personalfinance

Latest

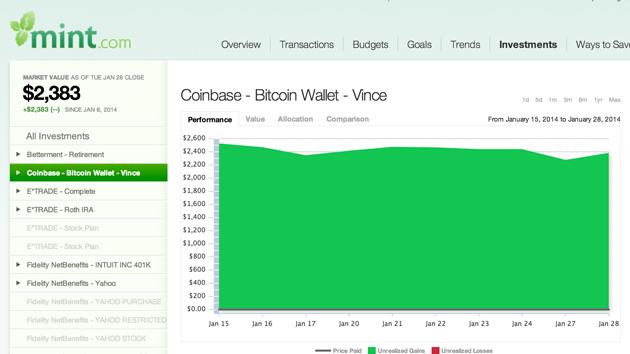

Mint now lets you keep track of Bitcoins with its personal finance apps

Now that Bitcoin has taken root in daily financial transactions, those who fancy the digital currency need a way to easily keep an eye on the tally. Well, for the folks that meet that criteria, Mint now lets users keep track of transactions with the help of Coinbase. This means that Bitcoin Wallet figures can be viewed alongside other banking, credit card and investment accounts. The integration also automatically converts the account balance to US dollars to keep the mental math at a minimum.

T-Mobile's 'Mobile Money' blends prepaid Visa cards and no-fee checking features

T-Mobile's latest service seems to fit its 'UnCarrier' agenda perfectly, since it has little connection to wireless and doesn't actually require users to have the company's phone service. Called Mobile Money, the personal finance product combines a smartphone app (iOS or Android) with a branded prepaid Visa card. Without paying a single fee, T-Mobile wireless customers can deposit checks into their Mobile Money account by taking a picture of them with their smartphone, withdraw money from 42,000 in-network ATMs and reload the cards with cash at T-Mobile stores (non-T-Mobile customers would pay additional fees). There are also no maintenance fees, minimum balances or activation fees. While many already have free checking accounts with their bank or credit union that offer similar features, this is aimed at people who for various reasons can't get a traditional checking account, and rely instead on check-cashing or payday loan services that charge high fees. It's very similar to the service Boost Mobile launched last spring with a similar focus, and T-Mobile Chief Marketing Officer Mike Sievert says households currently using check cashers can save up to $1,500 per year in fees. What it isn't however, is a mobile payment service like Isis Mobile Wallet, which it has no connection to. Interested customers can sign up now online or in T-Mobile stores, and next month it will expand to include Safeway locations.

Intuit releases Mint QuickView in the Mac App Store

Personal finance site Mint.com (owned by Intuit) has released its first OS X app in the Mac App Store. Called Mint QuickView, the app allows Mint.com users to quickly take a peek at their finances. The app isn't a full-fledged personal finance app like Quicken or iBank, rather it's a small window (read: mini browserish) to your Mint account. You access it from OS X's menu bar to see the balances on all your Mint accounts, recent transactions, and net income. The app also displays badged notifications when you have new transactions or one of your accounts needs tending to. Owners of the new MacBook Pro will also be pleased to find the app is Retina display ready. Mint QuickView is a free download and requires Mac OS X 10.6 or later.

Mint adds split-transactions and budget adjustments to iOS app, 40% of users now mobile-only

Popular personal finance site Mint.com is launching an update to its iOS app today that adds the ability to split transactions and adjust budgets on the fly. Those two new features were the most requested from users and make an already excellent app even better. Intuit gave me a sneak peek of the updated app last week, and it's clear that the progression of their app demonstrates the company is keenly aware of how important mobile is becoming to the Mint platform. The company told me that Mint users are remarkably mobile-oriented. In fact, some 40% of the service's subscribers access their accounts only through their mobile devices - skipping the desktop browser entirely. And that number is rising thanks to the popularity of its iPad app. Intuit expects over half of Mint's users will only access the service via mobile very soon. The new split transaction and budget features apply to both the iPhone and iPad app. To adjust a budget, tap the budget category to reveal a 6-month spending bar chart for that category. The bar chart is helpful for you to see how much your actual spending for that budget changes month-to-month. Your current budget is displayed in a slider to the right of the bar chart. If you want to change your budget, simply drag the slider up or down. A nice feature of the budget slider is a variable speed scrubbing that readers will be familiar with from iOS's video apps. While adjusting the budget, users can slide their finger to the left or right to decrease or increase the budget in smaller or larger increments (say, $1, $10, or $25 at a time). Users can also select additional budget categories to display in addition to the currently shown ones. The other major new feature is the ability to split transactions. While viewing your transactions you'll now see a "split" button. Tap it to bring up the split transaction window. You can then divide a transaction into as many categories as you want. For example, a $2,500 transaction from Walmart, which by default would normally be labeled "Shopping," can now be split into multiple transaction categories –- i.e. $1,200 for "Electronics," $85 for "Food," $234 for "Clothing," etc. Best of all there's no arithmetic required. When you split a transaction, each category's sum is automatically deducted from the original category's total. You can check out the new features in the gallery below. Mint version 2.4 is a universal app and a free download. %Gallery-155427%

Personal Capital announces iPhone app, Universal Checkbook

One of the major issues with financial services apps these days is that there are way too many of them. Every different bank or investment firm seems to have at least one app; many have multiple apps required to access different accounts thanks to the outdated systems behind those accounts. Today, Personal Capital announced a free iPhone app that brings together all of those accounts into one app, and also lets users move money easily or pay bills from any account. Yesterday, I had the privilege of watching a demo of the Personal Capital app presented by Bill Harris (CEO of Personal Capital, ex-CEO of Intuit and PayPal) and Jim Del Favero, VP of Software Product Management and also a veteran of Intuit. It's obvious that Personal Capital had looked at all of the personal finance applications on the market at this time, because its new app manages to avoid all of the pitfalls inherent in the others. Harris noted that when most people launch a personal finance app, they want to see their balances. However, most other apps require you to navigate to another screen to look at balances. Not so with Personal Capital; the first screen you see after logging in (shown above right) lists the current balances for all of your accounts, whether savings, checking, credit or debit cards, or investments. %Gallery-154876% Navigating the app is also a pleasant surprise. While most personal finance apps I've used are a nightmare to move within, Personal Capital made it possible to dive deeper into each account with a single tap. Harris mentioned that most of the app can be navigated by just using a thumb -- something that's unheard of in most iPhone apps. For each account, there's a ring-like feature with segments marking off the relative amount of money assigned to different categories. Within that ring is a small line graph indicating the balance of the account over time. Tap the graph, and you see individual transactions. It's an intuitive and quick way to navigate through the history of transactions for an account. Personal Capital also announced a new feature in the iPhone app that is not part of their iPad app -- the Universal Checkbook. This feature makes it simple to pay literally anyone from any account with a few taps. Adding a checking account to Personal Capital is also quite simple -- you just take a picture of a blank check and the account is added. That's it. No typing of account numbers required. If you wish to try Personal Capital, the service is free for the basic functions. If you decide that you'd like personalized portfolio management, they charge less than a 1 percent fee for the privilege. That's one other amazing feature of the app, by the way. If you want to contact your finance advisor at Personal Capital, you can tap a button and send them a message, make a direct call, schedule a time for a call, or call them via FaceTime. Expect to see a more complete review of the app in the near future. Show full PR text Remote Control for Your Money Personal Capital Launches Free iPhone App SAN FRANCISCO, CA – May 8, 2012. How can you manage your money when you're not at home? Personal Capital's new iPhone app gives you complete control across all your accounts at all your financial institutions: • Check Balances – Check current balances and recent transactions on all of your bank, credit card and brokerage accounts. • Monitor Cash Flow – Monitor your total income and spending, with quick comparisons to prior months. • Track Investments – Track and understand your entire investment portfolio across all your accounts – including IRAs, 401(k)s and 529s. • Move Money – Move money anywhere – from any account to any person, any biller or any other account. "You've got a remote control for your television. You need a remote control for your money!" said Bill Harris, CEO of Personal Capital. "There are good reasons to put your money in many different accounts – most people do. But to take control of your money, you want to view everything in one place, and do everything in one place. View and do." • View – See everything – from your total net worth to your most recent credit card purchase – on your iPhone. • Do – Move your money from anywhere to anywhere. It's remarkably easy, with just three taps on your iPhone: 1. FROM 2. TO 3. AMOUNT It's like having instant electronic access to the checkbooks for every one of your accounts. You tell us "from, to, amount", and we take care of the rest. ### About Personal Capital Developed by a team of high-tech and finance veterans, Personal Capital combines technology with personal service to create an entirely new way to manage your money – all of your money, at all your banks and brokers. Our free service effortlessly gathers all your financial data in one place, and helps you take control of your financial life. To learn more, please call 855-855-8005 or visit PersonalCapital.com.

RIM, Telefonica announce NFC trial, aim to launch mobile wallet next year

RIM's NFC campaign is about to roll into Iberia, now that the BlackBerry manufacturer has announced a new partnership with Madrid-based Telefonica. This week, the two companies unveiled plans to begin testing a mobile payment and ID card system across the Spanish capital, in the hopes of launching commercial services next year. The so-called Telefonica Wallet for BlackBerry trial will involve some 350 Telefonica employees and a select group of testers within Madrid, each of whom will be able to make payments, access offices and check bank statements from their BlackBerry handsets. Telefonica's Matthew Key told Reuters that his company chose RIM to participate in the trial primarily because of the security of its BlackBerry platform, stressing the importance of earning enough consumer trust to handle sensitive personal data. No specifics yet on when or where the carrier will launch a full payment system, though Key said that Telefonica's aiming to bring it to a handful of markets in 2012.

Google Checkout merges with Google Wallet, completing the inevitable

In a move that has "common sense" written all over it, the folks over at Mountain View have decided to merge Google Checkout with Google Wallet. The marriage hardly comes as a surprise, considering the fact that both services serve essentially the same purpose -- namely, storing all your payment information in one neat little package. To make things even tidier, Big G has just folded Checkout into Wallet, which will soon be integrated within the Android Market, YouTube and Google+ Games, as well. As a result, the Checkout moniker will vanish from the Earth, but current users will be able to seamlessly switch over to Wallet the next time they log in to their accounts or make an online purchase. For more details, check out the source link below. [Thanks, Samer]

Mint.com iPad app finally hits the App Store

The wait for Mint.com's iPad app is finally over. Today Mint's parent company Intuit unveiled its iPad app, and while many of us would have preferred to have it sooner it proves the old adage "good things come to those who wait." Last week I got a exclusive sneak peek of the app and I can tell you that out of all the websites that have made the browser-to-iPad leap, Mint is the one that has done it most successfully. Founded in 2006, Mint.com was one of the first fiscal information sites that acknowledged a simple fact: most people just want one easy-to-view dashboard to see all their financial accounts at a glance. Mint.com achieved this through aggregating checking, credit card, and loan accounts and presenting them to users in a beautiful UI. Mint was so successful in achieving its goals, personal financial software powerhouse Intuit bought the company in 2009. Since the iPad launched, Mint users have been clamoring for for a native iPad app. While Mint.com is an excellent web-based service, the site is hard to use on the iPad since its high level of interactivity was designed for desktop web browsers rather than large touchscreens. With the release of the Mint iPad app today, the company has brought the full power of its service to the iPad. As a whole, the iPad app offers more engaging ways to view your finances than the browser-based service ever could. Launch the Mint app and you're presented with the Overview screen, composed of five modules that let you see your financial health at a glance. The charts module at the top of the screen shows you a quick overview of your finances using colorful graphs. These graphs allow you to easily see your spending overview, your spending over time, and your net income. The mini feed module is a Twitter-like feed of your financial history, including alerts and financial advice. The budget module tracks your monthly spending. The top spending module shows you the top categories you spend in. Finally, the accounts module shows you all your accounts at a glance. Tapping on any of the modules takes you to a more detailed screen breaking down your finances. For example, tapping on the Spending Overview graph in the charts module takes you to a new screen where that graph is fully interactive. On this screen you can scroll though the pie chart (much like you scroll an iPod's click wheel) to really dig in to see where your spending is going. When you've chosen a category in the interactive pie chart you can tap on the category to see all of its transactions and, even cooler, see all the details of that category laid out in an interactive pie chart. At the bottom of the individual category charts is the Time Navigator, which allows you to select a single month to view your spending in a specific category or select a range of months to see how you've been spending in that category. A nice feature about the app is that is really takes advantage of using multitouch gestures to navigate within it. For example, when viewing an individual transaction you don't need to tap a "back" button on a screen to return to the previous screen, you can simply swipe the current page out of the way to get back to it. It's little features like this that making using the Mint app such a joy. Other welcome features of the app include a search function that allows you to search transactions by merchant, categories, or tags; passcode lock with automatic wiping if the wrong passcode is entered too many times; every transaction can be edited right in the app; and users can enter manual transactions that let them track cash purchases on the go. The manual transaction feature integrates with Google Places, allowing users to see a list of nearby merchants that they can then select as the place they spent their cash. Manual transactions will automatically be categorized based on the type of merchant selected and they are also mapped and geotagged. Speed is also something you see in the iPad app. Users who have been with Mint for four or five years probably have a large amount of transaction histories for their accounts, and the Mint app navigates transaction histories quickly without any lag. When I interviewed Mint founder Aaron Patzer shortly after Apple unveiled the iPad, he told me that a Mint iPad app was something the company was planning on. So why did it take so long? According to the Mint developers who gave me an advance preview of the app, they didn't want to release a Mint iPad app just so they could say they had an iPad app. They wanted the Mint iPad app to have as high an impact as possible and they wanted to take the time to get it right, "putting the stress on quality" as one Mint engineer told me. Mint "wanted something that really did justice to the device. We didn't want to just port the iPhone app and just magnify everything. [We] wanted it to feel very immersive. The way people use the iPad is very different than the way they use the iPhone. People spend a lot more time on the iPad. The usage patterns are different. [We] wanted to really give people a mechanism [where] they could really dig deep into their finances." Given how well the app runs, it's a bit surprising that Mint's developers consider Mint for iPad as a "very 1.0" release; they are already planning to add more features to it, like additional trends charts (including Net Worth) and goals. My take: Mint has done a better job translating the site to the app than almost anyone else who's gone down this road, because their app captures the full functionality of the website without compromising any usability features. Indeed, because of its powerful interactivity and features I would say that the Mint for iPad app is even better than the Mint website at allowing users to view, track, and manage their personal finances. It's that good. Check out the gallery below to see what the app looks like and then download the free universal iOS app from the App Store. %Gallery-137509%

Kinect hack lets you manage your bank account with gestures, will occupy your living room (video)

You know all those convoluted gestures and hate-infused fist pumps you make every time you look at your bank account? Well, you can now put them to good use, thanks to a new Kinect hack from Lithuania-based Etronika. The company's software, which made its debut at last week's CTIA E&A event, effectively brings motion-controlled banking directly to your living room. All you have to do is stand in front of your display, clap your hands to choose an icon, or wave your hand back and forth to navigate across the app's carousel menu. This means you can pay your bills, check your balance and return to fetal position without even touching a sharp object. "A lot of banking software apps are filled with boring crap," Etronika CEO Kestutis Gardziulis explained with refreshing candor. "With our software, you could be on the couch at home, having a beer, all while dealing with your bank account and kicking back." Beer, banking and body language -- sounds scandalous! Head past the break to watch a demo video, starring Pam Beesly's doppelgänger.

Doin' the Moneydance 2008r2

Keeping track of personal finances isn't usually something to dance about, but with the newly released Moneydance 2008r2 for Mac, you might at least do a little happy dance whenever your checking account balance is in the black.Moneydance is a full-featured personal finance manager with online banking and bill payment, budget tracking, scheduling of transactions, and investment management tools. It's perfect for older Macs, requiring only 4.8 MB of hard disk space and a thrifty 128 MB of RAM. The US$39.99 Mac app (upgrade free for existing users) includes a ton of bug fixes and improvements. There's a new popup display of transaction information and splits when you hold down the alt key when hovering over a transaction, plus improved graphs, the ability to store online passwords in the data file (encryption must be enabled), and more. A free trial is available for those who are curious.