banks

Latest

Mobile-first bank Simple is shutting down

One of the first-ever mobile-first banks is shutting down.

Apple 'surprised' by Germany's new law to open up mobile payments

Germany has introduced new legislation to deal with money-laundering, and it's causing problems for Apple. On Thursday, the German Parliament passed a raft of new measures to bring the country in line with EU directives on money laundering. These include stricter regulations for real estate agents, notaries, auction houses, and operators of electronic money infrastructure. The legislation didn't specifically name Apple nor Apple Pay, but it basically means Apple and Apple Pay.

Apple hopes interest-free iPhones will boost slow Chinese sales

As smartphones get more expensive, and the innovation in new devices gets less grand, there's less reason to upgrade your device every two years. It's a problem for all device manufacturers which rely upon handset sales to grease the wheels of their business, but Apple thinks it has a solution. The company has teamed up with a number of Chinese banks to offer interest free credit on a number of new iPhone purchases.

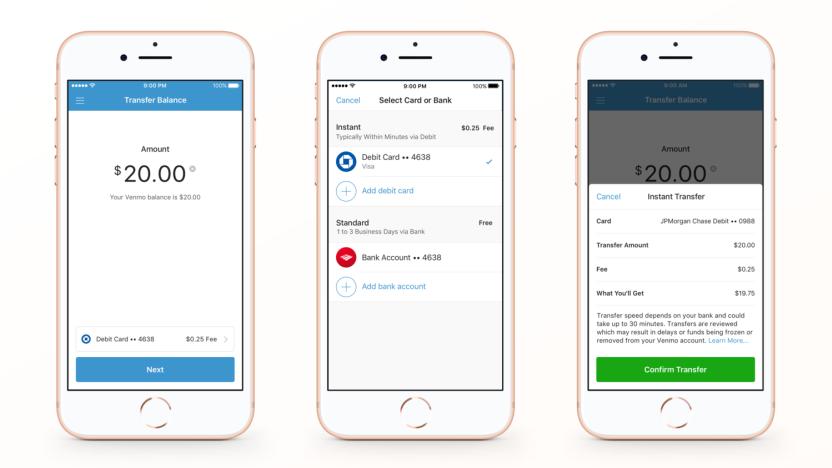

Venmo's 25-cent instant transfers are now available for everyone

Payment sharing services from Paypal, Square and Venmo are great, but it can take some time to move funds from those accounts to your bank so you can use them in real life. Last year, Paypal introduced $0.25 instant transfer fees to make it much faster to move money to your real-life bank. Now Paypal-owned Venmo is doing the same, offering transfers of funds in less than 30 minutes.

Open Banking is here to change how you manage your money

After completing a review of the retail banking sector back in the summer of 2016, the UK Competition and Markets Authority (CMA) concluded that stagnation had set in. It found that hardly anyone switches banks each year, and the huge financial institutions don't put a lot of effort into retaining or competing for business. Among a number of reforms the CMA put into motion was "Open Banking," which requires all the big banks to make your financial data accessible in a standard format. The deadline to comply with the open banking initiative passed over the weekend, and several key names have missed the launch. It's now officially up and running, however, and it promises to completely change how you choose and use all kinds of financial services.

UK banks finally learn how to clear cheques in a day

Despite a huge rise in online and contactless payments, cheques are still ridiculously popular. In 2016 alone, Brits sent over 477 million of them, making their recipients wait up to five days to get their hands on the money. For decades, the Cheque and Credit Clearing Company has facilitated this delay by requiring banks to send them to a clearing centre -- which involves a system of checking, verifying and transportation around the country -- but that wait will soon be reduced to one day under new rules unveiled today.

A second hacking group is targeting bank systems

It's bad enough that one hacker group has been wreaking havoc on banking systems worldwide, but it's apparently getting worse. Security firm Symantec reports that a second group, Odinaff, has infected 10 to 20 of its customers with malware that can cover up bogus money transfer requests sent through the ubiquitous SWIFT (Society for Worldwide Interbank Financial Telecommunication) messaging system. Most of the attacks targeted Australia, Hong Kong, the UK, the Ukraine and the US. And unlike the initial attackers, Odinaff appears to be a criminal organization (possibly linked to the infamous Carbanak team) rather than a state-sponsored outfit.

'Open banking' data will help Brits compare and switch accounts

Just as Ofcom is making it easy to switch broadband and mobile providers to inspire us to hunt for the best deals, the UK's Competition and Markets Authority (CMA) wants us to be similarly proactive about our bank accounts. Having completed a lengthy probe into retail banking, the CMA believes the secret to a more competitive industry lies in our data, and the sharing of it.

NY Fed rejected, then later approved $81 million bank heist

The financial industry has used a messaging system made by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) to securely authenticate transfers between banks for decades. But recent fraudulent money requests have broken the system's impenetrable reputation. Back in February, hackers used this method to steal $81 million from the Federal Reserve Bank of New York, but officials just revealed that those requests had been red flagged and rejected previously in the day -- only to be approved hours later.

ATM hacking spree nets thieves $12.7 million in two hours

Normally when your data is part of a haul from some security breach your most immediate worry is about how it can be used to steal your identity online. Well, sometimes that information is instrumental in physical heists. On May 15th, a team of hackers coordinated to withdraw $12.7 million from about 1,400 convenience store ATMs across Japan in under two hours.

Google launches Android Pay in the UK

As promised, Google has brought Android Pay to the UK. The app is now live in the Google Play Store, meaning anyone with a compatible credit or debit card can link their bank account and start making payments. The Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, M&S Bank, MBNA and Nationwide Building Society are all on board at launch, however it might take a little while before your particular bank is up and running. Oh, and don't expect Barclays to support Android Pay any time soon. It's a little preoccupied with its own Android app.

Big banks want to adopt Bitcoin tech for the financial sector

Whenever you make a Bitcoin transaction, it's recorded on a public ledger called "blockchain." Now, a handful of big banks have partnered (PDF) with New York firm R3 to adopt the cryptocurrency's database system for use in finance. These nine banks, including Goldman Sachs, JPMorgan Chase & Co. and Barclays, will help the firm develop standards and agree on the underlying architecture that the sector will use. After that, they will decide where the software can be applied and then test it out to be sure. Due to the way blockchain works, it has many potential applications: for instance, it could speed up the process of tracking ownerships or the transfer of assets between two people.

Atom is a new UK bank that'll have no branches, just apps

Banking is a bit of an old boys' club dominated by a few huge, lumbering corporations, but up-start Atom thinks it's time for a new player with a different approach. Atom wants to take mobile banking seriously; so seriously, in fact, that it aims to exist almost solely as a mobile app. The company has just been granted a UK banking licence and plans to launch later this year, first using mobile apps to offer its services before graduating to desktops in due course. Atom will have a 24-hour support team available by phone, email, webchat and social networks, but the idea is you can do everything, even open an account, from within the mobile app.

IBM's planning to harness bitcoin for its own payments platform

Bitcoin may have a long march toward legitimacy, but that doesn't mean its technical design isn't about to go mainstream. Reuters is reporting that IBM is examining the cryptocurrency's inner workings in an attempt to build a new form of international payment system. The idea behind the scheme is to get people to swap cash without having to use a bank or wire service. Instead, users would use a bitcoin-style system to transmit money anywhere in the world without having to use a third party that charges service fees.

Banks respond to fraud with improved verification for Apple Pay

Reports of thieves using stolen payment info with Apple Pay surfaced earlier this week, and banks are already stepping up security measures. In fact, the culprits used the software to employ credit card details stolen during Target's massive breach in 2013. The Wall Street Journal reports that those financial institutions are making customers take extra steps to verify that cards being entered into Cupertino's mobile payment platform really belong to them. Tools like one-time authorization codes, a call to customer service and security questions are being used to confirm identities for those who want to pay with an iPhone. What's more, some banks will require you to authorize Apple Pay by signing into your online banking. If you'll recall, Apple Pay itself remains locked down, and the fraudsters were able to take advantage of banks' rather lazy identity checks. Of course, even with the added checks, you'll want to keep a close eye on things to ensure someone hasn't swiped your card number.

Police kill money-stealing botnet that infected millions of PCs

Europol and police forces across Europe have shut down Ramnit, a botnet that infected up to three million computers world-wide. The virus, generally installed by email phishing attacks or rogue sites (please stop clicking on attachments, whoever your are) was mostly used by criminal hackers to steal banking info. If you were so foolish to click, the program gives hackers remote access to your Windows PC, letting them steal banking credentials, personal details and other info. The countries hit hardest were the US, India and Bangladesh.

RBS and NatWest add Touch ID login to their banking apps

If you manage your personal finances from a smartphone, you'll be familiar with the tiresome verification procedures that banks use to double-check your identity. To make everything a little simpler, RBS and NatWest are introducing Touch ID support to their iOS banking apps tomorrow. So rather than punching in a long-winded passcode, you'll just need a fingerprint to log in to your account. The feature is entirely optional though, so if you're worried that Touch ID isn't quite secure enough to protect your lifelong savings, it can easily be disabled on your iPhone 5S, 6 or 6 Plus. More importantly, the BBC reports that some in-app features will still require additional verification and, similar to contactless credit and debit cards, there will be an upper limit for new payments. So even if a crafty crook copies your fingerprint, most of the app should remain under lock and key.

Subtle malware lets hackers swipe over $300 million from banks

It's no secret that hackers see banks as prime targets, but one band of digital thieves is conducting heists on a truly grand scale. Security researchers at Kaspersky have published details of malware attacks that have stolen at least $300 million from financial institutions in 30 countries. The crooks not only trick bank employees into installing a virus (Carbanak) through spoofed email, but spy on staff in order to mimic their behavior and prevent any telltale signs that money is falling into the wrong hands. Many of the attacks focus on shuffling money to outside accounts, although some will send paper cash to ATMs monitored by criminals.

Visa's secure payment system is expanding to online shopping

Visa's move to protect your credit card numbers was apparently pretty popular. How do we know that? Well, it's coming to a bunch of places that aren't adorned with the Apple logo -- that's how. The company has announced that "other leading device manufacturers and technology companies" will adopt Visa Token Service this year. What's more, the company says it plans to use its secure payment system (one that doesn't any of your actual credit card info, but randomized data) on Visa Checkout transactions online as well. Even better? The outfit says that it expects some of the biggest online retailers to adopt VTS too. Oh, and banks and credit unions in the Latin America, the Pacific region of Asia and the United States are also supposed to come on board with the tech in 2015. If that means less worrying after the next inevitable data breach, hey alright! [Base image credit: OrphanJones/Flickr]

FBI wants to know if US banks launched revenge hacks against Iran

Your parents might have told you that revenge solves nothing, but it's not clear that American banks have learned the same lesson. Bloomberg sources understand that the FBI is investigating whether or not US financial institutions hired hackers to conduct retaliatory hacks against Iran, crippling the servers that had been used to attack the companies starting in 2012. There isn't any hard evidence banks acted on their anger, although they at least came close. JPMorgan Chase acknowledged that one of its officials proposed an offshore strike that would have knocked the Iranian servers out of commission. The staffer didn't offer a full-fledged plan, however, and nothing appears to have come out of the idea.