cash

Latest

The UK's Alan Turing £50 bank note is a love letter to coding

The UK has unveiled its £50 Alan Turing bank note, and it's appropriately both very secure and a nod to the computer scientist's achievements.

Tetris is now a daily game show with cash prizes

N3TWORK's mobile 'Tetris' app gets a game show mode and more.

Samsung's Pay Card will be a 'true digital wallet' for its UK phone owners

Samsung Pay Card will act like a digital wallet.

UK raises contactless payment limit to £45 amid coronavirus spread

The limit for contactless card payments in the UK will be increased to £45 from April 1st. According to UK Finance, the decision was already under consideration by those in the industry, but the process has been sped up to respond to the coronavirus outbreak, and to support consumers that would rather pay by contactless at this time. It's important to clarify, however, that the World Health Organization has not warned people against using paper money and coins, but it does advise thorough handwashing after handling it.

Google spent a record sum rewarding researchers for hacking its products

Google is not messing around when it comes to its bug bounty program. Last year it paid out $6.5 million to researchers that reported vulnerabilities -- almost double the $3.4 million paid out in 2018. The largest single award was for $201,337, which was given to Guang Gong of Alpha Labs, who discovered a major exploit on the Pixel 3.

Amazon may may offer cashierless Go tech to movie theaters and stadiums

Even if it doesn't open the stores itself, you could see Amazon-style cashierless stores proliferate across the US. According to CNBC, Amazon is in talks with a variety of merchants, including movie theatres, airport stores and sports stadiums to license its Go technology to those companies. Specifically, CNBC says Amazon has approached OTG's CIBO Express and Cineworld's Regal Theatres about potential partnerships. The company could also license the tech to concession stands at MLB stadiums.

Amazon rolls out a cash payment option for online orders in the US

Amazon is bringing its cash payment option for Amazon.com orders to the US. If you'd like to pay with physical money, you can select the PayCode option at checkout. You'll receive a QR code, then you'll have 24 hours to pay for the goods at a participating Western Union. If you'd like to refund an item, you can get your cash back from a Western Union too.

Amazon Go stores will start accepting cash

When Amazon Go stores first popped up, they promised the "future of shopping": a cash-free experience in which you simply grab what you want and leave as the items are automatically tracked and charged to your account. Now, it appears customers will be able to choose between that futuristic convenience and tried-and-true currency. An Amazon spokesperson told CNBC that Amazon Go stores will begin accepting cash.

Square sellers no longer need signatures for card payments

Square Cash is continuing its crusade to make the business of parting with your hard-earned money a little less painful. It's just announced that it's cut down EMV transaction time on Square Reader for contactless and chip even further, to just two seconds, compared to the average eight to 13 seconds. The process uses a new "dip transaction flow" that prioritizes the parts of a transaction that are critical to security, which means less time standing in line, waiting for your card info to churn through to the issuer.

Chase now offers phone-based withdrawals at 'nearly all' ATMs

It took a long, long time, but Chase's phone-based ATM withdrawals are finally widespread. The bank has expanded its card-free access to "nearly all" of its ATMs across the US, giving you one less reason to panic if you leave your wallet at home. As before, you can get in by tapping a device with a Chase debit or Liquid card linked to Apple Pay, Google Pay or Samsung Pay, and then entering your PIN code. It's functionally equivalent to using your regular card, so you're not facing the usual limits that come with making tap-to-pay purchases.

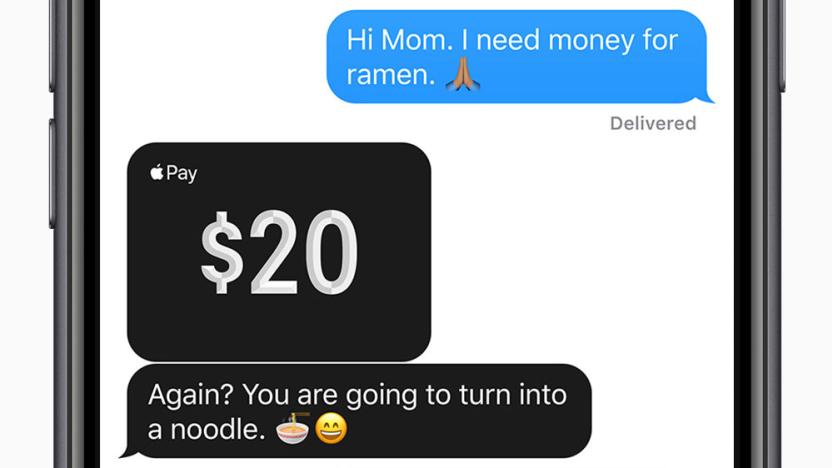

Apple Pay Cash is available in iMessage to iOS 11.2 beta users

If you've been waiting like we have for Apple to finally launch its Venmo-like competitor after the release of iOS 11, now's the time. According to reports at TechCrunch and CNET, Apple is soft launching peer-to-peer money transfer via iOS 11.2 beta right in the Messages app.

Tap your phone to withdraw cash from Wells Fargo ATMs

Wells Fargo enabled smartphone-only ATM withdrawals back in March, but the need to punch in both an app-specific code and your PIN partly defeated the convenience of the feature. As of now, though, it's decidedly easier: the bank has enabled NFC access at more than 5,000 of its ATMs across the country. As with Chase, you just have to tap your phone (using Apple Pay, Android Pay or Samsung Pay) and enter a PIN code to start a transaction at a supporting machine. Suffice it to say this is considerably faster than entering two codes just to withdraw some cash.

Amazon UK now lets you easily convert cash into online credit

The beauty of shopping online is that you can browse and buy without ever leaving the comfort of your sofa. Amazon accepts all major debit and credit cards online, but what if you've got a bundle of cash lying around you'd rather use instead? Enter "Amazon Top Up - In Store," a mouthful of a new service that lets you convert cash into online credit.

With Amazon Cash, you can shop online without a bank card

Internet shopping is great, but most of it is off-limits if you don't have a credit or debit card. Unless you thrive on gift cards, you'll have to settle for whatever is in physical shops. Today, though, Amazon is removing that barrier. It's launching an Amazon Cash service that lets you apply cash toward your online account. It's a bit convoluted -- you have to visit a participating store, show a barcode (either on your phone or on paper) and fork over your money. There are no fees, however, and you can contribute between $15 to $500 at a time.

Driver murders prompt Uber to tighten security in Brazil

Uber India launched cash payments in 2015 and the company has since expanded to South America, but there has been a dark side: crime. At least six drivers in Brazil have been murdered and robberies are up tenfold since the cash service launched there in July of 2016. Following protests and a Reuters inquiry, the company has instituted a new policy requiring Brazil's cash users to register with a social security number.

Barclays' new ATMs let you withdraw money with your phone

Contactless technology is, we're told, destined to replace physical currency. In the meantime, you'll soon be able to use your phone to withdraw cash from an ATM -- if you're with Barclays that is. The banking giant announced today that it's in the process of rolling out new in-branch cash machines that will let you withdraw up to £100 with your smartphone or contactless card.

You can now tell Siri to send money via PayPal

Siri is still very much a walled garden, but Apple has slowly begun opening its voice assistant to third parties. At its WWDC keynote back in June, the company confirmed app makers could let iPhone and iPad users send and receive money via Siri, with Square Cash and Monzo becoming the first to tap into that functionality. Now, bigger players are tapping into hands-free money transfers, after PayPal announced it too now lets users in over 30 countries send and request money via using only their voice.

Square's money-sending app now holds on to your cash

Square Cash is all well and good if you want to send money to someone right away, but what if you want to set something aside for later, such as paying back a friend? You're covered after today. Square has updated its Android and iOS apps to introduce the optional Cash Drawer, which holds on to the money you receive in one handy place. In other words, it's a bit like PayPal and other digital wallets. You can withdraw money whenever you need it, and you'll soon have the choice of adding money from your own bank account. And don't worry, this is optional -- if you use Square Cash precisely because it's not a go-between like PayPal, you can carry on as usual.

AT&T matches Verizon's $650 offer to swap carriers

AT&T has announced that it'll hand you up to $650 in credit should you choose to switch from another mobile carrier. If you're prepared to jump through the various hurdles, you'll be entitled to a pre-paid gift card equal to the value of your ETF or device balance. In addition, the network is letting you pair the deal with its buy one, get one free offer, enabling you to grab two shiny new devices at the same time. The offering is the latest in a long series of credit offers, with Verizon pushing its own offer to $650 last December.

Apple fined $347 million for Italian tax... irregularities

Apple's Italian subsidiary has reportedly been slapped with a €318 million ($347 million) bill for failing to pay tax in the country. According to the BBC and La Repubblica, authorities found disparities between the amount of money it brought in and the amount it handed over between 2008 and 2013. In that five-year period, it's believed that the firm paid just €30 million ($33 million), significantly less than the €880 million ($961 million) it's believed to have owed.