payments

Latest

Bird wants you to make purchases through its mobile app

E-scooter startup Bird has started testing a new in-app payments feature called Bird Pay. If you live in Santa Monica or Los Angeles, you can try it out at select businesses across the two cities. If you see a tablet like the one pictured above, you can pay for a purchase by opening the Bird app, scanning a QR code, entering the amount you owe and then swiping up to confirm the payment. It's not as straightforward of a solution as say Apple Pay, but it does bypass the need for an NFC terminal -- which businesses in the US have been slow to adopt.

Igor Bonifacic02.25.2020

Vodafone is the latest to leave Facebook's Libra Association

The Facebook-created Libra Association is still bleeding members months after it formalized its council. Telecom giant Vodafone has confirmed to CoinDesk that it left the Association. Unlike past defectors, though, it's not so much about regulatory jitters surrounding the cryptocurrency. Vodafone said it instead wanted to focus on expanding its own payment service, M-Pesa, beyond the six African countries where it's currently available. It's not burning bridges -- the company said it wouldn't rule out the possibility of "future cooperation."

Jon Fingas01.21.2020

Amazon may offer hand recognition payments to other stores

Amazon's rumored hand recognition payment tech might be useful beyond paying for produce at Whole Foods. Wall Street Journal sources say the company is developing hand-based checkout terminals that it would sell to "coffee shops, fast-food restaurants" and other stores that tend to have repeat customers, not just Whole Foods. It's also clearer as to how the technology might work. The system would reportedly start by linking your payment card to your hand, asking you to insert your old-school plastic and scan your hand before you could pay using your hand alone.

Jon Fingas01.18.2020

PayPal buys money-saving service Honey for $4 billion

Even before it split with eBay, money transfer service PayPal consistently sought new ways to part consumers from their cash. It hasn't strayed far from its core competences, acquiring payment companies like Braintree (and as a result Venmo), Xoom and iZettle, but its latest purchase will see the company dive right back into the online shopping space.

Matt Brian11.21.2019

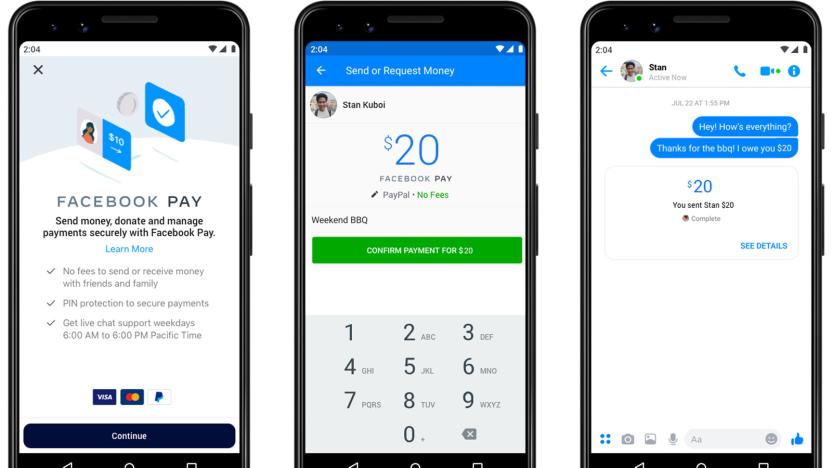

Facebook Pay lets you buy goods and send money inside Facebook's apps

Libra isn't Facebook's only big leap into the payment world. The social media giant has unveiled Facebook Pay, its bid at simplifying both purchases and money transfers. Once you've set a payment method, it's theoretically quick and easy to buy tickets, shop on Marketplace, contribute to fundraisers or cover your share of last night's pizza. You can set it up on an app-by-app basis, but Facebook also lets you set it up across apps -- a one-time setup could make it useful across Facebook's ecosystem. The core app and Messenger will support Pay in the US this week, while Instagram, WhatsApp and more countries are in the pipeline.

Jon Fingas11.12.2019

Uber will pay drivers and couriers after every trip

Uber is making a bigger push into payments and financial services by setting up a division called Uber Money. Among the initiatives Uber has in store is paying its more than 4 million drivers and couriers after each ride. It plans to do so through its no-fee mobile bank account, which it's integrating into the Uber Driver app.

Kris Holt10.28.2019

Apple Pay is more popular than Starbucks for US mobile payments

For a while, the most popular payment app in the US was... Starbucks. Yes, enough people were buying venti lattes that even dedicated payment services were being left by the wayside. You can't say the same now, though. Analysts at eMarketer have estimated that Apple Pay will be more popular than Starbucks' payments in the US, with 30.3 million iPhone owners using the tap-to-pay option in 2019 versus Starbucks' 25.2 million. The alternatives aren't likely to come close, apparently. Google Pay should have 12.1 million users, while Samsung Pay is poised to have 10.8 million users.

Jon Fingas10.23.2019

You can tell Alexa to pay your bills (if you're in India)

Amazon Pay users in India can now ask Alexa to pay their utility, internet, mobile and TV bills, according to TechCrunch. Indian Amazon Pay users can take advantage of the cross-platform functionality with any Alexa-enabled device, not just first-party devices like the company's Echo smart speakers. This means even headphones with Alexa built-in support the functionality.

Igor Bonifacic10.16.2019

Amazon may may offer cashierless Go tech to movie theaters and stadiums

Even if it doesn't open the stores itself, you could see Amazon-style cashierless stores proliferate across the US. According to CNBC, Amazon is in talks with a variety of merchants, including movie theatres, airport stores and sports stadiums to license its Go technology to those companies. Specifically, CNBC says Amazon has approached OTG's CIBO Express and Cineworld's Regal Theatres about potential partnerships. The company could also license the tech to concession stands at MLB stadiums.

Igor Bonifacic09.30.2019

Amazon rolls out a cash payment option for online orders in the US

Amazon is bringing its cash payment option for Amazon.com orders to the US. If you'd like to pay with physical money, you can select the PayCode option at checkout. You'll receive a QR code, then you'll have 24 hours to pay for the goods at a participating Western Union. If you'd like to refund an item, you can get your cash back from a Western Union too.

Kris Holt09.18.2019

Venmo can instantly transfer money to your bank account

Venmo's instant transfers are no longer limited to sending money to debit cards. The PayPal-owned service now permits transferring money immediately to linked bank accounts. It still incurs the same 1 percent fee with a minimum 25-cent transfer cost and a maximum $10 outlay. If you can tolerate that, though, it might just save your hide if you're running low on funds or just want assurances that money is sitting in your bank account.

Jon Fingas08.12.2019

Apple Card rolls out in the US this August

The rumors of an imminent Apple Card launch were on the mark. As part of Apple's latest earnings call, CEO Tim Cook confirmed that the iPhone-centric credit card will be available in the US sometime in August. He didn't provide a specific date or other launch details, although Apple has already explained a fair amount about it -- you sign up for the card from an iPhone, and can use it either through Apple Pay or through a flashy titanium card that will be mailed to you for free within a few days.

Jon Fingas07.30.2019

Monzo's app-only banking is coming to the US

You might not have heard of Monzo in the US, but there's a good chance your British friends have when the digital bank has racked up over 2 million customers in its short history. And now, it's coming to the US... in a manner of speaking. Monzo has unveiled plans to roll out service to the US in the "next few months," including the mobile app and a Mastercard debit card. It'll build the audience slowly by connecting with hundreds of people at a time at events before it conducts a wider-scale launch. However, don't expect it to function as a bank at first. It'll be closer to a money transfer service akin to Venmo or Apple Pay Cash.

Jon Fingas06.13.2019

Samsung Pay will work on some NYC trains and buses starting today

A momentous thing is happening in New York City today: They're finally fixing the subway! Just kidding, the Metropolitan Transit Authority (MTA) is rolling out contactless payments for select stations and bus lines. (Because that will address overcrowding, broken air conditioners and aging signal systems!) We already knew that Apple, Google and Fitbit's payment systems would each be supported, and today we're learning that Samsung is a-go too. If Samsung's press release seems light on details, that's because it's the MTA that's charting a course toward a new system that only uses contactless payment methods. The agency's plan is called One Metro New York, or OMNY for short, and today's limited roll-out represents just one early step. The big milestone for 2020 will be enabling mobile ticketing through a forthcoming OMNY app. That move alone would help bring the MTA in line with other public transportation systems, including New York's own Metro North and Long Island Railroad. Looking further ahead, in 2021, the MTA plans to issue a new card that's meant to ultimately replace the yellow swipeable one we use today. That will be available at unspecified retail locations to start, and will expand to vending machines in subway and commuter rail stations by 2022. And, if all goes according to plan, the MTA will retire the swipeable card in 2023. For now, OMNY is only available on Staten Island buses and 4, 5, and 6 stations between Atlantic Avenue-Barclays Center and Grand Central. Again, you can use it with other payment systems too, including Apple Pay, Google Pay and Fitbit Pay. It'll also work with contactless credit and debit cards. Check it out if you're so inclined, and remember: be safe, don't look anyone in the eye and avoid the pole-dancing rats.

Dana Wollman05.31.2019

Fitbit devices can pay for your NYC bus or subway ride

Add Fitbit to the growing list of device makers that will support tap-to-pay in New York City's mass transit system. When the city's contactless fare pilot program starts on May 31st, Fitbit Pay-equipped wearables like the Versa Special Edition, Charge 3 Special Edition and Ionic will let you pay per ride on the MTA's Staten Island buses as well as the 4, 5 and 6 subway lines running between Grand Central and Atlantic Avenue-Barclays Center. You could use your watch to track your gym session one moment and get a ride home the next, in other words.

Jon Fingas05.29.2019

UK government starts accepting Apple Pay and Google Pay

It's now that much quicker for Brits to pay for official services online -- if you use the right services. The UK government now supports Apple Pay and Google Pay for a handful of online services as part of a trial. Right now, it's primarily useful for travel. You can use your mobile device to quickly pay for Global Entry (fast-tracking entry to the US), the Registered Traveller Service (for frequent non-EU visitors to the UK), the Electronic Visa Waiver Service (for some Middle Eastern visitors to the UK). It'll also work for "basic" DBS checks for work.

Jon Fingas05.05.2019

Facebook Marketplace lets sellers ship items across the continental US

Facebook will soon let Marketplace sellers ship items anywhere in the continental US, while you'll be able to pay for purchases directly through the platform. As such, sellers who are happy to ship their goods will be able to cater to customers on the other side of the country. Buyers, meanwhile, should have access to a broader selection of items and perhaps some peace of mind through purchase protection for eligible items.

Kris Holt04.30.2019

Facebook will scrap Messenger payments in the UK and France

Facebook will discontinue peer-to-peer Messenger payments in France and the UK on June 15th, the company told Engadget. "After evaluating how we give people the best experiences in Messenger, we made the decision to focus our efforts on experiences that people find most useful," Facebook said, adding that active users will be notified ahead of the changes.

Steve Dent04.16.2019

Amazon Go stores will start accepting cash

When Amazon Go stores first popped up, they promised the "future of shopping": a cash-free experience in which you simply grab what you want and leave as the items are automatically tracked and charged to your account. Now, it appears customers will be able to choose between that futuristic convenience and tried-and-true currency. An Amazon spokesperson told CNBC that Amazon Go stores will begin accepting cash.

Christine Fisher04.10.2019

Apple is launching a credit card

The rumors were true -- Apple is releasing its own credit card. Apple Card promises to make the most of the company's privacy, simplicity and (of course) integration with your iPhone. You can sign up for the Goldman Sachs-backed card directly from your device (it'll be useful right away), and it'll appear in an updated version of the Wallet app that can show your latest bills, transactions and spending history. Naturally, you can use Messages to ask for customer service.

Jon Fingas03.25.2019