Payment

Latest

Walmart Pay arrives in 14 more states (update)

When Walmart talked about a wide national release of its mobile payment service before the start of July, it wasn't kidding around. Walmart Pay has launched in 14 more states on top of a slew of rollouts earlier in the month -- it's not quite ubiquitous (we count 33 states plus Washington, DC), but it's close. This latest deployment includes heavily populated states like California, New York and Washington, so you're far more likely to use your Android phone or iPhone to shop at the big-box retail chain.

Microsoft brings mobile payments to your Windows 10 phone

Windows 10 users have been left out of the tap-to-pay trend while their friends use the likes of Android Pay and Apple Pay, but they're about to catch up in style. If you're a Windows Insider in the Fast Ring and use a Lumia 650, 950 or 950 XL, you can get a new version of the Wallet app that gives you NFC payments at stores that support it. It'll seem mostly familiar if you've used current Android or iOS options -- it's just a matter of unlocking your phone and bringing it close to the shop's terminal. The app will hold your coupons, loyalty cards and passes, too.

Samsung Pay now works with your loyalty cards in the US

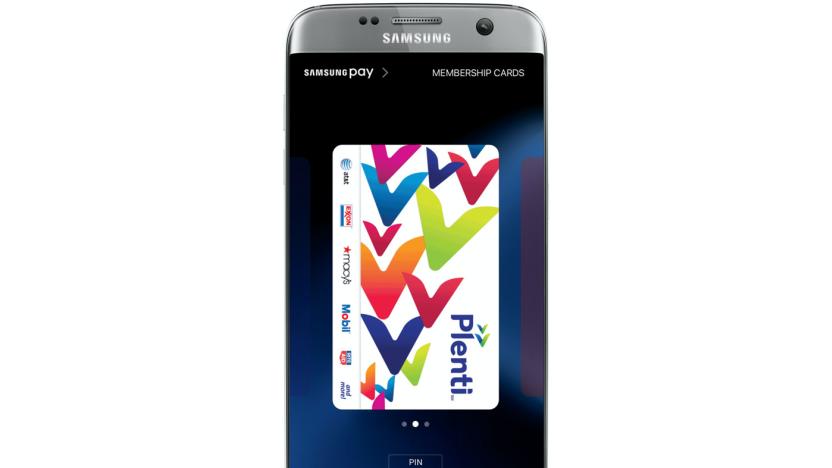

Samsung Pay can substitute for your credit and debit cards, but those probably aren't the only hunks of plastic you're looking to replace. What about the points program card for the grocery store, or the discount card for the pharmacy? Relax. Samsung Pay now supports loyalty and membership cards in the US, so you can make the most of those price drops and freebies without bulking up your wallet.

Walmart Pay launches across Texas and Arkansas today

Walmart's mobile payment service is beginning a massive rollout today, with Walmart Pay launching at around 600 stores across Texas and Arkansas.

Apple Pay finally becomes useful in Canada

Apple Pay technically launched in Canada back in November, but it might as well have been non-existent -- you could only use a directly-issued American Express card, which isn't all that common in the country. At last, though, things are opening up. Apple has announced that its tap-to-pay service is now available through a much, much wider range of providers. Right now, you can use it through heavyweights CIBC and RBC (both credit and debit cards) as well as smaller providers ATB (initially MasterCard-only) and Canadian Tire (MasterCard). The other big three (BMO, Scotiabank and TD) aren't ready yet, but they've all committed to letting you pay with your iPhone or Apple Watch in the months ahead.

Samsung team-up aims to improve your mobile payments

If you've ever tried paying with your phone at a store, you know that the experience is often only as good as the payment reader -- a sketchy terminal could lead to you pulling out a credit card in embarrassment. Samsung thinks the industry can do better, though. It's partnering with some of the larger point-of-sale device makers (such as Verifone and Ingenico) to guarantee "maximum compatibility and universal acceptance" for Samsung Pay. The hope is that this will boost the adoption of mobile payments simply by giving you a better time when you tap-to-pay, with fewer errors that make you rethink the whole concept.

Samsung Pay joins China's trillion dollar mobile wallet market

With Apple already expecting China to be its biggest mobile payment market, it's no surprise that its biggest direct competitor, Samsung, also wants a slice of this piping hot pie. After a one-month public beta, today the Korean giant is officially launching its Samsung Pay service in China in partnership with UnionPay -- inevitably the same bankcard company that helped launch Apple Pay locally. In other words, only UnionPay credit and debit cards -- up to 10 of them per device -- can be associated with local Samsung phones for the time being.

Apple leads the (tiny) mobile payment world

It's no secret that the mobile payment space is becoming increasingly crowded, but who's out in front? If you ask Crone Consulting, it's Apple... although Cupertino might not have much to crow about. The analyst group estimates that Apple Pay is the market leader, with 12 million iPhone owners making tap-to-pay purchases at least once a month. Android Pay and Samsung Pay are distant seconds with 5 million active users apiece. However, Crone is quick to note that both of these rivals are roughly half a year old -- they're catching up quickly to an incumbent that's been around for a year and a half.

Smart strap brings payments to your Pebble smartwatch

Right now, you have slim pickings if you want to pay for things from your wrist: there's the Apple Watch, an upcoming Swatch model, eventual Samsung Gear S2 support and... that's about it. However, Fit Pay might just widen the field a bit. It's crowdfunding the Pagaré smart strap, which brings NFC-based tap-to-pay support to any Pebble Time smartwatch -- yes, including the Round. It should work at most shops that accept Apple Pay or Android Pay (it uses a similar, token-based system), and it shares familiar security measures, such as disabling access when you remove your timepiece. You don't even need to bring your phone once you've set things up.

Barclays confirms it'll support Apple Pay by April

Since it came to Britain in July 2015, Apple Pay has made slow and steady progress, with 15 banks or credit card issuers now supporting the service. However, in that time, Barclays has done nothing but flip-flop over its decision to link its cards with Apple's NFC payment platform. After first declining to comment at launch, the bank quickly changed its mind and voiced support for the service. It then made customers wait months before offering an "early 2016" launch date at the end of last year. Following another few months of silence and hundreds of irate customer tweets, Barclays CEO Ashok Vaswani has finally offered to clear things up, confirming that Apple Pay support will roll out by April at the very latest.

MasterCard and Coin bring payments to your fitness band

Right now, you don't have many choices for paying for things from your wrist: there's the Apple Watch, the Microsoft Band (at Starbucks) and not much else. MasterCard and Coin don't think you should have to suffer from this lack of choice, though. They're teaming up to bring credit card payments to all kinds of wearable devices, including fitness trackers and a wider variety of smartwatches. Coin will supply the necessary hardware and software, while MasterCard will unsurprisingly handle the service side of things.

Soon Google Wallet will send money via text messages

A forthcoming update to Google's Wallet app will drastically change how users send and receive money using it. Instead of needing the recipient's email address, the app now only requires a phone number. When sending money this way, the recipient will receive a text message with a secure link. They then simply enter their debit card number to receive the funds, which transfer to their checking account in minutes. That seems a heck of a lot easier than the current method where both parties have to have the app installed on their phones and have a bank account linked to it.

Walmart wants you to pay through its mobile app

Never mind Android Pay and Apple Pay -- Walmart would rather you use its own mobile payment service. It's launching Walmart Pay (how creative!), a payment system that has you scanning QR codes within its app to make purchases. It's not the most elegant method as a result, but the upshot is an approach that works on most phones, in any checkout lane, with any major payment card you have. And despite what it looks like, Walmart swears that this isn't meant to muscle out other mobile payment services -- they could be integrated "in the future."

PayPal, Square and big banking's war on the sex industry

For nearly a decade, PayPal, JPMorgan Chase, Visa/MasterCard, and now Square, have systematically denied or closed accounts of small businesses, artists and independent contractors whose business happens to be about sex. These payment processing authorities have also coerced websites to cease featuring sexual content under threat of service withdrawal, all while blaming ambiguous rules or pressure from one another.Monday a federal appeals court ruled that pressuring credit card companies like Visa and Mastercard to stop doing business with speech-protected websites violates their First Amendment rights. Specifically ones that feature content from sex workers. And in June, the FDIC clarified that it's against the rules for businesses like PayPal, Chase and Square to refuse business or close accounts based on "high risk" assessments related to human sexuality. But it may not be enough to stop what's become an entrenched pattern of systematic discrimination by payment processors -- one that disproportionately denies financial opportunities for women.

Square's new reader arrives to accept mobile payments and chip cards

We've known about Square's new NFC-friendly reader for a while, and now the point-of-sale gadget is available for use. Starting today, 100 merchants in "select cities" (quite a few, actually) will begin accepting NFC-driven payments like Apple Pay, Android Pay, Samsung Pay and those newfangled chip credit/debit cards. The reader is a square pad (of course) separate from the company's usual POS setups and sliding readers, allowing you to hover your phone or insert a card to complete purchase. The unit is wireless and pairs with either a countertop system or Square's free mobile app to handle the transactions. However, the new reader itself will set businesses back $49 in order to get started. For the initial rollout, look for the device at businesses in the following cities: Atlanta, Austin, Boston, Chicago, Denver, Los Angeles, Nashville, New Orleans, New York, Miami, Minneapolis, Philadelphia, Phoenix, Sacramento, San Francisco, Santa Cruz, Seattle, St. Louis Tampa, and Washington, D.C.

Flywheel gives taxi drivers an Uber-like app of their own

Flywheel has helped drag taxis into the modern era through app-based hailing. However, that modernization usually stops in the cab itself -- your driver's gear is antiquated next to the phone-based tech in a Lyft or Uber car. Taxis are about to catch up, though. Flywheel has launched TaxiOS, a platform that replaces the dispatch, meter, navigation and payment systems with phone-based software. It not only streamlines the overall experience for both you and the driver (no matter how you're paying), but marks the first instance of GPS-based metering in licensed taxis. In theory, you're getting both a more accurate fare and fewer rude surprises.

Designer makes a dress that can pay for your purchases

One of MasterCard's first partners for its new wearables project is Adam Selman -- Rihanna's favorite fashion designer, according to The New York Times. Since that initiative aims to bring mobile payments to pretty much everything, you can guess what his contributions to the initiative are: clothes and accessories that can pay for your purchases. And, thankfully, they look like items people would actually wear rather than ridiculously futuristic pieces that came right out of The Jetsons. One of them's the dress the woman in the image above is wearing, which hides a payment chip storing her credit card details right inside its bow.

Apple Pay comes to Australia and Canada this year

At last, Apple Pay will be available outside of the US and the UK... if you have the right credit card. Tim Cook used his company's fiscal results call to confirm that the tap-to-pay service will be available in Australia and Canada by the end of 2015, while Hong Kong, Singapore and Spain will get it in early 2016. However, it sounds as if you'll be limited to using an American Express card at first. Despite leaks, you probably won't be using any other account for iPhone-based purchases on launch. It's likely that other providers will get with the program, though, so don't despair if you prefer MasterCard or Visa.

Chase hopes you'll use its shopping app instead of Apple Pay

You might think that the future of phone-based shopping belongs to tap-to-pay services like Apple Pay and Android Pay. However, Chase begs to differ. The banking giant has unveiled Chase Pay, a mobile app that uses your credit, debit or prepaid card to make purchases through CurrentC. And yes, that means what you think it does... both good and bad. It'll let you take advantage of loyalty programs and even pay by scanning some receipts, but you'll also have to make many payments by scanning QR codes. As it stands, you'll have to be patient -- Chase Pay won't be available until mid-2016.

Square bets big on payments as it becomes a public company

It's a big week for Jack Dorsey in more ways than one. The new Twitter CEO's other company, the payment service Square, has filed for an initial public stock offering that's tentatively worth up to $275 million. It's not certain just when shares will be available. However, the move shows a belief that Square's hopes of reinventing the purchasing process (through everything from readers to food delivery) have legs. As it stands, investments might be necessary in the short term. While Square's bottom line is improving, it continues to lose money -- $77.6 million just in the first half of this year. Going public gives the firm more breathing room, and may sharpen its focus. After all, it's about to have the expectations of many, many people riding on its shoulders.