Apple Arcade and Google Play Pass will be totally different stores

Revenue models can have a shockingly large impact on the creative process.

Google and Apple have just begun a public experiment. One that affects the daily lives of millions of people; specifically, anyone who plays mobile games.

Apple launched Arcade on September 19th, charging $5 a month for unlimited access to more than 100 mobile games on its store. The company spent a reported $500 million to acquire high-profile titles like Skate City, Where Cards Fall, Grindstone, Assemble with Care, Sayonara Wild Hearts and Overland. This means Apple paid developers upfront for their games, even before some of them were finished. Think of it as the Netflix model of content acquisition.

Google launched Play Pass, its own subscription service, September 23rd. Play Pass hosts Android games rather than iOS, and it didn't debut with the same fanfare as Apple Arcade (or, for that matter, Google's other game-streaming service, Stadia). While Apple had a lineup of exclusives and new titles go live alongside Arcade, Google launched Play Pass with a generic promise of access to "hundreds of awesome games and apps" for $5 a month.

Paying to acquire games wasn't, and isn't, part of Google's plan. Instead, it pays Play Pass developers after their titles go on sale, determining their value with an algorithm that factors in how much time players spend in-app.

Over the past five years I've tried to be as productive a developer of small, short narrative games as I possibly could.

I knew this day would come. pic.twitter.com/LJUFWGkPLE— Will O'Neill (@willoneill) September 23, 2019

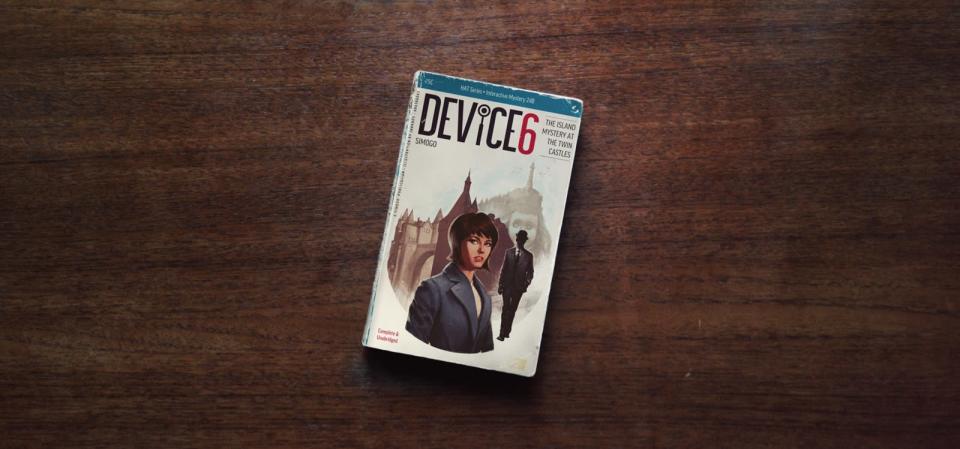

That's a red flag for mobile developers. After all, many of mobile gaming's most powerful and acclaimed titles are contained experiences rather than infinitely replayable tapping extravaganzas. Games such as Florence, Device 6, Superbrothers Sword and Sworcery EP and Monument Valley helped prove the depth of mobile experiences, but they're designed with endings in mind. In a playtime competition with Candy Crush, they're doomed.

Google's algorithm considers other "signals" besides in-app minutes to determine a game's value, and the company says it will continue to tweak this model so that all types of content can succeed on Play Pass. Soon after the rollout, Google edited the language in its Play Pass developer guide to remove a direct reference to time-based royalty payments. However, playtime is still a factor in Google's algorithm. It isn't for Apple Arcade -- and these disparate revenue models will likely shape two wildly different worlds of mobile gaming.

Chain reaction

The bar for mobile games is high, with players expecting perfectly addictive vignettes and console-quality experiences in their pockets. Today, AAA shooters and esports titles like Call of Duty Mobile, Fortnite, PUBG and Arena of Valor all exist on smartphones and tablets. However, this mobile market has been carved out during the past decade by smaller studios like Simogo, Capybara Games, Snowman, Vlambeer, Sirvo, Ustwo and Spry Fox -- developers that focused on crafting rich experiences for phones and tablets at a time when it was still cool to call mobile gamers "filthy casuals." Smartphone technology has only become more powerful and pervasive over the years; mobile now represents 45 percent of all global gaming revenue, easily outstripping PC and console segments.

Despite their accessibility, these mobile games -- rich with detail, narratively complex, mechanically sound, stylish as hell -- are often the result of years of collaborative creative work. And then they load up in seconds on your phone, available to play in between liking posts, listening to podcasts and snapping selfies.

Sam Rosenthal and Brandon Sorg have been working on Apple Arcade exclusive Where Cards Fall for more than six years, since they were students at the University of Southern California. It's a powerful coming-of-age story told without words, and a puzzle built around houses of cards and spatial awareness. Rosenthal and Sorg graduated in 2013, and over time they picked up enough artists, audio engineers, producers and programmers to form their studio, The Game Band, and finish Where Cards Fall. They partnered with Alto's Adventure studio Snowman in 2015, and the game made its way to Apple Arcade in 2019.

"Every little detail in games, somebody has to do it," Rosenthal said. "You don't really get anything for free. If you want, say, foliage to move in the wind, there's a million different approaches that you could do for that, and mobile has its own constraints. You might be thinking of using a shader effect, which is what we ultimately did. And then you have a technical artist who's spending a lot of time just thinking about how bushes move in the wind properly."

This brand of creativity is fragile. With so many moving parts, it's possible for minute decisions to trigger chain reactions that change a game at its core.

This is where platform holders like Google and Apple hold an inordinate amount of power. These companies shape the types of games that are sold on their storefronts simply by how they do business.

Back in the filthy casual days of mobile gaming, the App Store and Google Play were flooded with 99 cent clones and simplistic, free-to-play titles designed to keep players engaged long enough to tap through ads. This phenomenon persists today. However, it didn't start because a ton of studios suddenly decided derivative, endless-tapping titles were the next big innovation in game design. It was because that's what made money.

"I've had conversations with pretty big free-to-play studios and -- I won't name any of them -- but they've mentioned, yeah, 'We don't care if the game is fun at all.' It's just literally, got to check off all these boxes, and get all these metrics, and that's the only thing that matters," said Ryan Cash, founder of Snowman. "It's kind of like designing games for a casino. They don't care if the slot machine is fun. They care if it's performing and making money."

Google's time-based algorithm perpetuates the old mobile model. Money-focused free-to-play developers wanted to create infinite-loop games that kept people tapping through ads, and a revenue model that pays out according to playtime will push these folks toward the same goal. Addictive rather than innovative. Simple rather than thoughtful. And, of course, in as many versions as possible.

The current Apple Arcade model involves investment and post-launch monetization deals with a wide selection of high-profile developers. This model is already creating a storefront with vastly more taste, range and style than Play Pass. Apple's history of supporting mobile developers like Ustwo and Snowman has led to a handful of prominent indies launching new games on Arcade. Apple's revenue model is generous enough to lock down launch and exclusivity deals with major companies like Sega, Devolver, Bandai Namco, Ubisoft, Cartoon Network and Square Enix. All of this means Apple Arcade is a weirder, and so far more wonderful, store than Play Pass.

"Apple's approach to me feels a little bit more like a platform holder on, say, a console," Rosenthal said. "They obviously have major differences, but for the longest time we've had platform holders paying for exclusives and incentivizing developers really to take advantage of what makes their platforms unique. And I think that's overall a good thing. We get a lot more stuff on the platform that wouldn't have made it there otherwise. We get a diversity of content."

It's clear why Google would opt for a post-launch payment algorithm: Apple's approach is expensive. Apple reportedly threw down $6 billion to develop its lineup for Apple TV+, another $5-a-month subscription service that goes live on November 1st, and at the same time it spent half a billion to make Apple Arcade what it is today. This level of investment is likely unsustainable for either service.

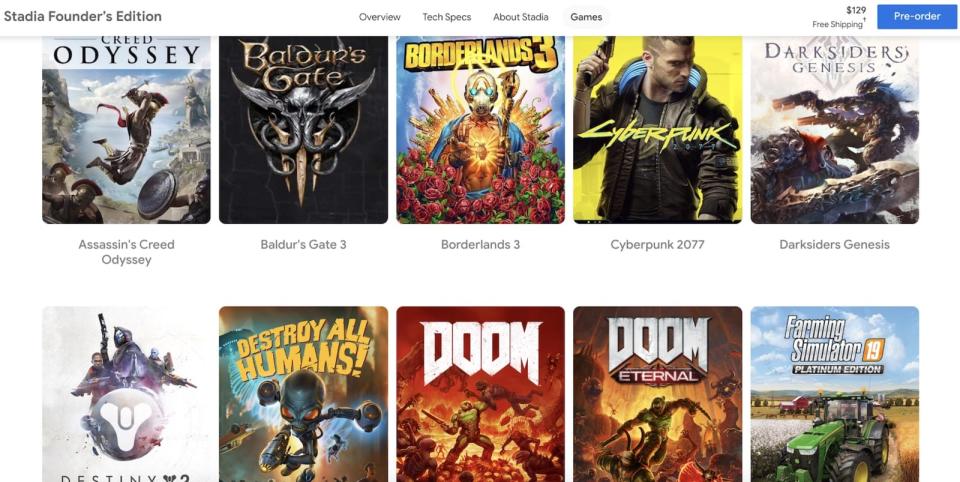

But let's zoom out even wider. While Apple is diving into the broader entertainment space, Google is doubling down on games. It's launching Google Stadia, a service that promises to eventually stream any title to any device with stable internet access, making games playable in the Chrome browser and loadable via links. If it works as advertised, Stadia (and its rivals, like Microsoft's Project xCloud) will activate a new era in video games, fundamentally changing the way the industry operates. Developers will be able to build games without platform limitations, and publishers will be able to distribute titles seamlessly to a wider audience than ever. Exclusivity deals, rather than hardware, will fuel platform wars. Everyone will be a mobile gamer.

Stadia will go live in November for anyone who buys the $130 Founder's Edition hardware bundle. Post-launch, Stadia Pro will cost $10 a month, granting users access to free and for-purchase games streamed at up to 4K. Meanwhile, Stadia Base is a no-charge option that caps streams at 1080p and offers games only for individual purchase, with no trickle of free titles. Stadia is closer to Xbox Live Gold than "Netflix for games," but it'll be the first real test of international internet infrastructure as it relates to video-game streaming.

With Google's full ambition in perspective, the company's throwaway approach to Play Pass makes a lot more sense. If all goes to plan, Stadia will eventually subsume the mobile market entirely, making Play Pass and maybe even Apple Arcade irrelevant. Google is investing in mobile gaming, but it's doing so through Stadia rather than Play Pass.

As it stands, Apple Arcade compares favorably to Play Pass. However, Arcade will one day have to compete with Stadia and the full might of Google's streaming infrastructure. And Microsoft's. And every storefront that follows.