payments

Latest

You won't have to sign for credit card purchases much longer

For all of the progress the US has made in payment technology, it still clings to the past when it comes to credit card payments. You still have to sign for many in-person purchases, which is downright backwards in an era of chip-based cards and digital tokens. And the financial industry is finally ready to kiss them goodbye. As of later in April, four of the biggest credit card networks (AmEx, Discover, Mastercard and Visa) will no longer require signatures for these credit card transactions. It's up to retailers to decide whether or not to ditch handwritten approvals. As the New York Times noted, though, it's doubtful many retailers will keep up the tradition.

Venmo temporarily halts instant money transfers

Did you need a friend to pay you back on Venmo as soon as humanly possible? You might have to twiddle your thumbs for a little while. Venmo has temporarily pulled its instant transfer feature in order to make a "few changes" to the service. You can still use regular bank transfers, but that won't help much if you need that money to pay a bill.

Amazon's first debit card arrives in Mexico

Amazon has taken a number of steps to help you shop online without a bank card, and now it's taking those efforts to their logical conclusion: the internet retailer has launched its first debit card, Amazon Rechargeable, in Mexico. Unlike a conventional debit or credit card, you can top it up using cash -- you can load it with the equivalent of $967 US every month. You get a virtual card the moment you sign up (you only need to supply basic name, gender and date of birth info), and anyone who loads Rechargeable with the equivalent of $27 or more will get a physical card.

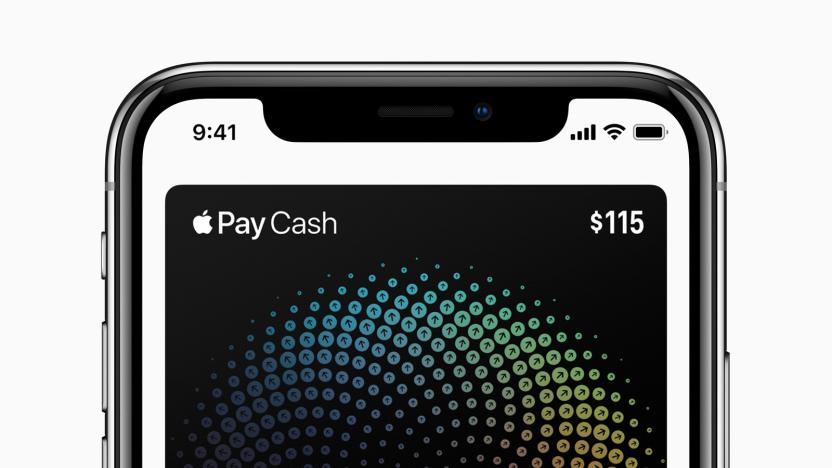

Apple Pay Cash nears its first international expansion

Apple Pay Cash may not be limited to Americans for much longer. Users in Brazil, Ireland and Spain have all reported seeing the peer-to-peer payment service show up in iOS' Messages app, suggesting that launches in their countries (and potentially more) are just around the bend. Apple hasn't officially announced anything yet, but it's hard to imagine the company asking people to configure the feature and letting it sit unused for more than a short while.

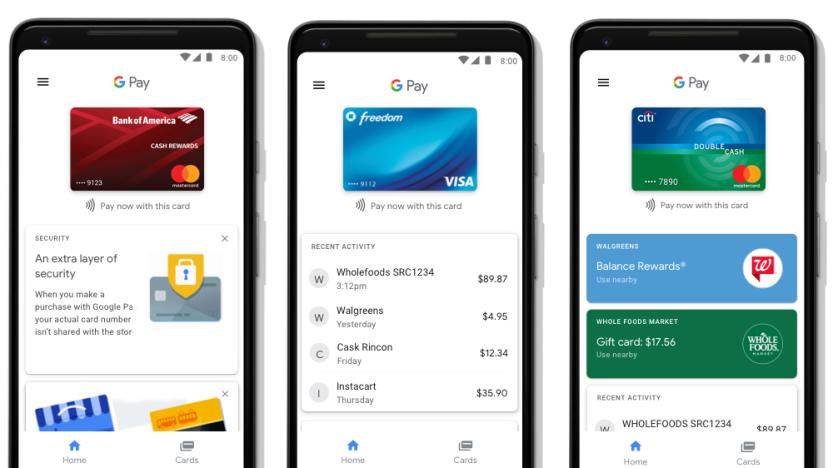

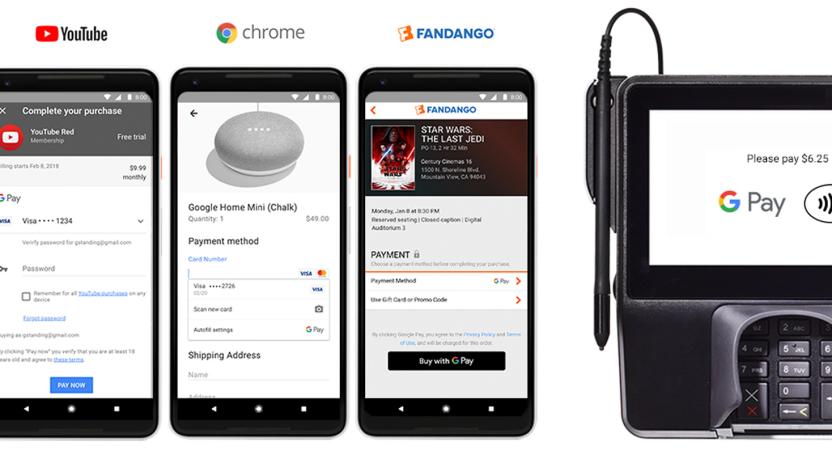

Google Pay is the new Android Pay

Google recently admitted that Android Pay and Google Wallet probably didn't need to exist as two different services. After a fictional, Highlander-style battle, it was Google Pay that emerged victorious, taking on a new name to define this united brand. And so today, Android Pay becomes Google Pay. The app still does everything you'd expect it to, though there's a new Home tab that puts recent transactions, nearby stores and rewards in one place. The Cards tab, on the other hand, is more a catalog of your payment cards, gift cards, loyalty schemes and offers. Unexpectedly, Google Pay doesn't actually include Google Wallet functionality, meaning you can't use it to send or request money. Not yet, anyway.

Google explores texting from your browser

Google's Android Messages app could soon get a dramatic makeover with some interesting new features, judging by an APK teardown by XDA Developers and Android Police. Most significantly, it looks like you'll be able to pair your phone with a computer and text directly from a browser like Chrome, Firefox and Safari, much as you can with Google's Allo messaging app.

WhatsApp starts digital payment tests in India

WhatsApp has finally started testing the digital payments feature it's been working on since early 2017. The Facebook-owned chat app is currently giving a limited number of users in India the chance to give its built-in payments feature a spin. Based on the screenshots shared by UI designer Nagender Rao Savanth, testers will have to verify their phone number via SMS to be able to use the government-backed Unified Payments Interface within the app. They can then choose among the pretty large list of banks available, including the State Bank of India, HDFC Bank, and ICICI Bank, which are some of the biggest in the country.

Curve's payment-switching smart card goes live in the UK

Like the thought of switching payment methods for a purchase long after you've left the store? You now have a chance to try it. Curve has launched its smart card in the UK, letting you not only consolidate your credit cards (of the Mastercard or Visa variety) and debit cards, but switch between them for payments up to 2 weeks after the transaction. If you know you're going to hit your credit limit, for instance, you can switch a purchase to debit to give yourself some breathing room.

Google Wallet and Android Pay are finally united under one brand

Google's payment strategy has been more than a little confusing. It originally offered tap-to-pay under the Google Wallet badge, but it moved that functionality to Android Pay while turning Google Wallet into a money transfer service. Thankfully, Google knows it's a mess and is cleaning things up. The search giant is uniting all its payment efforts under a singular Google Pay brand. Whether you're tapping your phone at the cashier, buying a gift on the web or paying a friend for last night's pizza, you'll see the same name.

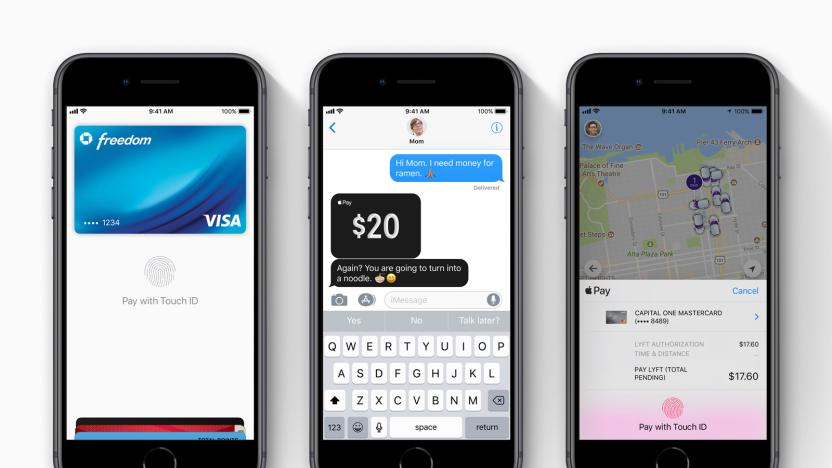

Apple Pay Cash money transfers are available in the US

Apple had to rush-release iOS 11.2 to tackle a nasty date-sensitive bug, leaving hopeful Apple Pay Cash users twiddling their thumbs. Thankfully, you haven't had to wait too long -- Apple's money transfer service is rolling out in the US. As promised, you can add a virtual Apple Pay Cash card to iOS' Wallet app and send Venmo-style payments through your iMessage chats. If you owe a friend for pizza, you don't have to download a separate app or hit the ATM to settle your debt.

Visa swaps payment cards for NFC gloves at the Winter Olympics

Visa is very fond of showing off its tap-to-pay technology at the Olympics, and that's truer than ever with the 2018 Winter Olympics around the corner. The payment giant is selling a trio of NFC-equipped gadgets to help you shop at the PyeongChang games, most notably a set of winter gloves. Yes, you can pay for that souvenir without freezing your hands as you reach for a credit card or even your phone. You won't have to use them or the other devices at the games, but they'll come with prepaid values of between 30,000KRW to 50,000KRW ($27 to $45) to encourage shopping in South Korea. Visa hasn't offered pricing.

UK banks can now clear cheques in a day

Although the future of payments is digital, thanks to contactless and mobile, physical methods like cheques are still remarkably popular. For years, recipients have needed to wait up to five days for their signed piece of paper to clear, but that's all about to change. Thanks to a new image-based processing system implemented by the Cheque and Credit Clearing Company, cheques can now be cleared in a day.

Fitbit's first smartwatch can now make payments in the UK

Convenient contactless and mobile payment options are a dime a dozen these days, but that isn't discouraging Fitbit from throwing its keys into the bowl. After launching in the US and elsewhere during recent weeks, Fitbit Pay is now live in the UK, if not with a few catches. For starters you're going to need one of Fitbit's new £300 Ionic smartwatches, the company's first wearable that isn't geared solely towards activity tracking. Then there's the fact that at launch, it only supports Starling Bank, one of the UK's relatively new, branchless outfits that digs into your payment data to help you better manage your money from your mobile.

Patreon moves to restrict adult content on its crowdfunding site

NSFW Warning: This story may contain links to and descriptions or images of explicit sexual acts. Patreon is a crowdfunding platform that enables people to receive subscription payments for the work that they do. It's a way of connecting individuals and small businesses with paying audiences, from news websites and YouTube channels through to activists and educators.

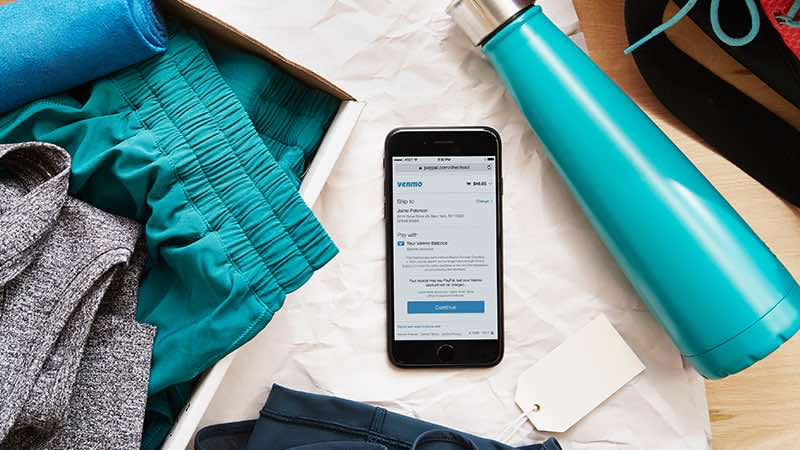

Online shoppers can now use Venmo to pay for their new gear

It's already great for paying back friends and splitting the rent, but Venmo is about to get even more useful. In a bid to court a more youthful generation of online shoppers, PayPal -- the popular app's parent company -- announced this morning that over 2 million US online retailers will accept payments through Venmo.

London Costcutter trials finger-vein readers for faster payments

The humble Costcutter supermarket at Brunel University in London has recently become home to a biometric payment system that allows customers to check out with a tap of their finger. The store's owner has begun trialling Sthaler's Fingopay system, which authenticates people by looking at the 3D pattern of veins beneath their fingertip -- one of the most unique identifiers around -- rather than their fingerprint.

Google’s mobile wallet for India uses sound for money transfers

After weeks of rumors, Google has officially released its payments app in India. Tez (Hindi for "fast") is a mobile wallet that seems like a blend between Android Pay and PayPal. Users can link their bank accounts and use it to pay for items in physical stores and online. The app also lets you transfer money securely to nearby users by using sound to pair devices (what Google calls "Audio QR"). Unlike NFC, the tech works on any smartphone in India, whether Android or iOS. And, it keeps your account info private.

Wisconsin company offers staff implants for keys and passwords

Don't assume that companies chipping employees is usually the stuff of dystopian science fiction -- it's here... although it's better than it sounds. Wisconsin's Three Square Market is giving employees the option of receiving a rice-sized implant (not pictured above) that will handle authentication for just about everything at work. It's the first such company-wide move in the US, Three Square claims. The chip will handle payments for food in the break room, front door access and even PC sign-ins. It promises to be very convenient, but it's easy to see why people would balk at an idea that sounds Orwellian at first blush. Three Square at least appears to be addressing some of those issues, but there are still some problems that are difficult to escape.

Curve's smart card switches between credit and debit after purchases

Have you ever bought something only to regret it later as you run into a spending limit on the card you used? If you live in in the right country, you might have a way to overcome this particular strain of buyer's remorse. Curve is giving its British and European Mastercard users the ability to switch a purchase between credit or debit up to two weeks after the transaction took place. If you realize you're going to go into overdraft, or that you should have expensed dinner on your corporate credit card, you can make a change before it's too late.

PayPal 'instantly' transfers money to your bank account

PayPal can be frustrating if you want to put funds in your bank account. It can take a day or more for transfers to go through, and that's a problem when rival services like Zelle can promise speedier access to your money without needing a separate app. To that end, PayPal is rolling out an instant transfer option in the US. So long as you're willing to accept a 25-cent transaction fee, your funds will hit your bank account within a few minutes, and no more than 30 minutes in the worst cases. If you withdraw money from PayPal before a shopping trip, it should be ready to use by the time you get to the store.