Payment

Latest

Google Pay is the new Android Pay

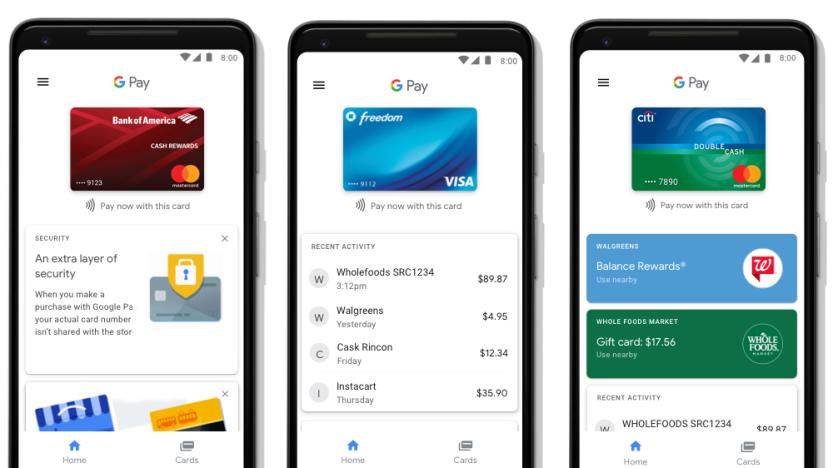

Google recently admitted that Android Pay and Google Wallet probably didn't need to exist as two different services. After a fictional, Highlander-style battle, it was Google Pay that emerged victorious, taking on a new name to define this united brand. And so today, Android Pay becomes Google Pay. The app still does everything you'd expect it to, though there's a new Home tab that puts recent transactions, nearby stores and rewards in one place. The Cards tab, on the other hand, is more a catalog of your payment cards, gift cards, loyalty schemes and offers. Unexpectedly, Google Pay doesn't actually include Google Wallet functionality, meaning you can't use it to send or request money. Not yet, anyway.

Venmo's 25-cent instant transfers are now available for everyone

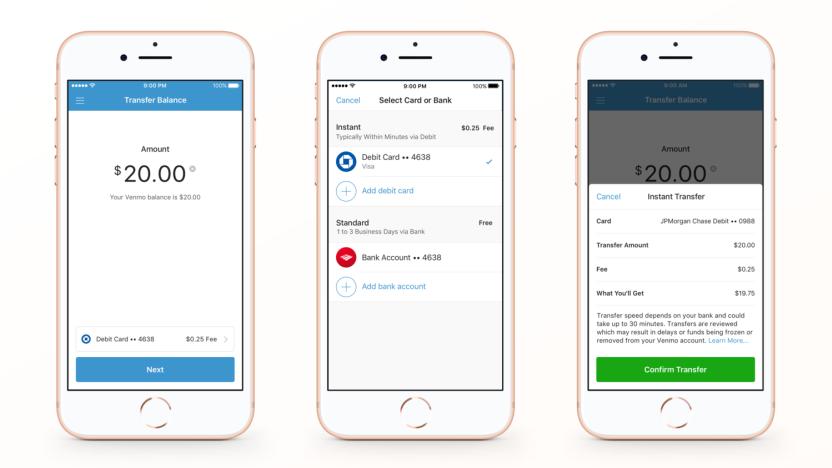

Payment sharing services from Paypal, Square and Venmo are great, but it can take some time to move funds from those accounts to your bank so you can use them in real life. Last year, Paypal introduced $0.25 instant transfer fees to make it much faster to move money to your real-life bank. Now Paypal-owned Venmo is doing the same, offering transfers of funds in less than 30 minutes.

Curve's payment-switching smart card goes live in the UK

Like the thought of switching payment methods for a purchase long after you've left the store? You now have a chance to try it. Curve has launched its smart card in the UK, letting you not only consolidate your credit cards (of the Mastercard or Visa variety) and debit cards, but switch between them for payments up to 2 weeks after the transaction. If you know you're going to hit your credit limit, for instance, you can switch a purchase to debit to give yourself some breathing room.

Google Wallet and Android Pay are finally united under one brand

Google's payment strategy has been more than a little confusing. It originally offered tap-to-pay under the Google Wallet badge, but it moved that functionality to Android Pay while turning Google Wallet into a money transfer service. Thankfully, Google knows it's a mess and is cleaning things up. The search giant is uniting all its payment efforts under a singular Google Pay brand. Whether you're tapping your phone at the cashier, buying a gift on the web or paying a friend for last night's pizza, you'll see the same name.

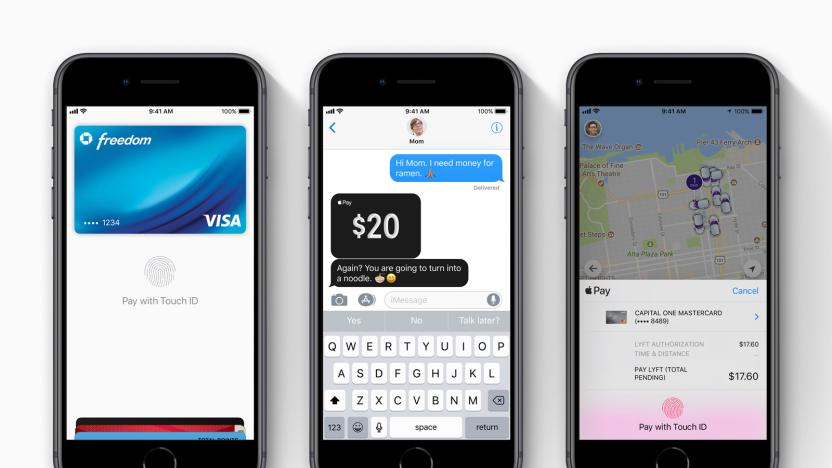

Apple Pay Cash money transfers are available in the US

Apple had to rush-release iOS 11.2 to tackle a nasty date-sensitive bug, leaving hopeful Apple Pay Cash users twiddling their thumbs. Thankfully, you haven't had to wait too long -- Apple's money transfer service is rolling out in the US. As promised, you can add a virtual Apple Pay Cash card to iOS' Wallet app and send Venmo-style payments through your iMessage chats. If you owe a friend for pizza, you don't have to download a separate app or hit the ATM to settle your debt.

Visa swaps payment cards for NFC gloves at the Winter Olympics

Visa is very fond of showing off its tap-to-pay technology at the Olympics, and that's truer than ever with the 2018 Winter Olympics around the corner. The payment giant is selling a trio of NFC-equipped gadgets to help you shop at the PyeongChang games, most notably a set of winter gloves. Yes, you can pay for that souvenir without freezing your hands as you reach for a credit card or even your phone. You won't have to use them or the other devices at the games, but they'll come with prepaid values of between 30,000KRW to 50,000KRW ($27 to $45) to encourage shopping in South Korea. Visa hasn't offered pricing.

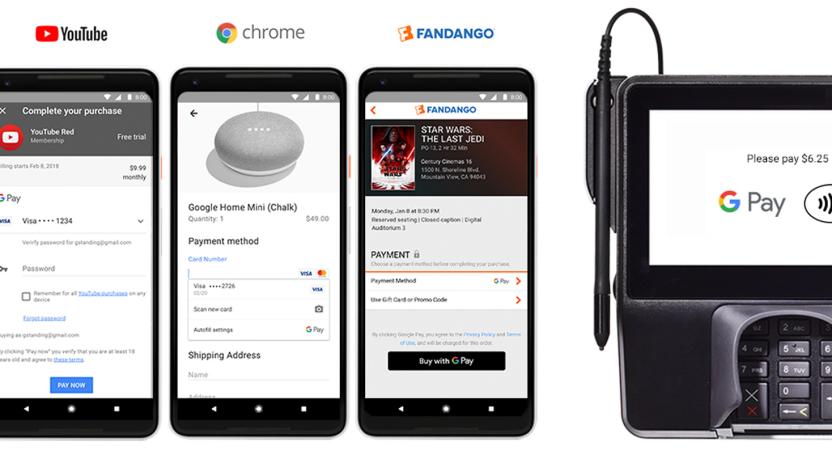

'Pay With Google' makes shopping on Android less of a hassle

As promised, Google is streamlining online purchases made through Android devices by rolling out Pay with Google. The feature lets you use any of the credit or debit cards you've previously logged on the web titan's products (like Chrome, Android Pay, YouTube, or Google Play) to checkout in just a few clicks -- verifying your purchase with a security code or your Android device. That way, you don't have to type in your lengthy card info on a website or app payment form. Instead, Google just sends the merchant your payment details and shipping address from your account.

Venmo invites users to try physical debit cards

Venmo is inviting select users to try out new debit cards that deducts right from their account, TechCrunch reported. This is four months after rival payment service Square started trying out its own card (and two months after its public launch), so Venmo is a little late to the game, but apparently users are already getting their new payment plastic.

NYC's Citi Bike adds Apple Pay to make bike-sharing easier

Next time you rent a Citi Bike in New York or New Jersey, you'll be able to pay with your iPhone. The latest update for the bike-sharing service's app adds support for Apple Pay, as spotted by AppleInsider. No, this isn't the most exciting update, but it does make using the app a little faster and easier for new users. From here on out, they won't have to stand idly on the sidewalk, fumbling with entering credit card info in the app just so they can take a quick ride to the JC Penny a few blocks away.

Curve's smart card switches between credit and debit after purchases

Have you ever bought something only to regret it later as you run into a spending limit on the card you used? If you live in in the right country, you might have a way to overcome this particular strain of buyer's remorse. Curve is giving its British and European Mastercard users the ability to switch a purchase between credit or debit up to two weeks after the transaction took place. If you realize you're going to go into overdraft, or that you should have expensed dinner on your corporate credit card, you can make a change before it's too late.

Airbnb tests payment-splitting feature so you don't get stiffed

Airbnb is testing out a feature that would allow reservations to be split among multiple people. So, if you're booking with rude friends who never pay you back or if you want to book an expensive reservation that may be too much for one credit card to handle, this new feature would help you out. The option allows a reservation to be split with up to 16 people and is being tested with just a few listings as of now.

PayPal 'instantly' transfers money to your bank account

PayPal can be frustrating if you want to put funds in your bank account. It can take a day or more for transfers to go through, and that's a problem when rival services like Zelle can promise speedier access to your money without needing a separate app. To that end, PayPal is rolling out an instant transfer option in the US. So long as you're willing to accept a 25-cent transaction fee, your funds will hit your bank account within a few minutes, and no more than 30 minutes in the worst cases. If you withdraw money from PayPal before a shopping trip, it should be ready to use by the time you get to the store.

Android Pay hits Canada without the support of some major banks

You have to sympathize with Android-loving Canadians. While Apple Pay has been available in the country since 2015, Android Pay has been a no-show -- you've had to pay for your Tim Hortons donuts the old-fashioned way. At last, though, it's here. In the wake of some not-so-subtle clues to the launch (logos have been visible for weeks in some places), Google has started rolling out Android Pay in Canada. It should work anywhere that already offers tap-to-pay shopping, and it'll accept MasterCard, Visa and debit cards from major banks including BMO, CIBC, Desjardins and Scotiabank. Many mobile and web apps will take Android Pay, too. With that said, there are some glaring omissions in support to watch out for.

Mastercard aims to speed up your chip-and-PIN payments

Chip cards are ultimately faster than paying with a magnetic stripe and a signature (or worse, a check), but they're sometimes slow -- and it's bad enough that Mastercard wants to do something. The company is partnering with Verifone and Global Payments to build its speedy M/Chip Fast technology into EMV card reading systems destined for the US. The focus is on fast food, grocery stores, mass transit and anywhere else that waiting even a few seconds might cause frustration (especially for the people behind you).

Smart card Plastc goes under despite $9 million in preorders

Plastc, a smart payment card that can store all your CC details, promised to be the only plastic you'll ever need to bring when it started taking pre-orders in 2014. Now, almost three years and countless shipment delays later, the company threw in the towel. In a statement posted on its website, Plastc says it has officially shut down on April 20th and will file for Chapter 7 bankruptcy. According to a Magnify Money editorial, Plastc raised $9 million from 80,000 pre-orders. It wasn't and will not be able to fulfill any of them.

Square chief teases a smart debit card

Square Cash's virtual payment card might not be quite so virtual in the future. Company chief Jack Dorsey has teased a strange, all-black Visa debit card that Recode suspects is really a physical Square Cash card. A Square spokesperson declined to comment, so take this with a grain of salt, but there's evidence to suggest there's something to this teaser. You see, Square seriously considered a payment card back in 2014 -- the company is no stranger to exploring the concept of a real-world card that draws from online funds.

Samsung Pay starts rolling out in Canada

Canadian iPhone owners have had Apple Pay for a while, but what if a Samsung phone is your weapon of choice? You might be set after today. Just a couple of weeks after the company revealed that Samsung Pay was coming to Canada in November, Galaxy phone owners are reporting that the tap-to-pay service is going live. You currently have to sideload the Samsung Pay app and framework on a compatible phone (typically a Galaxy S6, S7 or Note 5), but you may not have to take your wallet out after that. A formal launch should come soon.

Android Pay hits the web via Chrome

Android Pay is about to work in many, many more places. As promised, Google is bringing Android Pay to the web. If you use Chrome to shop at online stores like 1-800-Flowers and Groupon, you can soon rely on Android's official mobile payment system to check out faster and more securely than usual (it doesn't share account info with stores, for one thing). Also, you may want to get in the habit of using Android Pay if you're fond of ridesharing. It's the first mobile wallet to tie into Uber's Payment Rewards program, giving you discounts when you use Android Pay. Uber is marking the occasion with a US promo that gives travelers half of 10 of their rides when they use Android Pay with the service.

PayPal's Mastercard deal brings its payments to more stores

PayPal wants to be your go-to payment option online and in stores, but it has a problem: banks and credit cards aren't a fan of its free bank transfers and other attempts to push online payment over the conventional variety. However, it's trying to make amends. In the wake of a Visa deal from July, PayPal has forged a partnership with Mastercard that gives the credit card firm higher prominence online in return for more of a retail footprint. PayPal will make Mastercard a "clear and equal" payment choice in its wallet (complete with an image of your card), let you set the card as a default payment method and will "not encourage" you to link a bank account if you're a Mastercard customer. In exchange, you can use a linked Mastercard in your PayPal wallet to make in-store purchases at contact-free terminals.

Oracle data breach opened credit card payment systems to attack

Data thieves don't always have to go straight to the source to swipe payment details... sometimes, they can take a roundabout route. Oracle has confirmed to security guru Brian Krebs that hackers breached a support portal for Micros, the point-of-sale credit card payment system it acquired in 2014. It's not certain just how many systems were breached (Krebs' sources say over 700), but the intruders had slipped malware on to the portal that would let them grab logins for the companies using Micros. They wouldn't have had direct access to payment data, but there's a chance those account details could be used to slip malware into the credit card systems and then grab sensitive info.