ATM

Latest

Venmo will soon have accounts for teenagers, with no-fee debit card and ATM access

Venmo is rolling out Venmo Teen Accounts, which enables parents and guardians to give their teens a Venmo account with a debit card. The account supports ATMs and direct deposit.

Peter Cao05.22.2023

Security fails we’re kinda thankful for

As we gather 'round the fire, warming our facepalm-weary hands, the blaze burning bright with the shreds of our privacy and security, it's important to reflect on what we're grateful for: Companies that did the infosec version of stepping on a rake, forcing them to secure us better. Idiots who tried to "hack" the FCC comment system while leaving their OPSEC cake out in the rain. Whatever geniuses left road signs eminently hackable, and the ones who made ATMs susceptible to malware that literally spits out cash. Here are the "winners" of utter and complete security failures we're almost grateful for. Let's hope the next time these clowns fall off a stack of servers, they don't fail to miss the ground.

Violet Blue11.28.2019

The Netherlands places missing child alerts on ATMs

The Netherlands will be the first country in the world to display Amber alerts on ATMs when a child is reported missing. The initiative, which went into effect last week, will display the photos of missing children as the screensaver on more than 300 ATMs across the country. To start, the alerts will be displayed on machines located in airports and shopping centers, but the country's authorities plan to expand the service to other ATMs over time.

AJ Dellinger05.28.2019

North Korea-linked hacking group stole millions from ATMs

Lazarus, North Korea-linked hacking group that was behind the notorious WannaCry attack, managed to steal tens of millions of dollars from ATMs in Asia and Africa, according to a report from security firm Symantec. The hackers deployed malware called Trojan.FastCash and infected thousands of servers that communicate with ATMs. It then used that access to approve its own fraudulent transactions and withdraw money from the machines.

AJ Dellinger11.08.2018

After Math: Hello Darkness, my old friend

Well, this week lasted years. While we weren't being bludgeoned by the cantankerous Kavanaugh confirmation hearings, we were learning about how 50 million Facebook users had their accounts hacked, that Elon Musk is being sued by the SEC for his Twitter posts (the ones about privatizing Tesla, not the ones wherein he libels a rescue diver), and that Red Dead Redemption 2 will rustle the remainder of your hard drive's free space.

Andrew Tarantola09.30.2018

ATM 'jackpotter' sentenced to year in US prison

One of the men involved in an ATM jackpotting scheme in January this year is already facing punishment. A district court in Connecticut has sentenced Argenys Rodriguez to just over a year in prison, plus two years of supervised release and $121,355 in restitution, for collaborating on hacks that slipped malware into bank machines and forced the devices to spit out their cash. Rodriguez had pleaded guilty to bank fraud in June and will start his sentence on November 26th.

Jon Fingas09.28.2018

Chase now offers phone-based withdrawals at 'nearly all' ATMs

It took a long, long time, but Chase's phone-based ATM withdrawals are finally widespread. The bank has expanded its card-free access to "nearly all" of its ATMs across the US, giving you one less reason to panic if you leave your wallet at home. As before, you can get in by tapping a device with a Chase debit or Liquid card linked to Apple Pay, Google Pay or Samsung Pay, and then entering your PIN code. It's functionally equivalent to using your regular card, so you're not facing the usual limits that come with making tap-to-pay purchases.

Jon Fingas08.02.2018

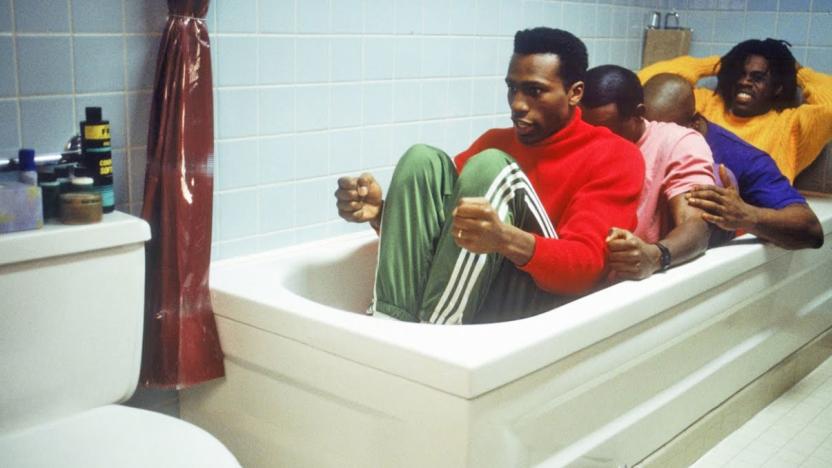

After Math: It's bobsled time!

The 2018 Winter Olympics are starting up but Pyeongchang won't be the only place crowning champions. This week we've already seen Waymo win out over Uber in court; Sasha 'Scarlett' Hostyn, the most successful woman in eSports, was victorious in an Olympic-backed Starcraft 2 tournament; and Amazon came up with yet another way to dominate the delivery market -- 2-hour Whole Foods deliveries. Numbers, because how else will you count the scorecards?

Andrew Tarantola02.11.2018

Two men charged with bank fraud following 'jackpotting' heist

A Connecticut court has charged two men with bank fraud after they allegedly stole thousands of dollars through ATM jackpotting. While a relatively new scheme in the US, jackpotting has been a problem in Asia, Europe and Mexico for years and involves loading up ATMs with malware and forcing them to release their cash contents. The two men are said to have dressed up as ATM technicians and accessed a Citizens Bank ATM in Cromwell, Connecticut in late January. Police found them near the ATM with tools and electronic devices believed to be required for jackpotting as well as $9,000 in $20 bills.

Mallory Locklear02.06.2018

ATM 'jackpotting' hacks reach the US

For some ATM thieves, swiping card data involves too much patience -- they'd rather just take the money and run. The US Secret Service has warned ATM makers Diebold Nixdorf and NCR that "jackpotting" hacks, where crooks force machine to cough up large sums of cash, have reached the US after years of creating problems in Asia, Europe and Mexico. The attacks have focused largely on Diebold's front-loading Opteva ATMs in stand-alone locations, such as retail stores and drive-thrus, and have relied on a combination of malware and hardware to pull off heists.

Jon Fingas01.28.2018

Russian hackers steal $10 million from ATMs through bank networks

The recent rash of bank system hacks goes deeper than you might have thought -- it also includes stealing cash directly from ATMs. Researchers at Group-iB have published details of MoneyTaker, a group of Russian hackers that has stolen close to $10 million from American and Russian ATMs over the past 18 months. The attacks, which targeted 18 banks (15 of which were American), compromised interbank transfer systems to hijack payment orders -- "money mules" would then withdraw the funds at machines.

Jon Fingas12.11.2017

Tap your phone to withdraw cash from Wells Fargo ATMs

Wells Fargo enabled smartphone-only ATM withdrawals back in March, but the need to punch in both an app-specific code and your PIN partly defeated the convenience of the feature. As of now, though, it's decidedly easier: the bank has enabled NFC access at more than 5,000 of its ATMs across the country. As with Chase, you just have to tap your phone (using Apple Pay, Android Pay or Samsung Pay) and enter a PIN code to start a transaction at a supporting machine. Suffice it to say this is considerably faster than entering two codes just to withdraw some cash.

Jon Fingas10.10.2017

You’ll need to show your face to use ATMs in Macau

Macau, the gambling capital of the world, is upgrading all 1,200 of its ATMs with facial recognition cameras. According to Bloomberg, any user looking to make a withdrawal will need to enter their PIN and then stare into a lens for six seconds to verify your identity. The move is partly to improve bank security, but mostly to enable China to keep an eye on who's doing what with their cash, and when.

Daniel Cooper06.29.2017

Wells Fargo activates cardless withdrawals for all its ATMs

Wells Fargo's pilot trial for cardless withdrawals must have gone well, because the bank is rolling out the feature to all of its 13,000 ATMs across the country. The company debuted the feature in select ATMs earlier this year. Starting on March 27th, though, you can withdraw cash from any of the bank's machines using only your smartphone. You'll have to request an eight-digit code from the Wells Fargo app to punch into the machine along with your PIN code every time you want to withdraw money. Take note, however, that the code can only be used once and won't be enough to open some branches' secure doors during non-business hours -- you'll still need your card for that.

Mariella Moon03.23.2017

Thieves find a more insidious way to steal credit card details

The secret service has issued a warning to banks and ATM companies about a new way that thieves can steal your credit card information. A report from Krebs on Security explains that "periscope" skimmers have been found inside teller machines in Connecticut and Pennsylvania in the last two months. Of course, since the devices attach to the internal mechanism, there's absolutely no way for an end user to tell if they're at risk.

Daniel Cooper09.14.2016

ICYMI: An accidental invention could create clean water

Today on In Case You Missed It: Some of the greatest inventions of our modern age, from the pacemaker to super glue, got their start as accidental discoveries. That's why we're focusing today's show on a find by the Pacific Northwest National Laboratory, where scientists meant to make magnetic nanowires but created a kind of carbon nanorod instead. It might prove to be a wonderful mistake, since studying the nanorods shows they can harvest, hold and evaporate liquid from their fibers. The hope is that the material could create cheap and low-energy water purification systems, changing the game for clean water delivery. We also showed you both the YouTube video where a ATM skimmer seller demonstrates how easy it is to scam money from those machines, and also a video of this dancing robot, because. As always, please share any interesting tech or science videos you find by using the #ICYMI hashtag on Twitter for @mskerryd.

Kerry Davis06.15.2016

'Mr. Robot' promo has you hacking a fake ATM

If you were planning a real-world promo for Mr. Robot, a TV show that's all about hacking and the culture that goes with it, what would you do? Invite fans to do some hacking of their own, apparently. As part of the run-up to the series' second season, New York City retailer Story has remade its store with a hacking-inspired game as its centerpiece. Clues littered around the store offer codes that let you 'hack' an Evil Corp ATM for real cash -- if you're astute, you can get as much as $50. It's not the same as a real ATM hack (thankfully), but it's very much in the spirit of Mr. Robot's stick-it-to-authority ethos.

Jon Fingas06.08.2016

ATM hacking spree nets thieves $12.7 million in two hours

Normally when your data is part of a haul from some security breach your most immediate worry is about how it can be used to steal your identity online. Well, sometimes that information is instrumental in physical heists. On May 15th, a team of hackers coordinated to withdraw $12.7 million from about 1,400 convenience store ATMs across Japan in under two hours.

David Lumb05.23.2016

Monopoly money is no more in the new Ultimate Banking edition

Hasbro has released a new edition of Monopoly called Ultimate Banking, that should help keep familial infighting to a minimum. Instead of paper money, which can easily be laundered or stolen when you aren't looking, this new edition uses debit cards. It also does away with the easily-corrupted Banker position, replacing the human with an electronic card reader (aka an ATM).

Andrew Tarantola02.15.2016

Get ready to use your smartphone to withdraw cash at ATMs

Soon, you won't need your card to withdraw cash from JPMorgan Chase ATMs. Upgraded machines arriving later this year will be accessible with your phone, using codes generated from its smartphone app. That's only the first stage: second-generation upgrades will offer up NFC access to bank accounts, like Apple Pay and Samsung Pay. Yep, you'll still be able to use your cards, but importantly, the new machines will also have higher withdrawal limits during banking hours — up to $3,000. Future upgrades include the ability to cash checks and pay bill through the machines, but expect to see those features some time in 2018. Chase isn't the only bank looking to involve your smartphone with your money.

Mat Smith01.28.2016