mobilepayments

Latest

LG Pay goes live in the US

More than two years after it arrived in South Korea, LG's long-delayed contactless mobile payment system has finally gone live in the US. LG Pay is available on the G8 ThinQ at launch. In the coming months, it'll be available on V50 5G, V40, G7 and V35 from Google Play, and it'll work on all future flagship devices.

Microsoft deal with Grab brings its AI, cloud tech to ride-hailing

Earlier this year Uber sold off its ride-hailing business in southeast Asia to a competitor, Grab, which is now raising $3 billion to further expand operations. Today Microsoft announced it's making a "strategic investment" in Grab, as the two launch a "broad partnership" to use Microsoft's machine learning and AI tech. The first step is adopting Microsoft's Azure servers as the cloud platform backing Grab's ride-hailing and digital wallet. After that the plans get bigger, as it anticipates using machine learning and image recognition to let passengers share their location with a driver by taking a picture of their surroundings that the system recognizes and converts into an address. Otherwise it could handle recommendations, improve fraud detection, improve its maps or power facial recognition to identify drivers and passengers. There are also non-AI powered parts of the arrangement, like in-car entertainment systems, linked rewards programs and integration with Outlook. Like Uber, Grab is building a platform to do a lot more than have a stranger come pick you up in their car, while for Microsoft, all of this seems similar to its efforts to compete with Amazon in building more-connected grocery and retail stores and dominate developing back-end technology to control everything. Microsoft didn't say how much it's investing in Grab, but Japan's Softbank is reportedly investing $500 million, while Toyota already announced it's in for $1 billion.

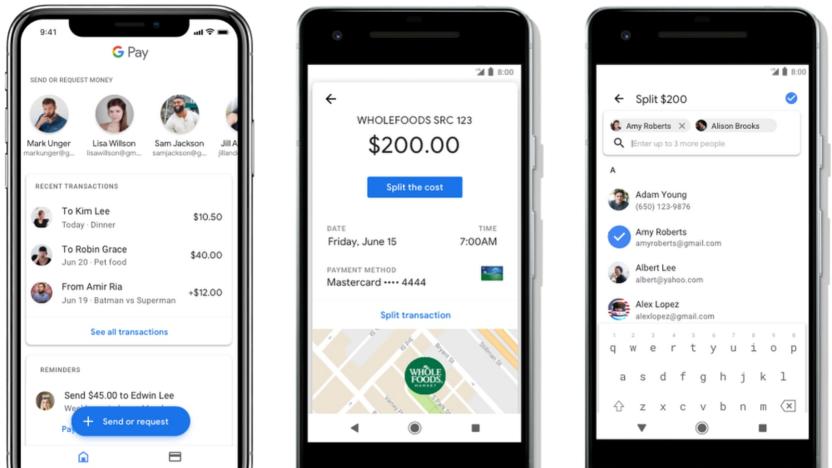

You can now send and receive money through Google Pay

Earlier this year, when Android Pay officially became Google Pay, we were surprised that the ability to send and receive money was still contained in a separate app (called Google Pay Send). Today, Google finally announced that the company is combining the Pay and Pay Send apps. Users in the US can send and request money through Google Pay, and soon users in the UK will have the same option.

Venmo won't let you pay or charge people from its website anymore

If you've ever used Venmo to pay someone your share of the electric bill or for a half a pizza, you probably did it from your smartphone. Most of the service's users do. There's a loyal subset of people who prefer using Venmo's website for all that, too, but they're all pretty upset right now. According to a statement included in users' May 2018 account summaries, Venmo will "phase out some of the functionality on the Venmo.com website over the coming months," and it's starting with the ability to send payment requests and complete charges from inside a web browser. (In a chilling coda, the company reiterates at the end of the statement that "this is just the start.")

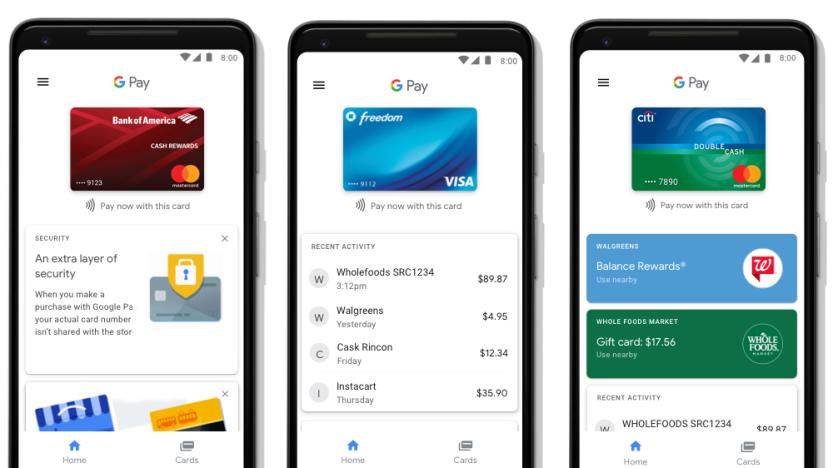

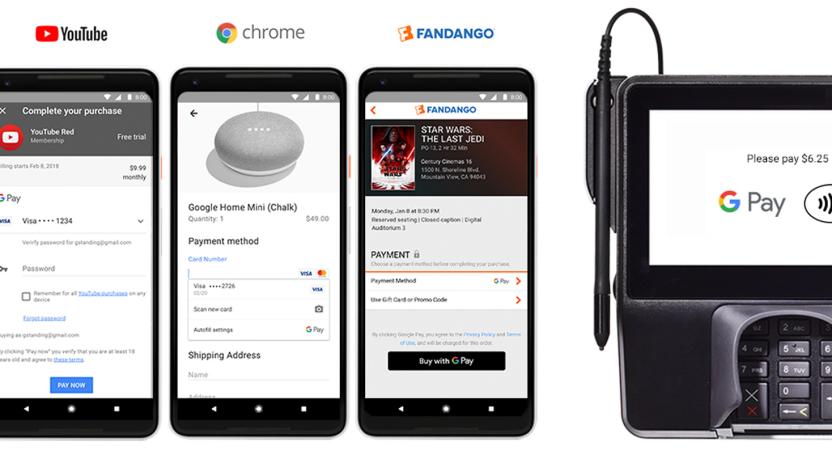

Google Pay is the new Android Pay

Google recently admitted that Android Pay and Google Wallet probably didn't need to exist as two different services. After a fictional, Highlander-style battle, it was Google Pay that emerged victorious, taking on a new name to define this united brand. And so today, Android Pay becomes Google Pay. The app still does everything you'd expect it to, though there's a new Home tab that puts recent transactions, nearby stores and rewards in one place. The Cards tab, on the other hand, is more a catalog of your payment cards, gift cards, loyalty schemes and offers. Unexpectedly, Google Pay doesn't actually include Google Wallet functionality, meaning you can't use it to send or request money. Not yet, anyway.

Google's Indian mobile money app can pay bills in a few taps

Manually paying your bills online usually involves jumping between multiple apps or websites, but Google might have an easier way. Its Tez mobile money app for India now includes a bill payment feature that lets you handle all those recurring costs in one place. You can add from a list of 80-plus companies (including utilities and telecoms) and pay directly from your bank account with a few taps. You get notifications when bills pop up, so you shouldn't forget about a bill until it's too late.

Google Wallet and Android Pay are finally united under one brand

Google's payment strategy has been more than a little confusing. It originally offered tap-to-pay under the Google Wallet badge, but it moved that functionality to Android Pay while turning Google Wallet into a money transfer service. Thankfully, Google knows it's a mess and is cleaning things up. The search giant is uniting all its payment efforts under a singular Google Pay brand. Whether you're tapping your phone at the cashier, buying a gift on the web or paying a friend for last night's pizza, you'll see the same name.

China will cap QR-code payments to tackle fraud

China's central bank is issuing regulations over QR-code-based payments. Paying for things by scanning a barcode with the Alibaba or WeChat app is more common than using cash in the region and now the government wants to keep closer tabs on where the money is going. You might laugh at the idea, but QR codes aren't the punchline in the east that they are here. For instance, plenty of cabbies prefer taking QR payments because it means they don't have to handle small change.

China’s WeChat Pay comes to London

Walk around Camden Market this weekend and you'll notice that many of the stalls now support WeChat Pay. The mobile payment platform — an extension of Tencent's messaging app WeChat — is big in China but almost unheard of in the UK (at least outside of the Chinese community). So why bother? Well, the north London market is popular with Chinese tourists. SafeCharge, a company that helps businesses process payments, took notice and has updated its point-of-sale (POS) software accordingly. Now, stall owners can accept WeChat Pay with a tablet and compatible till.

Fitbit's first smartwatch can now make payments in the UK

Convenient contactless and mobile payment options are a dime a dozen these days, but that isn't discouraging Fitbit from throwing its keys into the bowl. After launching in the US and elsewhere during recent weeks, Fitbit Pay is now live in the UK, if not with a few catches. For starters you're going to need one of Fitbit's new £300 Ionic smartwatches, the company's first wearable that isn't geared solely towards activity tracking. Then there's the fact that at launch, it only supports Starling Bank, one of the UK's relatively new, branchless outfits that digs into your payment data to help you better manage your money from your mobile.

Digital bank Monzo now supports Android Pay

Monzo, the British "bank" with a coral-coloured card and a clever savings app, has added support for Android Pay. It's only available for users with current accounts, however. Monzo started with a simple pre-paid card, forcing customers to transfer money from an existing bank account to take advantage of its app-based smarts. In April, however, it was approved by the UK authorities to act, well, like a real bank and offer proper accounts. Since then, it's slowly been inviting pre-paid card owners to switch over (the company says all users should be transferred in the next six weeks.)

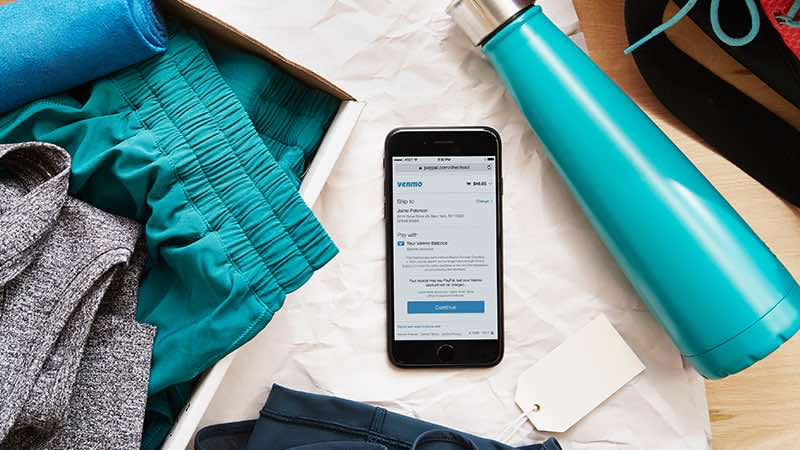

Online shoppers can now use Venmo to pay for their new gear

It's already great for paying back friends and splitting the rent, but Venmo is about to get even more useful. In a bid to court a more youthful generation of online shoppers, PayPal -- the popular app's parent company -- announced this morning that over 2 million US online retailers will accept payments through Venmo.

Tesco's mobile payments app is now called Pay+

Tesco's in-house mobile payment app PayQwiq has been around for a few years now, though it was only accepted in all Tesco stores from the beginning of this year. PayQwiq doesn't roll off the tongue all that well, but today it assumes a new name: Tesco Pay+. As always, the app functions as a virtual Clubcard and keeps a record of your receipts, but its main purpose is allowing you to brandish your phone at checkouts to pay for up to £250 of shopping with a tap.

Oyster card app simplifies top-ups in London

With the growing popularity of contactless payments, the humble Oyster card has a diminished role on the London Underground. Still, it's a useful option for tourists, children, or anyone who wants to keep a close eye on their travel spending. Today, Transport for London (TfL) has launched a mobile app for iOS and Android that makes it easier to top-up and review your balance. Once your account is set up, you can top-up from anywhere — no more queuing at a ticket machine. After 30 minutes, you simply need to touch a reader and the amount will be added on automatically.

Barclays customers can now ask Siri to make payments for them

In today's edition of companies making it all too easy for us to spend money, Barclays has added a feature to its iOS app that will debit your account after hearing you utter but a few words. Or, less sinisterly put, Barclays' mobile banking app now lets you make payments with Siri commands. Provided you've granted Apple's assistant access to your account in the app, you can transfer money to any previously known payee, or anyone in your iPhone's contact list. And you needn't worry about that annoying friend saying "Hey Siri, pay Jamie £15 with Barclays," as you still need to tap your finger to the Touch ID sensor to confirm the transfer.

Samsung Pay now supports HSBC and M&S Bank cards in the UK

In the UK at least, Samsung is awfully late to the mobile payments party. Samsung Pay launched last month well behind Apple Pay and Google's Android Pay, and almost two years after its debut in South Korea. To make matters worse, it was only available to customers who bank with MBNA, Nationwide and Santander. Today, it's playing catch-up with support for HSBC, First Direct and M&S Bank cardholders. While welcome, the app is still missing some of the big British money-lenders including Lloyds Bank and Barclays (Android Pay doesn't have the latter either, mind.)

Walmart Pay will hook new users with instant access to its credit card

When Walmart debuted its own in-house mobile payments service last year, the company was not afraid to roll it out quickly. Walmart Pay arrived in 4,600 stores nationwide in under two months, proving the retail giant could still be nimble -- especially if the result meant moving customers through the checkout line faster. And it paid off: according to a third party study, just eight months after launch the QR code-based system was the third most used mobile wallet after Samsung Pay and Apple Pay. Now the company is giving customers even faster ways to part with their cash.

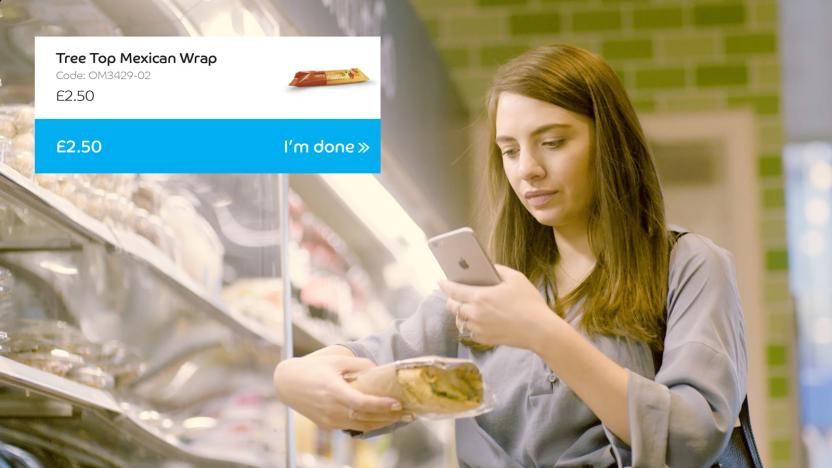

Barclaycard’s ‘Grab+Go’ swaps store checkouts for an app

With nigh-immediate grocery deliveries becoming more and more accessible, there's less incentive to pop down to your local shop to pick up the essentials. But Barclaycard is working on a way to make the in-store experience more convenient by allowing customers to dodge the checkout queue and pay for their basket with their smartphone. The "Grab+Go" app basically turns your device's camera into a barcode reader. When you're done combing the isles and scanning your haul, you simply checkout inside the app and your purchases are charged to a linked card. It then generates a digital receipt that the merchant also has access to, in case they suspect your bag is hiding a few undocumented items.

Alibaba opens its mobile payment system to 4 million US stores

Chinese internet titan Alibaba has struck a deal to let its global AliPay customers buy things in the US through First Data, makers of the Clover point-of-sale system. Just don't mistake this for a full American expansion to compete with Apple Pay and Android Pay: The partnership is explicitly aimed to convenience AliPay's 450 million existing global users visiting the US.

It looks like Apple is resurrecting its Venmo competitor

Apple began considering its own peer-to-peer payment system back in 2015. Since then, however, nothing seems to have come of it. Today, however, Recode reports that Apple is again in negotiations to launch its own money-transfer system to rival competing services like PayPal's wildly popular Venmo. Apple's new service, likely a feature for Apple Pay, could enable you to send money to a friend's iPhone from your own.