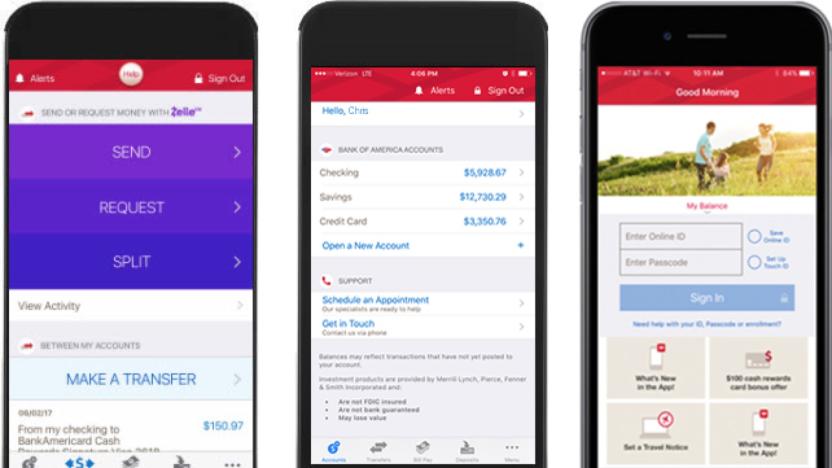

bankofamerica

Latest

Bank of America's AI assistant is ready to help with your finances

We've been expecting voice-powered virtual assistants in financial apps for a while now — Bank of America started developing its own back in 2016. Dubbed Erica, the virtual assistant is now ready to roll out to the bank's 25 million mobile clients across the US, from now through June of this year.

Four men linked to Mugshots.com have been charged with extortion

Four men allegedly behind the website Mugshots.com have been arrested and California Attorney General Xavier Becerra announced charges of extortion, money laundering and identity theft. The website mines information from police department websites, pulling names, mugshots and charges of those who have been arrested, and then publishes them online. To get the content taken down, individuals have to pay a "de-publishing" fee -- a practice that has been illegal in California since 2015. Becerra's office says that over the course of three years, the site collected more than $64,000 from California residents and over $2.4 million nationwide.

Banks ban credit purchase of cryptocurrency due to risks

If you use your Bank of America-, JP Morgan Chase- or Citigroup-issued credit card to buy cryptocurrency, then you'll have to find an alternative ASAP. According to Bloomberg, the banks have banned crypto purchase using their cards due to the virtual coins' volatile nature. BofA has already started declining credit transactions with known exchanges, though its debit cards aren't be affected by the ban. Citigroup also announced on Friday that it'll no longer process crypto purchases, while JP Morgan Chase's new rule will take effect today.

Bank of America is adding two-factor fingerprint authentication

In the wake of recent security breaches, including but certainly not limited to Equifax, Bank of America has stated it will integrate fingerprint-based two-factor authentication into its online banking setup. The financial institution will start using Intel's Online Connect system to ensure customer security at some point in 2018.

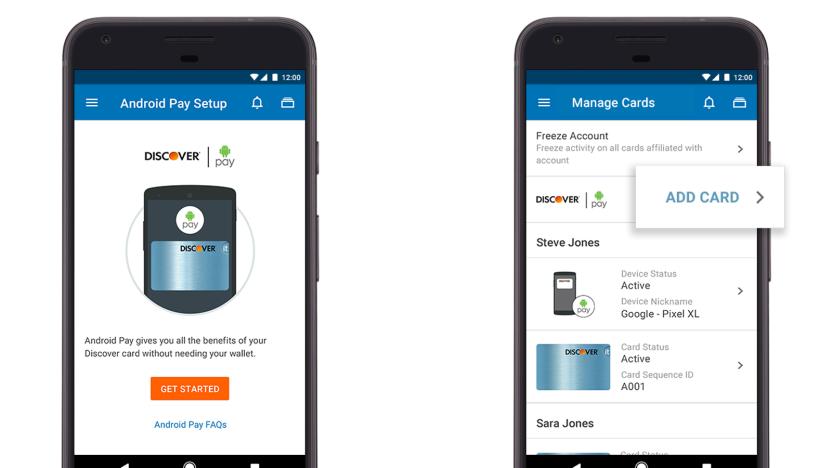

Android Pay now works with your mobile banking app

You no longer have to use Google's official app if you want to get started with Android Pay's tap-to-buy features. The internet giant has forged partnerships with several financial institutions (currently including Bank of America, BNZ, Discover, mBank and USAA) that let you add cards and use Android Pay from within their mobile banking apps. The tap-to-pay experience should remain familiar, right down to getting notifications whenever you make a purchase.

Bank of America is building an AI helper for its mobile apps

If you've ever wanted to get financial advice from a computer, then you're going to love what Bank of America is working on. The company has announced that it's developing Erica, a "virtual assistant" designed to help customers better manage their finances. The service will sit inside the firm's mobile banking apps and is designed to become your "trusted financial advocate." This means that it won't be long before an AI starts asking why you spend so much money on hats instead of paying rent.

MasterCard is lending its mobile payment tech to banks

MasterCard is hoping to make in-store mobile payments -- the ability to wave your phone at a terminal to buy something -- more accessible. The company is teaming up with several banks, including Citi and Bank of America, to let customers pay for stuff using bank apps on their phones. Meaning, you won't have to download a dedicated app.

Apple Pay users can withdraw money from select BoA ATMs

If you're an Apple Pay user with access to the cardless ATMs Bank of America installed earlier this year, you might be able to withdraw cash from the machines using your phone. Reports that BoA's machines will support Cupertino's mobile wallet began circulating back in January. Now a Redditor who goes by the moniker "WhatWhatTech" successfully used Apple Pay to withdraw cash from his account through a machine in Redondo Beach, California. These cardless ATMs have an NFC logo right beside the card slot -- simply tap your phone on that logo, and you'll be prompted to key in your PIN before the screen displays all the available transaction options.

New updates aim to make Android Pay a universal payment system

There's more to today's Android Pay news than just a long-awaited UK launch. Google doesn't want people to just think of Android Pay as a way to pay for things in stores with phones, so today it pulled back the curtain on new and updated APIs to let developers -- and merchants -- use Android Pay in more places and in different ways.

Bank of America now supports Android's fingerprint scanner

Sure, smartphone fingerprint scanners like Apple's Touch ID and Google's Nexus Imprint help keep your phone more secure. But they also make it easier to log into various apps or make purchases without having to type an unwieldy password into your phone. That's why we're glad to see the Bank of America app add support for Android Marshmallow's native fingerprint recognition APIs. This means that Nexus 5X and 6P owners can now log into their bank accounts with their fingerprint, a feature that was previously reserved for Samsung phones with a fingerprint sensor.

Watch the Patriots practice in VR through Google Cardboard

You can't currently get a first-hand experience of an NFL game short of becoming a football star and strapping on a helmet, but Bank of America and Visa are promising the next best thing. They've launched a virtual reality experience that lets you see the New England Patriots' training sessions using Google Cardboard. If you've ever wanted to see Gillette Stadium from the field or watch Tom Brady lead a practice play, you now have an easy way to do it. Only Android users can get the full-on VR experience, unfortunately, but any Patriots fan who can watch 360-degree YouTube clips can check it out.[Image credit: John Tlumacki/The Boston Globe via Getty Images]

Bank of America adds fingerprint logins to its Android and iOS apps

One of the most anticipated features arriving with Android's Marshmallow OS update is the new fingerprint reader capability. And while Marshmallow won't go live until the end of the year, a number of companies are already gearing up with fingerprint-enabled apps. Bank of America is one of them. The company announced on Tuesday (via its app update screens) that it has added fingerprint recognition for both Android and iOS' Touch ID to its mobile banking app. [Image Credit: Associated Press]

Samsung Pay beta arrives on every major carrier but Verizon

Samsung has opened the public beta of its new phone-based Pay service ahead of its official launch late next month. Beta participants will need to have a Galaxy S6, S6 Edge, Note 5, or S6 Edge+ (unrooted, mind you) as well as a credit or debit card from US Bank (Visa) or Bank of America (Visa or MasterCard). Additionally, they'll need cellular service from AT&T, T-Mobile, Sprint, or US Cellular. Verizon subscribers are SOL as the company is still "evaluating" Samsung's system. There's no word yet on when or if Verizon will actually participate. [Image Credit: FilmMagic]

Watch Kanye West and U2 play a surprise charity concert live on YouTube

World AIDS Day has already done a lot to both raise awareness of AIDS and fund research for a cure, but it's about to end with a bang. Bank of America and the (RED) charity are hosting a surprise concert at 7:30PM Eastern tonight in Times Square -- and they're streaming the whole thing live on YouTube. The gig will see most of U2 play alongside Bruce Springsteen and Chris Martin (Bono is recovering from an accident), with Kanye West and Carrie Underwood adding to the star power. It's short notice, we know, but it's definitely worth tuning in if you want to see some of the biggest names in music play for a good cause... and no, this won't show up in your iTunes library afterwards.

Ford, UPS and Visa want net neutrality, but they won't tell you that

It's not just tech giants (and President Obama) pushing for a tougher approach to net neutrality -- other outlets want reforms, too. A trio of regulatory filings reveal that representatives from Bank of America, Ford, UPS and Visa spoke to FCC commissioners multiple times this year to press for stricter net neutrality under the banner of an advocacy group, the Ad Hoc Telecommunications Users Committee. The companies tell Bloomberg Businessweek that they weren't taking particular stances on the issue, and were only concerned about getting their customers a "fast and reliable connection," as Ford puts it. However, the filings suggest otherwise -- the Ad Hoc members gave the FCC material explicitly asking for the internet to be reclassified as a public utility, as the President wants. So why the he-said-she-said discrepancy?

Bank of America issues refunds after double-charging Apple Pay users

Went on a spending spree with your Bank of America debit card the moment Apple Pay hit your iPhone? You might be in for a (brief) shock. The bank is now issuing refunds after it charged at least some Apple Pay users twice when they made purchases at retail shops. While it hasn't said what triggered the glitch, the issue doesn't appear to involve Apple's software -- there haven't been widespread reports of problems with other cards, and Apple itself doesn't process transactions. Whatever was the cause, it's not surprising that a major mobile payment service would run into some hiccups just after launch. Let's just hope that things go more smoothly from here on out.

Banks brace for cyberwarfare drill Quantum Dawn 2

Come June 28th, Wall Street outfits including the likes of Citigroup and Bank of America will be under siege -- from fake hackers, that is. Representatives from a total of 40 companies along with the Federal Reserve, Securities and Exchange Commission, US departments of Treasury and Homeland Security will take part in Quantum Dawn 2: a simulated cyberattack on faux trading and information systems. Led by the Securities Industry and Financial Markets Association, the drill will test the ability of participants to cooperate via email and phone to suss out what's going on and hatch a plan. The exercise will momentarily pause so that those involved can decide on a course of action, and then it'll speed up and model the effects of the decision over a longer period of time. With the recent flurry of hacking incidents and international finger pointing, something tells us this won't be the last we hear of drills like Quantum Dawn. [Image credit: MoneyBlogNewz, Flickr]

Bank of America brings live teller video chat to ATMs

If you're having trouble splitting those ATM deposits into both your savings and offshore accounts, Bank of America is there to help -- literally. Its new ATMs with Teller Assist add real-time video chat, letting you speak directly to an agent for more complex transactions. Starting this month in Boston, you'll be able to cash a check for the exact amount (including change) and select precise bill denominations for withdrawals, with functions like deposit splitting, cash back with deposit and credit card / loan payments rolling out later. The Teller Assist ATMs will run from 7 AM to 10 PM and hit locations across the rest of the US "throughout 2013." Beleaguered shift workers (or white collar criminals) can see more in the PR after the break.

Bank of America gets into card swiping with Mobile Pay on Demand, because 29 can play at that game

To call the mobile-based card processing business crowded would be a slight understatement -- launching a reader is nearly an instinctual reaction for commerce outlets that see Square running away with the market. What's to stop a bank from joining the fray? Bank of America doesn't see anything wrong, as it's starting up a me-too service through Mobile Pay on Demand. The headphone jack reader with Android and iOS support will seem very familiar to anyone who's been paying attention; the company does have some tantalizing lures for entrepreneurs, however, such as an ever-so-slightly lower 2.7 percent fee per transaction as well as a year-long deals marketing service subscription for any 2012 sign-ups. US shops that haven't already jumped on the bandwagon with Square (or Groupon, or Intuit, or Pay Anywhere, or PayPal or VeriFone) can pre-order a reader today and start taking payments on December 3rd.

Bank of America testing QR Code scanning mobile payment system in North Carolina

Mobile payment is still a bit of a wild west at the moment, and seemingly every technological and financial institution has a dog in this fight. Bank of America's not going to just sit idly by and watch it all unfold. The US's second largest bank has flirted with NFC in the past and is currently doing trials with QR scanning in Charlotte, North Carolina, where it's based. At present, five sellers in the area are taking part in the pilot program, with bank employees given access to the technology. The three-month trial is the result of a partnership with mobile payment company Paydiant, is compatible with Android handsets and iPhones, no NFC needed, naturally.