mobile payments

Latest

LG is shutting down its mobile payments service

LG Pay, the mobile payments service, is being phased out in the US less than two years after its launch.

Apple clarifies how Apple Card Family sharing will work

Apple is providing more details about its Apple Family Card in a new support document containing terms and conditions.

Venmo built crypto trading into its payments app

PayPal-owned payments company Venmo is rolling out the ability to buy and sell cryptocurrency to users.

China cracks down on big tech companies with new anti-monopoly measures

China is clamping down on big tech conglomerates by tightening its anti-monopoly guidelines for internet and digital payment services. The new rules effectively block companies from forcing sellers to choose between the leading online players, a common practice in the country, reports Reuters. The guidelines are aimed at Chinese heavyweights including e-commerce providers such as Alibaba Group’s Taobao and JD.com and mobile payment services like Ant Group’s Alipay or Tencent’s WeChat Pay.

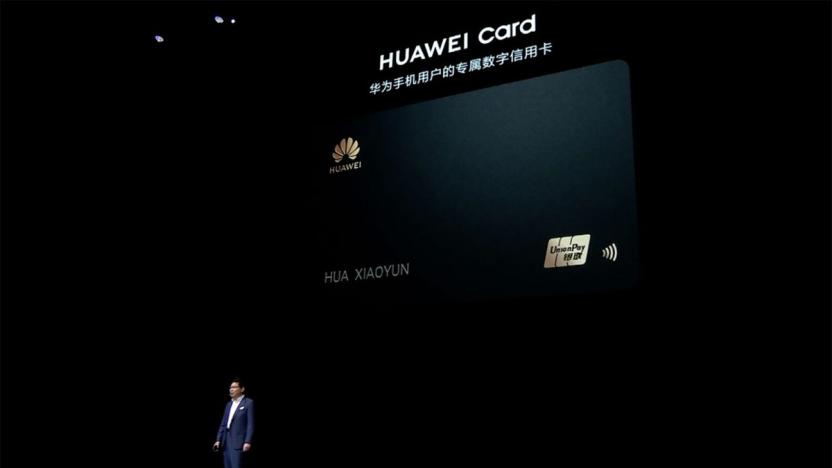

Of course Huawei will have its own credit card

Chinese phone manufacturers have a long history of taking Apple's best ideas and making them their own.So it shouldn't come as any surprise to see a company like Huawei announce a credit card.

Bird wants you to make purchases through its mobile app

E-scooter startup Bird has started testing a new in-app payments feature called Bird Pay. If you live in Santa Monica or Los Angeles, you can try it out at select businesses across the two cities. If you see a tablet like the one pictured above, you can pay for a purchase by opening the Bird app, scanning a QR code, entering the amount you owe and then swiping up to confirm the payment. It's not as straightforward of a solution as say Apple Pay, but it does bypass the need for an NFC terminal -- which businesses in the US have been slow to adopt.

Apple Pay is more popular than Starbucks for US mobile payments

For a while, the most popular payment app in the US was... Starbucks. Yes, enough people were buying venti lattes that even dedicated payment services were being left by the wayside. You can't say the same now, though. Analysts at eMarketer have estimated that Apple Pay will be more popular than Starbucks' payments in the US, with 30.3 million iPhone owners using the tap-to-pay option in 2019 versus Starbucks' 25.2 million. The alternatives aren't likely to come close, apparently. Google Pay should have 12.1 million users, while Samsung Pay is poised to have 10.8 million users.

LG Pay goes live in the US

More than two years after it arrived in South Korea, LG's long-delayed contactless mobile payment system has finally gone live in the US. LG Pay is available on the G8 ThinQ at launch. In the coming months, it'll be available on V50 5G, V40, G7 and V35 from Google Play, and it'll work on all future flagship devices.

Mexico is talking to Amazon about a QR-based payment system

Amazon might adopt the central bank of Mexico's upcoming mobile payment system, according to Reuters. The e-commerce giant reportedly approached Banco de México (Banxico) and offered to support CoDi, a government-backed mobile payment technology that would allow users to pay for online and in-person purchases through QR codes. Phone-based payment systems have become popular in emerging markets like India over the past few years and has the potential to take off in Mexico where half the population doesn't have a bank account.

Xiaomi announces its China-only answer for Android Pay

Xiaomi and China UnionPay have joined together to launch Mi Pay in China, a brand new way to pay via Xiaomi smartphones.

Australia's biggest banks are tackling Apple Pay

Some of the largest banks in Australia are banding together to protest Apple and its Apple Pay service. Apple Pay first launched in Australia back in April alongside Samsung Pay and Android Pay. Those two payment solutions aren't attracting the banks' ire, however. Apple's option is the target of the banks because they're unable to provide their own personalized mobile payment options in competition with Apple Pay -- the Cupertino company doesn't allow third-party payment apps with iOS.

Shell's UK petrol stations let you PayPal at the pump

Although Apple Pay is currently enjoying the limelight, companies all over Britain are working to get their own mobile payment strategies in order. Once such company is Shell, which after months of testing has begun rolling out its new PayPal-powered "Fill Up & Go" service across hundreds of its UK petrol stations. The idea is simple: download the Shell Motorist app, connect it to your PayPal account and scan a giant QR code at the pump -- no more queuing or worrying whether you've brought your wallet.

Apple Pay reportedly headed to Canada this fall

Canadian iPhone users will finally be able to use Apple Pay this fall, according to the Wall Street Journal. Sources say Apple is in discussions with six major Canadian banks, including Royal Bank of Canada, Toronto-Dominion Bank and National Bank of Canada, to launch its mobile payment service in the country in November. The big sticking points for many of the banks, though, are the fees Apple would take from every transaction, as well as security issues around authenticating cards, which has been a problem for some U.S. banks. If everything pans out, it would make Canada the first territory to get Apple Pay outside of the U.S. The WSJ notes that Canada's high iPhone penetration is one reason Apple may be focusing on it. iPhones make up a third of all smartphones in Canada, compared to just 20 percent globally, according to research company Catalyst.

Vodafone's mobile payment app to scrap top-ups with a new SIM

If you want to make contactless mobile payments in the UK, your options are pretty limited. Apple Pay is only available in the US (for now) and Google Wallet is bound to Gmail transactions and Google Play purchases in Britain. Spotting the opportunity to take an early lead, Vodafone is readying a new Visa-powered alternative. The company already offers an app called "Vodafone Wallet," but it relies on the user managing a separate SmartPass account. To pay with your phone, you first have to shuffle money across from your bank account to Vodafone's virtual piggy bank. It's a huge pain, so the network is prepping an updated app that allows customers to store their card details directly on the phone.

Google's new mobile payment platform is called Android Pay

It's shaping up to be a big year for mobile payments, what with Apple Pay enjoying rapid adoption and Samsung finally getting in the game too. Google also has a presence, but it's only very recently decided to ramp up its efforts in this space. Last week, we saw the company team up with AT&T, Verizon and T-Mobile to preload its Wallet mobile payment app on new Android phones, and now it's creating a new framework to power payments across its OS.

Google Wallet to come pre-installed on phones for major carriers

In an ironic turn, Google is now partnering with AT&T, Verizon and T-Mobile to bring its Google Wallet mobile payment app to their Android phones later this year. Yes, those are the same carriers who made life pretty difficult for Google with their own payment solution, Softcard (formerly called Isis). The real point of this deal: Wallet will be pre-installed on Android phones running KitKat or higher, which makes it far more likely that people will actually use it. Google's also acquiring some technology and intellectual property from Softcard, though it's unclear what exactly it's getting. Sure, it feels as if we're in the mobile payments Twilight Zone -- Softcard was the main reason Google couldn't bring Wallet to every single Android phone. But now that Apple Pay is taking off (even the US government wants in on the action), and Samsung is gearing up for its own wallet by buying LoopPay, Google has to do something to rev up its own mobile payment action. And that starts with making Google Wallet a default feature, rather than being an app people have to discover and install on their own.

Samsung is buying LoopPay for its own spin on Apple Pay

Samsung is moving into mobile payments in a big way by acquiring LoopPay, a company that lets you pay for things with your phone similar to Apple Pay. LoopPay's technology (which, notably, isn't based on NFC like Google Wallet and Apple's option) mimics swiping a traditional credit card when you hold one of its smartphones cases up to a card reader. That gives it the advantage of working in 90 percent of existing payment terminals (or so the company says). We heard back in December that Samsung was eager to license LoopPay's technology, but now it looks like the two companies are jumping straight into marriage. But really, it's no wonder Samsung is eager to catch up with a wireless payment option of its own after Apple Pay's strong launch last fall. Heck, even the the U.S. government wants in on Apple Pay.

Apple Pay interest high for retailers; PGA Tour to take it starting next week

The Wall Street Journal said in an article yesterday that Apple Pay is "making progress toward a goal that has eluded other mobile wallets: persuading people to use it." At a supermarket near Zion National Park in Utah, a night manager told the Journal that she estimates that 30 percent of all shoppers are now using the service and that a full five times as many customers use Apple Pay than use competing payment service Softcard. As of now, Apple says that over 220,000 locations in the US accept Apple Pay. The Journal noted that Brian Roemmele, a payments consultant, said "I've never seen a bigger adoption of an alternative-payment system," pointing to Bank of America's recent statement that nearly 800,000 of its customers signed up for Apple Pay in the fourth quarter of 2014. Retail point-of-sale supplier Harbortouch Payments LLC said it has seen a jump from 22 to 68 percent of merchants asking for wireless readers, starting in the month after Apple Pay was announced. Visa's Jim McCarthy, the global head of innovations and strategic partnerships said that "Apple Pay will be the 'reference model' for future mobile-payments services." Even Google is reacting to Apple Pay's wild success, apparently in negotiations to acquire Softcard. In other Apple Pay news, MasterCard announced that the PGA Tour will accept Apple Pay starting at the Phoenix Open in Scottsdale, Arizona this week. In a press release on Business Wire this morning, MasterCard stated: The acceptance of easy-to-use contactless payments, fully integrated into concession technology, is just the beginning of how MasterCard and the PGA TOUR are delivering an enhanced experience to golf spectators. MasterCard cardholders who use Apple Pay at supported course concessions during the Waste Management Phoenix Open – which begins Thursday, January 29th on The Golf Channel – may also get a Priceless Surprise! We're sure to find out more about how Apple Pay is faring from Apple's executives, including CEO Tim Cook and CFO Luca Maestri, during tomorrow's earnings call.

Starbucks beta trials new order-ahead feature in Portland, Oregon

Starbucks is shaking up the retail world with a new order-ahead feature that allows customers to order their favorite latte using their iPhone before they arrive at their local Starbucks. According to Wired, the new ordering tab will be available to iPhone owners in the test market of Portland, Oregon starting Wednesday. The feature will use geolocation to determine a customer's location and show them an ordering tab when they approach a local Starbucks cafe. Starbucks designed the feature to be an extension of the existing mobile payments option in its iPhone app, making it easy and convenient for customers to use. After a successful beta test in Portland, the "Mobile Order & Pay" feature will rollout on a city-by-city basis throughout 2015. Given Starbucks track record with mobile payments, this initiative has a reasonable chance of succeeding. The company recently confirmed that it processes approximately 47 million transactions each week with 7 million of those coming from mobile devices.

Square Register introduces gift cards and invoices to iOS app

Apple Pay may be making waves at major retailers, but Square Register continues to be the go-to source for small businesses looking to take payments from customers. With point-of-sale interfaces and a handy portable card reader, Square is one of the easiest ways for small businesses to take their clients' money. Today the company released a new update for their app that introduces some new features that should make business owners very happy. With the update, all iOS users gain the ability to send invoices directly from their mobile device, making it easier for freelancers to use the app for personal work billing. The biggest addition to this update comes for iPad users, the main device used for working with Square in small business settings. With the updated Square app, iPad users can now sell and redeem gift cards. While you might think this means your customers will simply get a gift card number to redeem, Square is actually making physical gift cards for clients. You can order custom cards for your business now directly from your Square dashboard. The update is available for free in the iTunes Store.