vivendi

Latest

Ubisoft fights off takeover by entertainment giant Vivendi

Ubisoft is finally free of Vivendi. The entertainment titan behind the Universal Music Group and Dailymotion kept buying more and more Ubisoft shares since 2015 to the point that it became the video game publisher's largest stakeholder. While Vivendi said that it was only interested in a seat in Ubisoft's board, the video game publisher sees its aggressive purchase as a hostile takeover and has been thinking of ways to fight it off for years. Now, it looks like Ubisoft will safely remain a Guillemot family business with help from (PDF) Tencent, Ontario Teachers' Pension Plan and other investors.

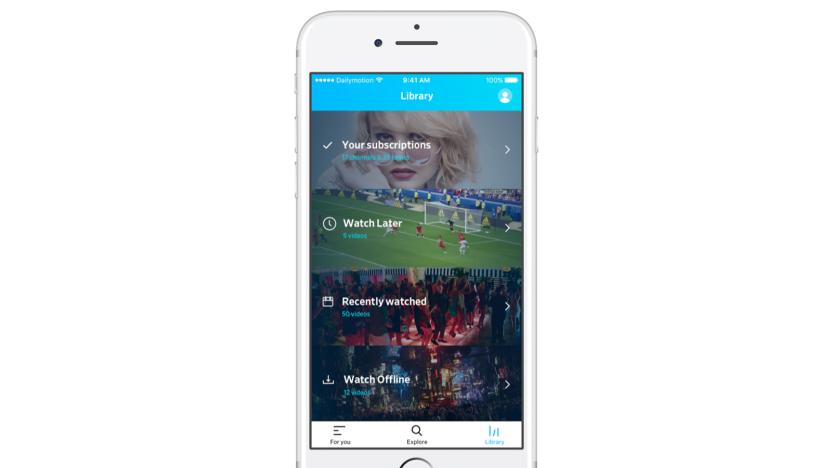

Dailymotion is trying to clean up its act with major redesign

Dailymotion announced this week that it has completely redesigned its app and advertising strategy. And the company hopes to attract viewers with higher quality content created through partnerships with media and entertainment brands. Three new partnerships with Universal Music Group, CNN and Vice were also announced.

The hostile takeover of 'Watch Dogs' studio Ubisoft continues

Ubisoft, the studio behind Assassin's Creed, Watch Dogs, South Park, Rabbids and plenty of other off-the-wall franchises, is slowly losing itself. The company is being swallowed up by Vivendi, the entertainment conglomerate responsible for Universal Music Group and Dailymotion, among other ventures. Vivendi has been buying Ubisoft stock with the goal of securing a seat on the studio's board, and it now controls 20.1 percent of Ubisoft shares and 17.76 percent of its voting rights. The latest stock purchase comes just days after E3 ended on June 16th.

Activision, Vivendi lawsuit settlement amounts to $275 million

Activision Blizzard reached a settlement this week over a shareholder's lawsuit in regards to the Call of Duty publisher's October 2013 buyout. As a result, Vivendi and others will pay $275 million to Activision to settle the litigation, which began in August 2013 before Activision's $8.2 billion purchase of itself from Vivendi was completed. Under the settlement terms, Activision will also add two directors to its board and must change the terms of its voting rights. According to the lawsuit, Activision CEO Bobby Kotick and Co-Chairman Brian Kelly seemingly benefited from insider knowledge of the company's purchase, obtaining a 10 percent discount when Kotick's investment firm purchased 172 million shares of Activision for $2.34 billion. The lawsuit alleged a "breach of fiduciary duties, waste of corporate assets and unjust enrichment." Emails from the suit presented in July revealed that Vivendi wanted to fire Kotick in 2013 during the purchasing negotiations. [Image: Activision]

Activision Blizzard resolves class action lawsuits

When Activision Blizzard bought itself to be freed from Vivendi, there was no shortage of unhappy shareholders, leading to several class action lawsuits filed against the company and other attendant actors in response to the whole process. Those suits have now been resolved and the case is now closed; the parties have settled out of court, with the proposed settlement seeing some of the defendants paying a total of $275 million to Activision Blizzard as well as multiple insurance companies. The Board of Directors wrote in a statement that "the transaction, structured through the efforts and significant personal investment of Bobby Kotick and Brian Kelly, has contributed to the creation of over $3 billion of value for shareholders" and that they are "pleased to be able to put this matter to rest." Adjustments have also been made to said Activision Blizzard board of directors and aspects of the corporate structure, with the company paying all legal fees of the plaintiffs. Since multiple defendants were involved in the suit (including Activision Blizzard itself), it's still unclear exactly who took the hit for this particular lawsuit, but it does mean that the matter has been resolved to everyone's satisfaction.

The Game Archaeologist: How Hellgate survived being Flagshipped

It seems that it really wasn't too long ago that I was filling in the time between night classes by boning up on video game news. I was drinking up all of the hot up-and-comers, such as Age of Conan and Warhammer Online, when I caught word that the maker of Diablo was trying to do the same thing again, only more online, in 3-D, and with a cool modern-day/futuristic/horror vibe. There's no better way to put it than to say that from the start, Hellgate: London looked all kinds of cool. Oh sure, you can scoff now with your perfect 20/20 hindsight, but I'm betting that more than a few of you thought the same with me around that time. Diablo but with guns and an online persistence -- how could we not be intrigued? One of my most vivid memories was being torn between the idea of buying a lifetime subscription deal for $150 (again, this was before the free-to-play era, but also before the era of us spending the same money on alpha access. I'm just saying that you can't judge me.). I didn't buy the lifetime sub, if you were wondering, but I did play. I even enjoyed Hellgate: London for a month or so, although something about it never quite clicked with me. It was only after I bailed that I watched with horror that one of the most infamous chapters of video game disasters took place. It's kind of like when you look at pictures of an earthquake and say to anyone near, "I was just standing there a week ago..." From its giddy heights of pre-launch hype to the crash simply known as being "Flagshipped" to its subsequent resurrections (yes, plural), Hellgate is a fascinating tale of a good idea, a terrible launch, corporate scapegoating, and improbable survival.

Activision CEO Bobby Kotick was nearly fired by Vivendi

Anyone who's paid attention to the roller-coaster that is Activision's relationship with its former owner Vivendi, here's a new wrinkle for you. Activision CEO and perennial villain in a million fans' hearts Bobby Kotick was nearly let go by Vivendi in 2013 over his refusing to sign off on any deal that excluded his own private investment group. According to the lawsuit filed in Delaware, this allowed Kotick, Brian Kelly (Activision's Chairman) and their investment partners (including Tencent Holdings Ltd.) to gain a 25% stake in the company at the same rate that Activision itself paid for the remainder. This is claimed to have allowed them to get away with not paying a premium for control over the company. The lawsuit alleges that this is an improper benefit to Kotick, Kelly and their group. What's really fascinating is that Kotick's stand on this issue, going so far as to threaten to resign in 2013, seems to have been seriously considered by parent company Vivendi. Former Vivendi CEO Jean-Francois Dubos and then-CFO Phillipe Capron were among those speculating on firing Kotick, with Capron going so far as to volunteer to do it the very next day after the email exchange in May of 2013. Considering he was one of the highest paid CEO's of any game company, I'm surprised they chose to back down -- perhaps his contract made firing him punishingly expensive. In the end, Vivendi blinked first and Kotick and his group got to make exactly the deal that they're getting sued over now.

Activision CEO Bobby Kotick was nearly fired in 2013

Vivendi, Activision's controlling shareholder in 2013, wanted to fire CEO Bobby Kotick, as revealed in emails that are part of a lawsuit filed by Activision investors (via Bloomberg). During negotiations for Activision to buy the majority of its own shares back from Vivendi in 2013, Kotick refused any deal that excluded his own investment group, a stance that made Vivendi executives consider losing him entirely, the filing says. One email from then-CEO of Vivendi, Jean-Francois Dubos, said, "I really wonder who's going to fire him." Philippe Capron, Vivendi CFO and Activision chairman, replied, "Myself, happily. Tomorrow if you want."

Vivendi to sell $850 million in Activision Blizzard stock

French multimedia company Vivendi has been steadily distancing itself from Activision Blizzard for awhile now, but a new sale brings Vivendi's stake in the House That Warcraft & Call of Duty Built down to just six percent. The $850 million deal is expected to close May 28, provided there are no holdups like last time. Last year, Activision Blizzard bought itself back from Vivendi, making itself an independent company owned in majority by the public. That deal was not without complications though, as an Activision Blizzard shareholder attempted to sue the company, putting the sale on hold. The Delaware Supreme Court overturned the ruling which had stalled the deal, and the purchase was completed October 11, 2013. [Image: Vivendi/Activision]

Activision Blizzard now free from Vivendi

Back in July, Activision Blizzard CEO Bobby Kotick led a charge to buy the company back from parent company Vivendi. After a few bumps in the road, the share buyback is complete and Activision Blizzard is now (mostly) free of Vivendi. $5.83 billion of stock is owned by Activision Blizzard, while Kotick and his partners hold on to $2.34 billion. Vivendi's not completely out of the loop yet, but its shares have been cut down to 12%. After five years under Vivendi's wing, Kotick says he is excited to "get back to focusing on making great games," according to a recent interview with Bloomberg.

Activision Blizzard completes buyback from Vivendi Universal in multi-billion dollar deal

Activision Blizzard recently bought back a controlling stake in itself from Vivendi Universal. The reacquisition was a joint effort by the company itself and an investment group that includes Activision CEO Bobby Kotick and Chairman Brian Kelly. When the dust settled, Activision Blizzard picked up 429 million shares and other assets for around $5.83 billion, while the investment group snagged 172 million shares -- an almost 24.7 percent stake -- for approximately $2.34 billion. The deal leaves a majority of the remaining 690 million shares in the hands of the public, while Vivendi is hanging onto 83 million shares, or about 12 percent. For his part Kotick is optimistic about the firm's independence, even stating that he expects that the company's developers will benefit from a "focused commitment to the creation of great games." Let's just hope that this newfound concentration bodes well for the company's historically doomed subsidiaries.

Activision completes purchase of itself from Vivendi

Activision's buyback of $8.2 billion of its own shares from Vivendi has been completed, the publisher announced today. It was just yesterday that the Delaware Supreme Court overturned a September ruling that halted the purchase, which followed a lawsuit by an Activision Blizzard shareholder in August. The shareholder alleged a "breach of fiduciary duties, waste of corporate assets and unjust enrichment" on Activision's behalf. The publisher's purchase from Vivendi amounts to 429 million of its own shares for $5.83 billion. Additionally, Activision CEO Bobby Kotick and Co-Chairman Brian Kelly purchased 172 million shares for $2.34 billion in a separate transaction. Activision is now officially an independent company, majority owned by its shareholders. "The shares Activision Blizzard purchased in the transaction will no longer be treated as outstanding, leaving the majority of the remaining 690 million shares in the hands of public shareholders," Activision noted in today's announcement. Activision said yesterday that it expected the purchase to be completed on October 15. The transaction came about four days ahead of schedule, as someone must have sprinted to the bank this morning.

Activision Vivendi injunction lifted by Delaware Supreme Court

A few weeks ago we reported on the holdup of the Activision-Blizzard buyback from Vivendi, due to court action on behalf a few stockholders. In September, an Activision stockholder sued Activision in the Delaware Cancery Court to prevent the deal from going forward. The lawsuit argued that the deal as it stood would give Activision CEO Bobby Kotick and Co-Chairman Brian Kelley too much control over the company, to the detriment of other stockholders. As of today, the Delaware Supreme Court has ruled in favor of Activision-Blizzard's appeal of the lawsuit. As a result, Activision-Blizzard looks to have the buyback completed by October 15th, 2013. The buyback will move forward as originally intended, with Activision-Blizzard as a company acquiring around 429 million shares from Vivendi, and the private investment group ASAC II LP simultaneously acquiring about 172 million shares. The total buyback is worth over US$8 billion.

Activision to buy $8.2 billion of its own shares from Vivendi on Oct. 15

Activision is free to buy back its own shares from current parent company Vivendi, now that the Delaware Supreme Court has overturned a ruling that prevented the deal from going down. The transaction is expected to be completed on October 15. Activision will buy 429 million of its own shares from Vivendi for $5.83 billion in cash, while Activision CEO Bobby Kotick and Co-Chairman Brian Kelly will separately purchase 172 million shares from Vivendi for $2.34 billion in cash. After the deal, Activision will have no one to answer to but itself – and all of its remaining shareholders. A lower Delaware court halted the transaction earlier this year after an investor sued, alleging the Activision board breached its duties by not putting the deal to a shareholder vote. Activision announced on September 24 its plans to appeal that ruling.

Court sides with Acti-Blizz, Vivendi split moves forward

The Delaware Supreme Court has sided with Activision-Blizzard in a lawsuit that was seeking to stop the planned split from corporate parent Vivendi. The suit was filed by shareholders who believe that Acti-Blizz's bid to become an independent entity would "disproportionately benefit" CEO Bobby Kotick and "an elite group of investors," according to Gamasutra. With the legal obstacles now removed, Activision-Blizzard expects to complete the deal by October 15th.

Activision Blizzard files an emergency appeal for buyback rights

It seems that Activision Blizzard just can't wait to get free of Vivendi. Not that the company is eager, but it literally cannot wait. The publisher had planned to essentially buy itself from its parent company, but following objections raised by a stockholder, the deal was put on hold by court order. Now the company has filed an emergency appeal, claiming that if the deal doesn't go through now, the company will have lost its window for self-ownership. According to the appeal, it will not be possible to obtain a shareholder vote before October 15th, which is when the deal automatically terminates. This vote by non-Vivendi shareholders is a necessity for the deal to go through, and Activision Blizzard representatives state that this injunction leaves the company in limbo and jeopardizes an $8 billion exchange. The court has scheduled a hearing for October 10th -- a hearing that looks to either make or break the deal as a whole.

Activision-Blizzard split from Vivendi halted

As reported in July, Activision-Blizzard made the move to separate itself from majority shareholder Vivendi Universal by buying itself back to the tune of over 8 billion dollars in total. About a week after the announcement, shareholder Todd Miller filed a complaint against Activision-Blizzard for doing so. Earlier this month, shareholder Douglas Hayes instigated a lawsuit against Activision-Blizzard to stop the sale, alleging that the company's CEO, chairman, and a handful of investors will benefit disproportionately from the sale. As a result, the deal is now halted for the time being. The lawsuit hinges around the fact that the Activision-Blizzard buyback from Vivendi is actually a two-part share acquisition. The first part involves Activision-Blizzard, as a company, purchasing around 429 million shares from Vivendi. The second part -- which was the subject of Todd Miller's complaint and is at the center of the lawsuit -- involves the private investment vehicle ASAC II LP, headed by Activision-Blizzard CEO Bobby Kotick and Co-Chairmain Brian Kelly, concurrently purchasing around 172 million shares from Vivendi. Hayes v. Activision-Blizzard alleges that the approval of the second sale represents a "breach of of [Activision-Blizzard and Vivendi's] fiduciary duties" and violates "certain provisions of the Company's certificate of incorporation" because it failed to submit the sale's approval to a non-Vivendi stockholder vote. For its part, Activision-Blizzard seems to view the halt as merely a setback, and intends to continue forward with the buyback. As per the following statement Activision-Blizzard "remains committed to the transaction and is exploring the steps it will take to complete the transaction as expeditiously as possible."

Activision Blizzard facing lawsuit from shareholder over going independent

Last week's announcement of Activision Blizzard separating from Vivendi might have made you unhappy, but it didn't make you as unhappy as Todd Miller. He's filed suit against Activision, the board of directors at Activision, and former parent company Vivendi on counts of unnecessary waste, breach of fiduciary duties, and unjust enrichment. Miller stresses that the sale nets an immediate windfall for CEO Bobby Kotick and entrenches him in a position of power within the company while failing to provide any benefit to the company as a whole or the individual shareholders. He also claims that the Activision board members are conflicted due to their previous positions within Vivendi and have no reason to resist this move, resulting in a net detriment for holders of the company's stock. Miller is calling for the purchase order to be rescinded and for Activision to institute controls so that this situation is not repeated in the future.

WoW looks to the future as Blizzard stocks surge

Blizzard might be weathering the sting of a 600,000 subscriber loss in World of Warcraft this quarter, but the studio's separation from Vivendi could be the salve to soothe the hurt. Following the news that Activision Blizzard is buying back shares to take away Vivendi's controlling stake, stocks have surged 18% in pre-market trading this morning. Baird Analyst Colin Sebastian says this is nothing but good news: "This looks like a win, win, win for Vivendi and Activision shareholders. It's a better outcome than a special dividend to Vivendi, and I expect Activision will function even better as an independent company without the overhang of a struggling parent." Blizzard is also taking steps to counter its subscriber drop. VentureBeat reports that the studio has increased its WoW development team, "lowered the barrier" for returning players to catch up to friends, and created an in-game proving ground so players can learn to heal or tank. We also have word that a new buff-centric class is being considered, although no specifics have been revealed.

Activision Blizzard is going independent, buying out Vivendi for $8 billion

Gaming giant Activision Blizzard announced it's buying out most of majority shareholder Vivendi's stake, at a total price of about $8.2 billion. Activision will pay about $5.83 billion in cash to Vivendi for 429 million shares, while an investment group led by CEO Bobby Kotick and co-chairman Brian Kelly will pick up 172 million shares for $2.34 billion, leaving Vivendi with 83 million shares, or about 12 percent of the company. The publisher of titles like Call of Duty and World of Warcraft (and Guitar Hero before it ran that into the ground), Activision reported $1.05 billion in net revenue for Q2 and raised its full-year revenue outlook slightly, although full results won't be available until August 1st. As Joystiq mentions, Vivendi has been unsuccessfully trying to sell its part of the company for nearly a year, hopefully this transaction works out the best for everyone. By everyone, we mean people still waiting for StarCraft: Ghost.