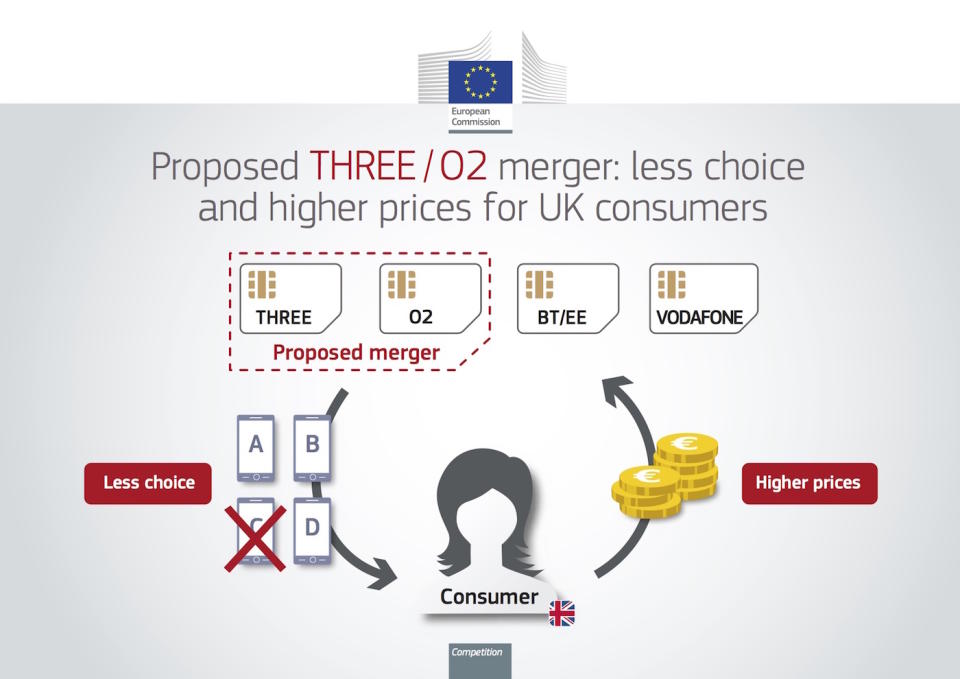

European regulators block Three and O2 merger

"Customers would have had less choice and paid higher prices as a result of the takeover."

We suspected it was coming, but the European Commission has finally come out and said it: Three UK owner Hutchison Whampoa cannot buy UK carrier O2. In a statement, the Commission said that a potential merger between Three and O2 would have "reduced competition" and "resulted in higher prices," which may have negatively impacted the quality of service for UK consumers.

When Hutchison confirmed it was buying O2, the UK's second biggest mobile network, for £10.25 billion in March 2015, it immediately began offering concessions in order to secure approval. One was to introduce a five-year freeze on the price of minutes, texts and megabytes across both networks. Others included the sharing of network capacity with one or two MVNOs, the divestment of O2's stake in Tesco Mobile and a wholesale agreement with Virgin Media.

European Commissioner Margrethe Vestager today confirmed that they didn't go far enough to satisfy investigators, stating MNVO concessions were "commercially and technically dependent on the merged entity" and raised too much uncertainty over how they'd be implemented.

"Allowing Hutchison to takeover O2 at the terms they proposed would have been bad for UK consumers and bad for the UK mobile sector. We had strong concerns that consumers would have had less choice finding a mobile package that suits their needs and paid more than without the deal," says Vestager. "It would also have hampered innovation and the development of network infrastructure in the UK, which is a serious concern especially for fast moving markets. The remedies offered by Hutchison were not sufficient to prevent this."

Commission has decided to block Hutchison's plan to take over O2 in the UK. Why? To serve UK consumers - affordable prices and innovation.

— Margrethe Vestager (@vestager) May 11, 2016

Although buyout rumours were swirling at the same time regarding EE and O2, Hutchison's bid for O2 came after BT's £12.5 billion deal for EE. The broadband provider was able to secure approval from the UK's Competition and Markets Authority (CMA) and the acquisition went through in January, despite opposition from rival providers. However, in Three and O2's case, the merger would ensure that the UK's mobile landscape has only three major players, which is something the CMA would only get behind if Hutchison agreed to sell one of its mobile businesses or break them up to form an independent fourth provider.

The Commission's three major areas of concern focus on the size of a combined Three/O2 network, the development of network infrastructure and a potential squeeze on smaller mobile providers who rely on wholesale agreements from the big four carriers to operate.

Together, Three and O2 would become the UK's biggest carrier with a market share of more than 40 percent. The Commission argues that because of its size, the combined entity wouldn't have an incentive to compete with EE and Vodafone, which may result in higher mobile prices across the industry.

Because Three and EE have a 3G network agreement and O2 is sharing infrastructure with Vodafone, the merged company would have played a role in determining its rivals' network plans. European investigators believe that would weaken both EE and Vodafone and hamper the development of next-generation mobile networks (like 5G).

Hutchison has come out firing following the announcement and is threatening to pursue legal action:

"We are deeply disappointed by the Commission's decision to prohibit the merger between Three UK and O2 UK. We will study the Commission's Decision in detail and will be considering our options, including the possibility of a legal challenge.

We strongly believe that the merger would have brought major benefits to the UK, not only by unlocking £10 billion of private sector investment in the UK's digital infrastructure but also by addressing the country's coverage issues, enhancing network capacity, speeds and price competition for consumers and businesses across the country and dealing with the competition issues arising from the current significant imbalance in spectrum ownership between the UK's MNOs."

What's next for the two carriers? Reports suggest that now the merger has been denied, other providers may decide to get in on the act. Liberty Global, owner of Virgin Media, reportedly expressed an interest in picking up O2 in the event that European regulators blocked the takeover. Should it not find a buyer, Telefonica may also consider making the company public.