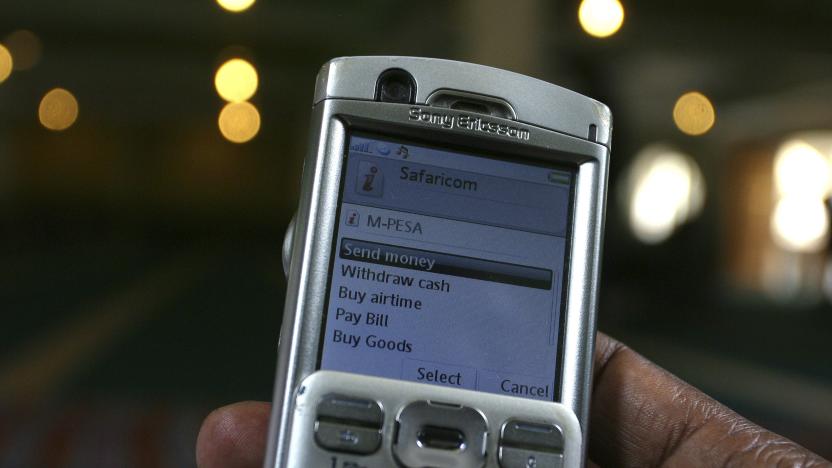

Hitting the Books: Kenya's digital divide is hampering its mobile money revolution

While mobile money apps have been slow to gain acceptance in the US, they’ve taken other nations like Sweden, China and especially Kenya by storm, enabling people for whom conventional banking has remained out of reach new ways to send, receive and invest their hard-earned cash. In Reimagining Money: Kenya in the Digital Finance Revolution, author Sibel Kusimba examines how apps like M-Pesa have radically adjusted the ways in which everyday people throughout Africa manage their money. In the excerpt below, Kusima looks at the financial roadblocks that prevents a significant portion of the country’s population from participating in this emerging digital economy.

Vodafone is the latest to leave Facebook's Libra Association

The Facebook-created Libra Association is still bleeding members months after it formalized its council. Telecom giant Vodafone has confirmed to CoinDesk that it left the Association. Unlike past defectors, though, it's not so much about regulatory jitters surrounding the cryptocurrency. Vodafone said it instead wanted to focus on expanding its own payment service, M-Pesa, beyond the six African countries where it's currently available. It's not burning bridges -- the company said it wouldn't rule out the possibility of "future cooperation."

Clever SIM sticker makes no-signal mobile payments possible

Mobile wallets aren't just for getting in and out of Starbucks that bit quicker. In several parts of the world, many people rely solely on mobile wallets for all their financial needs. These are particularly prevalent in Kenya, for example, where 58 percent of adults manage their money with mobiles. And we're not talking about smartphone apps and contactless payments here, but simpler systems like M-Pesa that work on feature phones and verify transactions via SMS messages. These are entirely reliant on the presence and performance of mobile networks, though, which a project called DigiTally is trying to address with a SIM sticker that lets users make and receive payments when there's no network connection whatsoever.