transaction

Latest

Google lets developers sell in-app purchases through Assistant

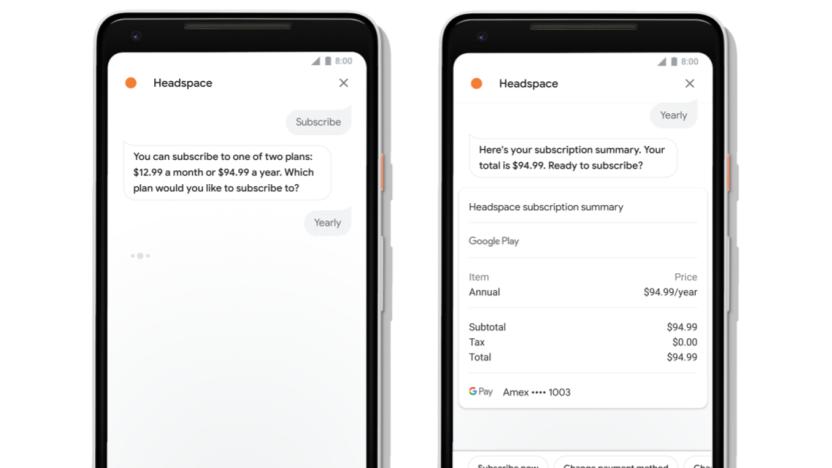

Google has taken steps recently to make its voice-controlled Assistant easier to use, and now it's rolling out features to developers to help them integrate the same levels of intuition into their apps. Launching today is support for digital goods and subscriptions, plus Google Sign-In, which will give users a seamless path for voice-controlled purchases. In other words, you'll be able to buy app upgrades, expansion packs or new levels while in conversation with Assistant, without having to transition into touch.

Square sellers no longer need signatures for card payments

Square Cash is continuing its crusade to make the business of parting with your hard-earned money a little less painful. It's just announced that it's cut down EMV transaction time on Square Reader for contactless and chip even further, to just two seconds, compared to the average eight to 13 seconds. The process uses a new "dip transaction flow" that prioritizes the parts of a transaction that are critical to security, which means less time standing in line, waiting for your card info to churn through to the issuer.

American Express will stop requiring signatures for purchases

Mastercard and Discover both announced in recent months that, starting next year, they would no longer require signatures for credit card transactions. Now, the Verge reports, American Express has announced it's also moving away from signatures. As of April 2018, American Express signature requirements will be no more and the company says it's because technology advances have made them obsolete. "Our fraud capabilities have advanced so that signatures are no longer necessary to fight fraud," American Express Executive VP Jaromir Divilek said in a statement.

Pay-to-trade could change the landscape of MMO economies

If you've noticed that it's become more difficult to buy, sell, or trade goods in an MMO these days due to the sheer amount of player-bound items, you're not imagining things. A writer for Gamasutra penned an article in which he discusses the decrease of in-game trade and suggests that studios might be missing out on a great source of potential revenue. First, he acknowledges why studios have moved to restrict trade. It keeps the headache of managing an economy to a bearable amount, it cuts out duping and exploits, and it stems revenue losses that are caused by third-party traders. However, the author says that the hassle could be worth it if studios were smart and got in on the action by creating a pay-to-trade economy. "In the real world, we pay huge sums in the form of taxes and fees to keep transaction costs low," he writes. "So here's my question for developers: How much would your players pay you in exchange for the ability to trade?"

Square intros flat-rate payment option at $275 per month, hits small business sweet spot

Square is most often pitched as heaven for small businesses, but that 2.75 percent cut per transaction is sometimes a problem for stores that are too successful. Enter a new flat rate option. Shops that don't take more than $250,000 a year in Square payments, or charge more than $400 in a given sale, can instead pay a flat $275 per month regardless of how many swipes they take. The deal makes the most sense for businesses handling more than $120,000 a year through the reader, establishing a definite limit to its usefulness; this isn't exactly for a budding jeweler (or Starbucks). Even so, the simplicity of the rate might be very alluring for companies that aren't keen on surprise costs or working out the math, and it's a contrast to the half-steps towards flat rates taken by VeriFone and other, more traditional outlets going mobile.

Dish Network rumored to have bought Clearwire's $400 million debt in secret transaction

We're not in the habit of entering the dry world of corporate debt notes, but Sprint's latest financial release might disguise a juicy bit of news. There's a rumor in the business press that Dish Network might have bought around $400 million of Clearwire's debt -- helping relieve the pressure on Sprint, which has been keeping its subsidiary alive on handouts. Unsurprisingly, no-one's commenting on the rumors, although Dish CEO Joseph Clayton did say he was open to a partnership (or acquisition) with Sprint / Clearwire late last year. If true, it could signal that it's getting ready for a fight against AT&T -- or maybe it just wanted to throw Dan Hesse a bone.

Square now available at Walgreens, Staples and FedEx Office

While a roster of competitors are trying to get their foot in the mobile payments door, Square's busy getting a foothold in retail stores. With Walgreens, Staples and FedEx Office locations now carrying the credit card reader, it's available at more than 20,000 physical shops throughout the US -- joining Apple, Best Buy, OfficeMax, Radio Shack, Target, UPS and Wal-Mart. Bringing it home from a brick and mortar establishment will set you back $9.95, but Square's sweetening the pot with a $10 rebate for new users. However, if your entrepreneurial snail mail-loving heart desires, you can still have one mailed to you by signing up online. Eager to start swiping plastic? Lookout below for the full press release.

Royal Canadian Mint aims to kickstart digital currency with MintChip developer challenge

Bitcoin may not have yet grown much beyond a relatively small base of enthusiasts, but it looks like the Royal Canadian Mint is hoping that its backing will help its own new digital currency catch on in a bigger way. While less decentralized and different than BitCoin in a number of other respects, it is similarly an all-digital currency, and one that requires no personal data to be shared during transactions. Those transactions can be both large and very small (with an emphasis on the latter), and handled in a variety of ways, including over the web or directly between two devices with the necessary hardware (a MintChip-enabled microSD card is one proposed option). While a more formal unveiling is apparently coming later this month, the Mint has already kicked off a challenge where it's inviting developers to create applications that use MintChip technology -- something that, for the near future, will only be available to said developers. Complete details on it can be found at the link below.

Google Wallet supports prepaid cards once again, afflicted users get $5 in compensation

Google Wallet's prepaid experiment hasn't been the smoothest of endeavors, but the company wants to make up for all the headaches -- with cash. A few weeks ago, Google disabled a feature that allowed users to add a Google Prepaid Card to their wallets after either removing it, or resetting their apps. The move came in response to mounting security concerns, but those issues have been allayed with the latest version of Google Wallet, meaning that users can now re-add their prepaid cards and hoover up all the money that was previously on them. To make up for the "inconvenience," Google has added an extra $5 to every prepaid card, and sent an email out to all its customers to let them know about it. So if you count yourself among the legions of inconvenienced, be sure to add your card and spend that $5 on something sublime.

Square's new Register app turns the iPad into a full-on point of sale terminal

Square continues to add functionality to its mobile payment platform, and the latest addition is its new Register app for iPad. The refresh brings a sleeker interface and greater Card Case integration along with analytics to break down sales by transaction type and chronology to track your business' performance. Additionally, you can set up custom permissions to limit employee access, create customer loyalty programs and there's an improved inventory system feature as well. Naturally, it still relies on Square's trusty card reader for swiping cards and charges 2.75 percent per transaction using Visa, MasterCard, Discover or American Express. Small businessmen, your payment chariot awaits, so check out a video of the new Square Register in action after the break.

T-Mobile brings Square to select small businesses, does the mobile payment thing

T-Mobile is throwing some of its weight behind the mobile payment movement this morning, becoming the first carrier to offer Square credit card readers to a handful of retail outlets. Under the company's new campaign, stores equipped with T-Mobile smartphones will be able to use Jack Dorsey's readers to finalize transactions from the comfort of their palms. This should come in handy for cash-only businesses, in particular, as T-Mobile emphasized in its announcement today. It's all part of the provider's lineup of small business offerings, though not every retailer will be involved at launch. To see the full list of Squared-up outlets, check out the source link below.

Online shopping gets iPad surge on Christmas Day, iOS dominates in December

There's no rest for the weary in retail this year, but at least on Christmas Day most of the shopping frenzy was online and not in line. IBM's Smarter Commerce unit, which tracks 500 online stores (but not Amazon, the largest, and probably not Apple's store either) told the AP that Christmas Day online shopping increased by 16.4 percent year over year. It's not clear if that number represents the number of individual transactions or of unique purchasers, but IBM did say that the dollar amount of online purchases made via mobile devices was up a whopping 172.9 percent over last year. Moreover, IBM exec John Squire reported that almost seven percent of all online purchases on 12/25 originated on a single device: the iPad. Seven percent of all transactions isn't bad for a platform that hasn't yet celebrated its second birthday, but the iOS slice of mobile e-commerce is a lot wider than that. According to a report released last week by retail insights firm RichRelevance, the overall dollar share of online purchases made from mobile devices has doubled over the past eight months and now stands at 3.74% of sales spending online. Of that chunk of cash, 92% of the December purchase transactions originated on an iPhone, iPod touch or iPad (up from 88% in April 2011). Think about that for a moment. Nine out of every 10 mobile transactions recorded by RichRelevance in December came from an iOS device; since RichRelevance, like IBM, can't see into Amazon or (probably) Apple's sales data, the true ratio could be somewhat lower or higher, but still. Even the average dollar value per order is higher for iOS than for Android ($123 vs. $101 in December), and both mobile platforms walloped the $87 AOV for desktop browser orders. As GigaOm noted, the volume of mobile transactions seems to spike on holidays and weekends, when shoppers are less likely to be sitting at their PCs. RichRelevance says it analyzed more than 3.4 billion transactions to arrive at its results, including data from 10 out of the 25 largest web retailers. Both Apple and Amazon hold their sales data very close to the chest, but you can bet that both companies are also mining through their records and coming up with similar conclusions -- shopping on mobile devices is growing fast, and iOS is leading the way and/or lapping the field. [via Business Insider & GigaOm] Photo by Ramberg Media Images (CC)

Visa aims at developing countries with new international prepaid mobile payment service

Shortly after announcing its new digital wallet service V.me for developed markets, Visa also made a presence at Mobile Asia Congress in Hong Kong to promote its new prepaid mobile money platform aimed at the under-banked and the unbanked consumers. By utilizing its recently-acquired Fundamo (which currently has more than 10 million mobile payment subscribers), Visa aims to leverage on the vast number of mobile phone users in developing countries -- many of whom are already using local but carrier-bound mobile payment systems -- in order to offer a globally interoperable mobile payment network. This overlaying platform is said to be more secure, much cheaper and more convenient than the likes of Western Union, especially when you can simply make mobile-to-mobile payments when sending money across countries. Nigeria and Uganda will be the first nations to get a taste of this early next year courtesy of telecommunications provider MTN Group, and eventually more developing countries in Africa, Asia and Latin America will join the list. Full press release after the break. %Gallery-139688%

Developers get Google Wallet on original Nexus S, squares wiping your phone with $10

Previously the exclusive phone-swiping domain of Sprint's Nexus S 4G, it now seems possible to get the wonders of Google wallet on its decidedly 3G predecessor. However, it's not an operation for the faint-hearted. If the words Cyanogen, full wipe, flash and kernel resemble white noise, it's probably worth waiting for an official release. See how the forum members at XDA Developers got their NFC wallet fix at the link below. [Thanks, John]

Engadget giveaway: win one of five Nexus S 4G phones with $1,000 Google Wallet credit!

We're pretty excited about Google Wallet, but the service is currently only available for Nexus S 4G phone owners, leaving most of you waiting for broader implementation. Well, how would you like to skip the line, getting to test it out on a Nexus S 4G of your very own? Google has supplied us with five phones to give away -- the company is even throwing in $1,000 (yes, one THOUSAND dollars) of prepaid credit to help fund those first few dozen taps. There's one catch: you'll need to use your Nexus S 4G with a Sprint plan, though the carrier is throwing in one month of demo service to get you started. Check out our in-depth preview for a detailed look at the service, and simply leave a comment after the break to be entered to win -- after checking that you meet the entry requirements, of course.

A week with Google Wallet (video)

Contactless payments have been something of a curiosity in the credit card industry. MasterCard's PayPass has been around for the better part of a decade, but merchants and banks alike seem hesitant to adopt the technology required to make the system work, and inconsistent implementation adds to the confusion -- particularly for customers. Google's new mobile phone-based Wallet service has the potential to transform the technology from its current status as a transaction turkey, to a future as a checkout champion. But will it work? We spent a week with a Wallet-enabled Nexus S 4G, using the device to pay whenever we encountered a MasterCard PayPass terminal. Unfortunately, that wasn't often enough, limiting us to just a handful of transactions in the first week. Still, with Google just beginning to roll out the service and only a limited selection of launch partners ready to go, it's impossible to deliver a complete verdict just yet. Jump past the break for an inside look at Google Wallet, including a video of the service in action, and a brief look at what the world of contactless payments may look like in the future.%Gallery-130759%

ERPLY's mobile credit card reader handles NFC payments on an iPad, obliterates the check-out line

It may look like nothing more than a glorified chip clip, but that dongle at the bottom of this guy's iPad is actually ERPLY's new credit card reader -- the latest addition to a growing field of NFC and mobile payment devices designed for small and large businesses. Once attached to an iPad's charging port, the peripheral will send a user's encrypted credit card information to ERPLY's point-of-sale and inventory management software, allowing customers to purchase products on the store room floor and giving retailers the ability to monitor transactions and stock flows in real time. Available for $50 (with a transaction fee of 1.9 percent), the reader is also equipped to handle both NFC and traditional card payments and, after processing a purchase, will automatically send a receipt to consumers via text or e-mail. At the moment, it's only available for the iPad, though iPhone users should be able to get their own version within the next three months. Swipe past the break for more information, in the full press release.

Leaked FCC document details AT&T's 4G LTE rollout plans, talks up T-Mobile merger

On Friday, a law firm accidentally posted a letter to the FCC website, detailing AT&T's confidential 4G LTE rollout plans and explaining how they would be bolstered by a merger with T-Mobile. Arnold & Porter LLP, which is helping design the deal on AT&T's behalf, quickly removed its partially redacted document, but the folks over at Gizmodo have gotten their hands on it once again and recently posted it for our viewing pleasure. According to the document, AT&T plans to extend its US coverage to 70 million consumers by the end of this year, before ramping that figure up to 170 million by the end of 2012 and a full 250 million by the end of the following year. The carrier plans to achieve this by upgrading a full 44,000 of its nodes to LTE over the course of the next three years and, once its merger goes through, hopes to cover 97 percent of all Americans within the six years following approval. The letter goes on to explain how the economics behind the TIA-approved deal would help facilitate these aspirations, while confirming that the merger is indeed as expensive as earlier reported -- a whopping $3.8 billion, to be exact. To read the document in full, hit up the links, below.

Cirque's GlidePoint NFC trackpad makes online shopping even lazier (video)

We've seen NFC technology pop up in everything from smartphones to windshields, but a company called Cirque has now expanded it to desktops, as well, with its GlidePoint trackpad. Cirque's system is relatively straightforward, consisting of its GlidePoint module (with an onboard NFC antenna) and a simple touch sensor. With these two elements working in harmony, users can scan a compatible card by hovering it over the module, while simultaneously using the trackpad to execute onscreen functions. The company has applied the same concept to its proprietary glass touch panel, as well, which could be integrated at payment terminals, or within tablets and touch-based smartphones. It remains unclear whether we'll see this kind of technology pop up on the commercial level, but for more details, check out the demo video after the break, followed by the full press release.

Zoosh does mobile payments using ultrasound, no NFC chip required

Zoosh. That may or may not be what an ultrasonic payment sounds like to a dolphin, but it is definitely the name of a new mobile wallet technology developed by Silicon Valley start-up, Naratte. While Google and other major players have focused on traditional radio-based NFC, Naratte has been quietly testing its ultrasound system instead, motivated by the fact that it can work on ordinary handsets without the need for specialized NFC circuitry. Two phones can "zoosh" each other using nothing but their built-in microphones and speakers, so long as they're both running the necessary app. Moreover, Naratte claims that cash tills can be upgraded to hear the sweet jangle of ultrasonic cash for just $30 -- around a third of the cost of installing radio-based NFC hardware. So who knows? The last time you came this close to ultrasound was probably just before you were born, but one day you might find yourself using it to buy diapers. Scary.