mastercard

Latest

Apple is launching a credit card

The rumors were true -- Apple is releasing its own credit card. Apple Card promises to make the most of the company's privacy, simplicity and (of course) integration with your iPhone. You can sign up for the Goldman Sachs-backed card directly from your device (it'll be useful right away), and it'll appear in an updated version of the Wallet app that can show your latest bills, transactions and spending history. Naturally, you can use Messages to ask for customer service.

After Math: Watch out now!

You'd think that the week after CES would bring at least a brief lull in the firehose that is tech news, but you'd be wrong. Google's paying $40 million for Fossil's smartwatch tech; LG's holding a huge sale for last year's most expensive sets ahead of the Super Bowl; and for some reason, Aaron Sorkin doesn't think we've had enough onscreen Zuckerberg (he too is wrong).

Sorry, MasterCard's free trial protection only applies to physical goods

Yesterday, MasterCard announced a new feature that would protect its customers from the automatic billing that kicks in after a free trial. The policy will require merchants to notify users about the end of the free trial, the cost of continuing with a subscription and how to cancel the subscription. And it seems like a pretty good feature, especially if you tend to forget to end subscriptions after free trials. But MasterCard has now updated its blog post about the new policy and it looks like it will only apply to physical products, not digital services.

MasterCard won't let companies bill you after free trials for physical products (update)

We've all made the mistake of starting a free trial and forgetting to cancel it before the billing period kicks in. Now, MasterCard will protect against this --but only for physical products. The company announced a new policy that will require merchants to get authorization from you before hitting you with recurring charges for subscriptions. It will also require companies to provide you with monthly updates with pricing and clear instructions on how to cancel if you need it.

Google and Mastercard reportedly teamed up to track offline sales (update)

Last year, Google launched a tool called "store sales measurement" that can tell whether an online ad is effective based on real-world purchases in the US. The tech giant didn't expound on how it built the tool and how it works -- now, a Bloomberg report says Google was able to create it thanks to a secret deal with Mastercard. Mountain View paid millions for a stockpile of Mastercard transactions after four years of negotiations, according to the publication's sources who were directly involved with the deal. Neither the tech giant nor the credit provider told the billions of Mastercard holders that their purchases were used to develop the ad-tracking tool.

Venmo's debit card turns your balance into real-world money

After months of testing, Venmo is ready to offer its own debit card in the US. The new piece of plastic now works at Mastercard-friendly locations instead of Visa (the company hasn't explained the switch), but the concept otherwise remains the same. The card lets you spend your Venmo balance at retail locations, and helps you split bills -- you can share transactions to have friends pay for their share of dinner or movie tickets. Naturally, you can use the Venmo mobile app to manage or disable a card.

Credit card companies unite for a checkout button to take on PayPal

Even if you don't use PayPal to send money to friends, there's a good chance you've reached for their checkout button in online stores, which is tied to all of your payment information. It's simply easier than getting up and finding your wallet. Now, the major credit card companies -- Visa, Mastercard, American Express and Discover -- are joining forces for a checkout button of their very own, the Wall Street Journal and Bloomberg report. And yes, it means the end of Masterpass and Visa Checkout, services that attempted to replicate the easy PayPal experience.

You won't have to sign for credit card purchases much longer

For all of the progress the US has made in payment technology, it still clings to the past when it comes to credit card payments. You still have to sign for many in-person purchases, which is downright backwards in an era of chip-based cards and digital tokens. And the financial industry is finally ready to kiss them goodbye. As of later in April, four of the biggest credit card networks (AmEx, Discover, Mastercard and Visa) will no longer require signatures for these credit card transactions. It's up to retailers to decide whether or not to ditch handwritten approvals. As the New York Times noted, though, it's doubtful many retailers will keep up the tradition.

American Express will stop requiring signatures for purchases

Mastercard and Discover both announced in recent months that, starting next year, they would no longer require signatures for credit card transactions. Now, the Verge reports, American Express has announced it's also moving away from signatures. As of April 2018, American Express signature requirements will be no more and the company says it's because technology advances have made them obsolete. "Our fraud capabilities have advanced so that signatures are no longer necessary to fight fraud," American Express Executive VP Jaromir Divilek said in a statement.

'Marie Claire' shop of the future is stuck in the present

Traditional retail may be failing, but it's giving way to tech-infused showrooms. Marie Claire, Neiman Marcus and Mastercard teamed up to showcase some of the concepts that will be driving that development in their New York City pop-up shop, The Next Big Thing. The store is open to the public every day until Oct. 12th, at 120 Wooster Street in trendy SoHo, and according to the invite, it's "a first-to-market, hands-on retail pop-up experience bringing to life the newest innovations in fashion, beauty, entertainment, technology and wellness."

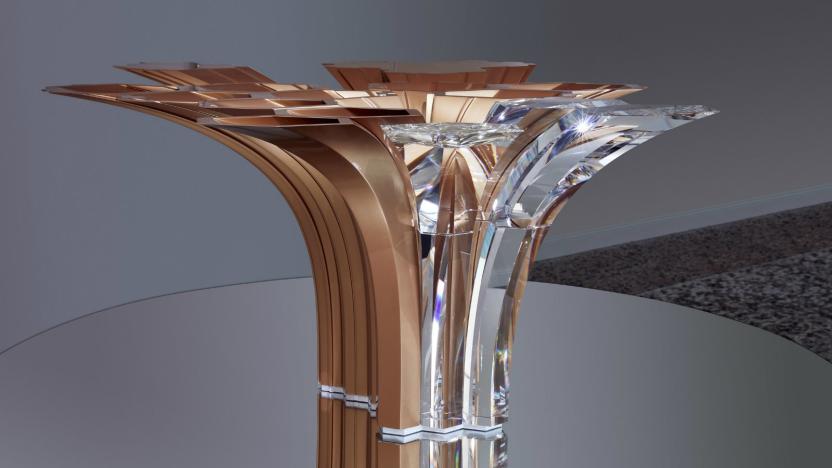

Swarovski's VR shopping app is glittery virtual decadence

Mixed reality apps from the likes of Ikea and Edmunds already let you preview things like furniture and cars. Keen to jump on an emerging trend, Swarovski is releasing its own VR experience. The crystal maker's bizarre new app offers a virtual shopping excursion through a random home stocked with insanely overpriced items. It's as escapist as VR gets, because there's no way anyone in their right mind would drop thousands of dollars on one of these faux-luxury products in real life.

Shopify goes after Square with a new mobile credit card reader

Shopify just released its new card reader that makes it easy for merchants to complete credit or debit card-based sales on the go. The reader accepts chip dips or swipes and works with Visa, Mastercard, American Express and Discover. It connects wirelessly to Android and Apple phones via Bluetooth and at full charge can carry out 400 chip dips and 700 swipe transactions.

Curve's smart card switches between credit and debit after purchases

Have you ever bought something only to regret it later as you run into a spending limit on the card you used? If you live in in the right country, you might have a way to overcome this particular strain of buyer's remorse. Curve is giving its British and European Mastercard users the ability to switch a purchase between credit or debit up to two weeks after the transaction took place. If you realize you're going to go into overdraft, or that you should have expensed dinner on your corporate credit card, you can make a change before it's too late.

Mastercard aims to speed up your chip-and-PIN payments

Chip cards are ultimately faster than paying with a magnetic stripe and a signature (or worse, a check), but they're sometimes slow -- and it's bad enough that Mastercard wants to do something. The company is partnering with Verifone and Global Payments to build its speedy M/Chip Fast technology into EMV card reading systems destined for the US. The focus is on fast food, grocery stores, mass transit and anywhere else that waiting even a few seconds might cause frustration (especially for the people behind you).

Mastercard adds fingerprint sensors to payment cards

Our fingerprints are quickly replacing PINs and passwords as our primary means of unlocking our phones, doors and safes. They're convenient, unique, and ultimately more secure than easily guessed or forged passwords and signatures. So it makes sense that fingerprint sensors are coming to protect our credit and debit cards. Mastercard is testing out new fingerprint sensor-enabled payment cards that, combined with the onboard chips, offer a new, convenient way to authorize your in-person transactions. Instead of signing a paper receipt or entering your PIN while struggling to cover up the number pad, you simply place your thumb on your card to prove your identity.

Mastercard app enables credit-card-free bar tabs

One of the most worrying things about going to a bar is the possibility that the credit card you handed over to open your tab with might get skimmed, or worse, stolen. Mastercard has a new digital payment tool that will let you open a bar tab through an app so you don't have to hand your credit card over to the bartender. Instead, showing them a 4-digit number (at least, during our demo) on your phone is all you have to do. You can pay for your orders from the app and leave after you're done, without having to sit around and try to catch the bartender's attention.

Mastercard built a mobile marketplace for farmers in East Africa

More than two billion people across the world continue to stay unbanked. One of the biggest reasons for that exclusion is accessibility. In developing countries in particular, low-income groups tend to get left out of the fold because they don't have access to basic banking services. But now, as simple services like mobile banking have proven to help people transition out of poverty in Africa, organizations are starting to focus on the financial inclusion of vulnerable communities. 2Kuze, a mobile payment solution from Mastercard Labs, is one such initiative that is built for farmers in Kenya.

Samsung goes big on smart fridges with 10 new models

Samsung must have done alright with its crazy WiFi-connected smart fridges last year, because it's launching six more in 2017, for a total of 10. That includes both three-door, four-door and four-door "flex" models with dual freezers (shown above). It's also updated the fridge's OS to Family Hub 2.0 with a new interface that lets everyone have a profile, complete with avatar. From there, you can share photos, calendars and handwritten memos on your fridge's giant 21.5-inch LED touchscreen. Voice control and entertainment apps like Pandora are on offer as well.

GM will use Watson AI to recommend services on the road

Artificial intelligence isn't just being used to automate cars... it's finding a home in conventional cars, too. GM has unveiled a partnership with IBM that will see the Watson cognitive computing platform power OnStar Go, its latest in-car service offering. The AI technology will suggest stores and services based on your location, your decisions and your habits. If you're driving home from work, for example, OnStar can remind you to pick up shopping on the way back. It can also recommend restaurants when you arrive in a new city, or tell you that a store order is ready for pickup.

Samsung Pay adds new online payment options

Samsung Pay already works in a lot of places because of its canny MST magnetic tech, and the company is taking steps to make the service even more ubiquitous. Starting next year, it will work with Mastercard's Masterpass, letting more users buy online from a computer or handheld device, skip the usual form-filling and authenticate with a fingerprint. (Mastercard also made Masterpass deals with Android Pay and Microsoft Wallet earlier this week.)