money transfer

Latest

US law enforcement has warrantless access to many money transfers

US law enforcement can access details of some international money transfers without a warrant.

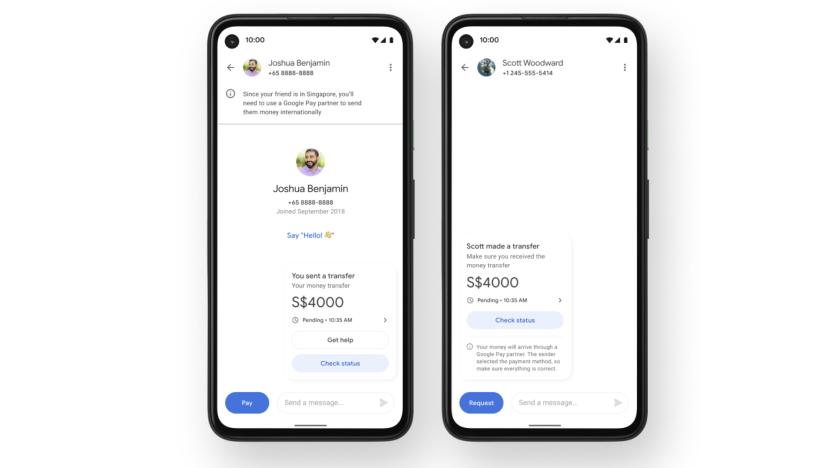

Google Pay is adding international money transfers

Google is adding international money transfers to its Pay app, starting with the option to send money to India and Singapore.

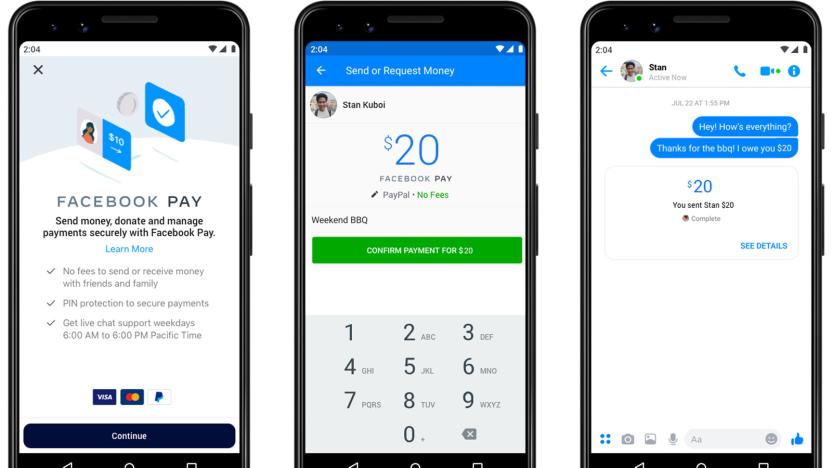

Facebook Pay lets you buy goods and send money inside Facebook's apps

Libra isn't Facebook's only big leap into the payment world. The social media giant has unveiled Facebook Pay, its bid at simplifying both purchases and money transfers. Once you've set a payment method, it's theoretically quick and easy to buy tickets, shop on Marketplace, contribute to fundraisers or cover your share of last night's pizza. You can set it up on an app-by-app basis, but Facebook also lets you set it up across apps -- a one-time setup could make it useful across Facebook's ecosystem. The core app and Messenger will support Pay in the US this week, while Instagram, WhatsApp and more countries are in the pipeline.

Samsung Pay now offers international money transfers for US users

Samsung Pay has continued to grow since it launched in 2015. Last year it finally got PayPal support and added the ability to purchase transport tickets in New York City. Now, Samsung is hoping to appeal to frequent travelers and those with family outside of the US by introducing a cross-border payments feature.

Google now lets Brits send money over Gmail

Instead of smartphone apps and traditional bank transfers, Google is hoping that its Gmail and Google Wallet integration can strike a chord with people wanting to send money in the UK. The feature has been available in the US for ages, but finally it's headed for British shores too. Once you've finished writing an email, you'll soon see a new "£" symbol at the bottom of Gmail's composer: type in an amount, select the source of your funds and then hit the "attach" option. Job done. It doesn't matter if the recipient has a Gmail address and, in addition, when someone sends you some cash Google will give you the option of redeeming it or returning it straight away. You can keep it in your Google Wallet account for further transactions, or transfer it to your bank account if you need it immediately. Google says the feature will roll out in the UK "over the coming weeks," so hang tight if you're not seeing it straight away. Is this a precursor to a full Google Wallet roll-out, with contactless mobile payments and physical cards galore? We aren't getting our hopes up.

Amazon shutting down little-used person-to-person payment service

On October 13th, you'll have one less option for sending cash to individuals online. Amazon's WebPay, a feature of the company's broader Payments platform, will be shuttered. According to a FAQ posted on its site, the service is being closed down because it's "not addressing a customer pain point particularly better than anyone else." Users have until the 13th to initiate any transactions, then there will be a 30-day grace period in which customers can claim their funds before WebPay disappears completely. Axing the unpopular service will allow Amazon to use its resources elsewhere -- perhaps by turning Payments into a more full-fledged mobile wallet service à la Google Wallet or Apple Pay. Of course, there are no shortage of options out there if you want to send money to friends and family electronically. Apparently there's a company called PayPal, or something, that's been doing it for a long time.

Bump Pay lets you tap a friend for cash

Taking cues from an ING Direct app that used its API, Bump Technologies has developed its own version of the mobile payments software, enabling phone-to-phone "Bump" transactions using PayPal. Yes, PayPal. That minor processing detail aside, the service appears to offer a fun solution for simplifying the fairly painful process of paying the check at group meals, or splitting a tank of gas with a friend. Both you and your bud need to have the app installed before you can beam that green, and there's no option to send payments remotely, though you could always use plain ole vanilla PayPal for that. The app is free, and if you have a checking account linked you won't have to deal with any fees. Bump Pay is iOS only "at launch" (read: it could be making its way to Android as well), so for now you'll need to bump the App Store to get folks paid.

PayPal's Digital Wallet lets you decide how you empty yours (video)

PayPal has been helping us pay for those impulse purchases for a long time, but now its forthcoming Digital Wallet could see it popping up on our bank statements a whole lot more. Speaking with eBay Ink, PayPal's Sam Shrauger gave a quick demo of some of the new features. As well as the regular payment handling, you'll be able to register gift vouchers, coupons, loyalty points and store credit cards all under one account. This sounds tidy, but more interesting is the ability to change how you pay for something (say, from credit to debit card) up to seven days after the fact. If you want to keep those big purchases on the Amex, that's no problem either, with configurable rules letting you assign different cards to different spending situations, including setting your own custom payment plans. It's not all about buying either, with savings also getting the digital treatment, that's if you haven't doled it all out on gadget rarities. The service is expected to land in May, in the meantime see the new features via the videos after the break.

ING Direct's iOS app adds 'bump' money transfer feature for well-heeled posses

Look, violence doesn't solve everything, but ING Direct reckons a gentle fist bump can help fix financial quarrels between you and your buddies. Recently added to the bank's iOS app is a feature that makes use of Bump Technologies' API, with which a physical bump between two active devices instantly triggers a money transfer, thus saving the sender from having to put in account details. 'Course, this is only usable for transactions within ING for the time being, so you'll have to stick to other methods for some quick and dirty mobile payments to the outside world.

Discover cardholders can send money to anyone with a cell phone, email address

With NFC payment systems just starting to roll out in the US, it'll be awhile yet before you can cut up those credit cards for good. But in the present, at least, you can use your handset to make sure you don't get stuck with a $100 bar tab... again. Discover just announced that it will let its cardholders send money to people in 60 countries -- so long as they have either a cell phone number or email address. As AllThingsD notes, Visa and American Express have hatched similar plans, though Discover is the first of the bunch to partner with PayPal. While people sending money don't need PayPal accounts, people receiving moola do -- or, at least, they must be willing to create one. For senders the service is free and, in fact, they get 0.25 percent cash back for the first $3,000 exchanged. As for Discover, a smaller player than Visa and MasterCard, it hopes some of PayPal's 230 million customers will sign up for a shiny new credit card while they're at it.

Nokia Money wants some of what PayPal's having

A healthy percentage of Nokia's revenue comes from emerging markets, and the company goes to great lengths to fill out the very bottom rungs of its lineup with devices to satisfy seemingly every need of every demographic -- built-in flashlights, segmented contact lists for phones shared among family members, the list goes on -- and now the company's tackling another need by offering rudimentary banking and money transfer services by way of the handset. Noting that of the four billion cellphones in the world there are only 1.6 billion bank accounts, Nokia's so-called Nokia Money service will bring electronic money management to some areas of the world for the first time -- a customer need only know the phone number of the intended recipient to send a payment. Powered by mobile money transfer specialist Obopay, Nokia Money's going to be shown at Nokia World next week on its way to a rollout in select markets early next year.

Visa gunning for your phone, announces Nokia and Android plans

Neither mobile banking apps nor mobile payment technologies are anything new, but the depth of Visa's newfound commitment to anything and everything mobile here is pretty unique. The company has announced a slew of initiatives to make it as frighteningly easy as possible for cardholders to do cool things with their accounts right from their phones starting with the launch of the Nokia 6212 Classic next month, which will serve up NFC-based contactless payments, cardholder-to-cardholder transfers, and realtime account alerts (subject to issuing bank availability). Meanwhile, they've wasted no time jumping on the Android bandwagon, revealing that they've hooked up with Chase to offer an Android app that delivers notifications, merchant "offers," and a location-based search of nearby retailers that accept Visa cards (which is pretty much all of them in our experience). If the Chase trial pans out, Visa plans to shop the Android app around to other issuing banks. Finally, there's also a new web-based mobile money transfer pilot going down that's scheduled to kick off around the end of the year involving several banks and "as many as" 6,000 cardholders; what are the odds that those 6,000 are going to be transferring much money among each other, though?[Via CNET]Read - Nokia partnershipRead - Android plansRead - Mobile money transfer

Western Union hopes to enable mobile money transfers, scammers rejoice

Just when you thought those Nigerian scammers were simply running out of avenues to coerce you into cashing some counterfeit check for $4.98 billion, along comes this. Western Union is apparently buddying up with 35 or so cellphone operators to "develop a system that would allow consumers to transfer money from country to country via their mobile phones." Reportedly, the outfit has successfully tested the service in a number of US cities, and if everything goes as planned, it could launch in Q2 of 2008. Notably, it still sounds like an actual human will be a part of the process, as the system will purportedly "connect the user to a company operator to complete the transaction." Quite frankly, we appreciate the convenience of such a service, but don't you go falling for any sappy stories of long-lost cousins needing your help to funnel in millions as you ride to work, alright?