payments

Latest

PayPal opens instant bank transfers in the US

PayPal made it possible for businesses to get paid instantly, but what if you're an individual who just wants funds in a hurry? You might be set after today. The payment service has launched an Instant Transfer option in the US that shuttles money directly to your bank account, not just your debit card. It'll carry a 1 percent transaction fee and isn't worth it in most cases, but it could be vital if you need to pay a bill and would rather wait seconds for your funds instead of hours or days.

Jon Fingas03.12.2019

Philadelphia is the first US city to ban cashless stores

Philadephia has passed a law requiring almost all businesses to accept cash payments, effectively banning cashless stores. It comes into force July 1st, and businesses which violate it face a fine of up to $2,000.

Kris Holt03.08.2019

Apple Pay is now accepted at Target and Taco Bell

Some of the last holdouts on tap-to-pay services are finally hopping aboard. Target, Taco Bell, Jack in the Box, Hy-Vee and Speedway have all introduced support for Apple Pay (and services like Google Pay by extension), making it trivially easy to check out when you need to run an errand or crave a Taco Supreme. The rollout will be gradual in some cases. Target expects all its 1,850 locations to support the technology in the "coming weeks," while Taco Bell and Jack in the Box expect to complete their deployments in the "next few months."

Jon Fingas01.22.2019

Venmo lost a lot of cash due to payment fraud

Venmo apparently had a good reason for disabling web payments and temporarily shutting off instant money transfers -- it was losing money hand over fist. The Wall Street Journal has obtained documents indicating that the PayPal-owned service took a 40 percent larger than expected operating loss ($40 million) in the first quarter of 2018, and payment fraud played a major factor in that financial blow. Where Venmo had expected dodgy transactions to represent 0.24 percent of its activity, the numbers shot up to 0.4 percent in March.

Jon Fingas11.26.2018

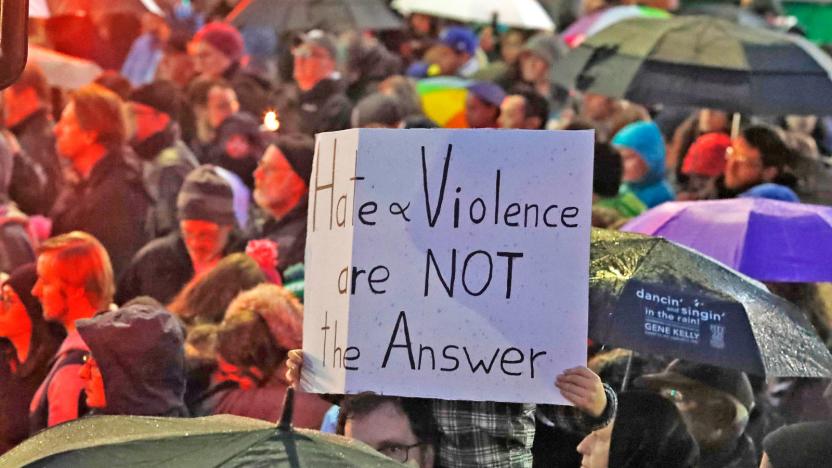

Gab loses hosting provider following Pittsburgh mass shooting

Gab continues to lose support from internet services following the anti-Semitic mass shooting in Pittsburgh. Hosting provider Joyent is suspending service for Gab as of the morning of October 29th, likely leaving the social network "down for weeks," according to a tweet. Joyent only said there had been a "notice of a breach of our Terms of Service," but it was likely a response to Gab's inaction against the shooter's numerous racist conspiracy posts ahead of the attack, including one that same morning.

Jon Fingas10.28.2018

PayPal bans Gab in wake of Pittsburgh mass shooting

Internet giants are continuing their crackdown on hate speech following the anti-Semitic mass shooting in Pittsburgh. PayPal has banned the social network Gab, a known haven for hate speech, after reports revealed that the shooter was a frequent poster and had signaled his intentions shortly before the attack. While PayPal didn't provide an immediate reason for the ban in its message to Gab, the payment platform told The Verge in a statement that it didn't accept a site that was "explicitly allowing the perpetuation of hate, violence or discriminatory intolerance."

Jon Fingas10.28.2018

PayPal cash withdraws are coming to Walmart stores

PayPal users will soon be able to withdraw and deposit money directly into their accounts at Walmart stores. It'll be the first time that PayPal users will be able to take out cash from their account balance in brick-and-mortar Walmart stores.

AJ Dellinger10.11.2018

PayPal's redesigned app is all about paying your friends

We wouldn't blame you for thinking PayPal's app has lost focus -- it seems more interested in investments and ordering food than on... well, paying people. It's a good thing the company is cleaning things up with a redesigned mobile app, then. The new version is a return to the basics of sending and receiving money, with the optional features shunted to a "more" menu. The home screen now focuses on notification cards (such as alerts when you've received funds) and includes a list of recently paid people and businesses in order to speed up your most common payments. Think of it like Instagram's Stories carousel, only here you're paying friends for your share of last night's pizza.

Jon Fingas08.24.2018

Three years in, Samsung Pay has a long way to go

Samsung Pay debuted roughly three years ago to much fanfare, but how's it been doing since? Pretty well -- relatively speaking. The Korean tech giant has announced that its tap-to-pay service has racked up 1.3 billion transactions worldwide and is now available on six continents thanks to a launch in South Africa at the end of July. That makes it available in 24 markets -- rather convenient when the Galaxy Note 9 is days away from hitting stores. The growth is no mean feat, although it's important to put it in context.

Jon Fingas08.21.2018

Chase links its payment app to Samsung Pay so you'll actually use it

Do you use Chase Pay for your retail shopping? No? We won't blame you -- its insistence on using QR codes for purchases makes it far less convenient than tap-to-pay services, not to mention less common. Now, however, it's admitting that it needs to get with the times. Chase has introduced an option to link its payment app to Samsung Pay, letting you use either NFC or stripe-simulating MST tech to clinch the deal. It's much easier when you're in a hurry, of course, and makes the Chase Pay app useful in millions more places. Moreover, there's strong financial incentive -- linking the two will help you earn both Chase Ultimate and Samsung reward points, and it should be easier to redeem your Chase points in the process.

Jon Fingas07.27.2018

Tesla reportedly asks for money back on payments to suppliers

Tesla's financial woes have been in the headlines for awhile now, and their latest move isn't exactly one that instills confidence. According to The Wall Street Journal, Tesla has been sending memos to its suppliers asking for retroactive discounts. In other words, it's asking for cash back on payments it has made to these suppliers since 2016. While hard numbers aren't available, Tesla described it as a "meaningful amount of money" in the memo.

Swapna Krishna07.23.2018

Snapchat ends its peer-to-peer payment service on August 30th

Snap's one-time hope of becoming a major player in money transfers has come to an ignominious end. The company has confirmed to TechCrunch that it's discontinuing its Snapcash service on August 30th. While it didn't say what would happen to users' accounts, it promised that they'd receive notifications through both the Snapchat app itself as well as the support website. It's sad news if you're a frequent Snapchatter who used the feature to cover your share of restaurant bills, but you could see this coming given the competition and Snap's own fortunes.

Jon Fingas07.22.2018

Venmo's debit card turns your balance into real-world money

After months of testing, Venmo is ready to offer its own debit card in the US. The new piece of plastic now works at Mastercard-friendly locations instead of Visa (the company hasn't explained the switch), but the concept otherwise remains the same. The card lets you spend your Venmo balance at retail locations, and helps you split bills -- you can share transactions to have friends pay for their share of dinner or movie tickets. Naturally, you can use the Venmo mobile app to manage or disable a card.

Jon Fingas06.25.2018

Buskers in London are the first to accept tap-to-pay cards

The move toward a cashless society has created a problem for buskers: how do they get paid when many listeners won't have physical currency? There's now a solution on hand. The Mayor of London's office and iZettle (which was recently snapped up by PayPal) have partnered on a first-ever initiative that lets buskers accept tap-to-pay contributions. Participants plug special card readers into their smartphones and set a fixed donation amount -- after that, you just have to wave your card (or a compatible NFC device) to ensure a street performer gets paid.

Jon Fingas05.27.2018

Paypal lets you spend money in Gmail, YouTube and more

Android Pay users have been able to dip into their PayPal accounts for a little over a year. Now, the money transfer service has partnered with Google to provide a more seamless way to use it across products like Google Play, YouTube and Gmail.

Rob LeFebvre05.25.2018

Gmail for iOS now sends money and snoozes emails

Gmail on your iPhone can now help you settle a tab with a friend. A quiet update to the iOS app has introduced the ability to send and receive money using Google Pay. As on Android devices, Gmail sends the payment as an attachment -- the recipient only needs an email address to receive their money. The feature might not be as simple on iOS given that you need to download an app to use it, but it's easier than some third-party apps and more widely available than Apple Pay Cash.

Jon Fingas05.08.2018

You can soon pay bills directly through your Outlook inbox

If you manually pay the bills that pour into your email inbox, you know it can get tiring: you typically have to launch your browser or an app and wade through any number of screens to send your money. Microsoft might have a better way. It's developing a framework that uses Microsoft Pay to handle bill and invoice payments directly inside Outlook. Companies will need to use a supported service (such as Braintree, Stripe, FreshBooks and Intuit), but this could reduce payments to just a few clicks.

Jon Fingas05.07.2018

Instagram shopping is about to get dangerously easy

Last year, Instagram revealed an upcoming appointment-booking feature, another step towards the company's larger plans of becoming a shopping service of sorts. Now TechCrunch reports that the photo-sharing service is quietly adding an electronic payment option for some users, something not mentioned with the previous appointments feature.

Rob LeFebvre05.03.2018

BMW, Ford and GM want to bring blockchain to your car

Seemingly every company is determined to hop on the blockchain bandwagon, and that includes automakers. BMW, Ford, GM, Renault and and a string of tech partners (including Bosch and IBM) have formed the Mobility Open Blockchain Initiative, a group that hopes to use blockchain's distributed, decentralized ledger technology across many aspects of your experience, even when you're not driving. They hope to create standards that allow for secure payments for everything from autonomous car hailing to congestion charges to ridesharing.

Jon Fingas05.02.2018

Samsung Pay finally works with your PayPal Wallet

Samsung Pay support for PayPal was unveiled back in July of last year with promises that it would be ready "soon," but that clearly didn't happen -- you've had to use your regular payment cards in the months since. Whatever prompted the wait, it's ready. PayPal has started enabling support through Samsung's tap-to-pay feature, letting you draw from your Wallet's funds instead of a credit or debit card.

Jon Fingas04.23.2018