banking

Latest

Opera accused of offering predatory loans through Android apps (updated)

Opera has frequently tried to claim the moral high ground in the web browser world, but it's being accused of using its side projects for far less virtuous behavior. Hindenburg Research has published a report alleging that Opera is running four Android apps aimed at India, Kenya and Nigeria (CashBean, OKash, OPay and OPesa) that appear to be in direct violation of Google Play Store policies forbidding predatory loans and deceptive descriptions. The apps would claim to offer maximum annual percentage rate (APR) of 33 percent or less, but the actual rates were much higher, climbing to 438 percent in the case of OPesa. And while they publicly offered reasonable loan terms of 91 to 365 days, the real length was no more than 29 days (for OKash) and more often 15 days -- well under Google's 60-day minimum.

Tech companies won’t become banks, but they’ll pretend to

Silicon Valley has already eaten plenty of industries, from camera and newspaper businesses to watches and even flashlights. Now, Big Tech appears to be turning its attention to banking. But don't expect Facebook or Google to launch their own banks. According to the experts, this sudden play for financial services is about your loyalty, not their competition.

Google wants to be your new bank

It's not just Apple and Facebook diving headlong into the financial world. Google has revealed plans to offer checking accounts in 2020 through a project nicknamed Cache. The search giant won't handle the actual underpinnings -- Citigroup and a credit union at Stanford University will both handle the accounts and feature the most prominent branding. There will still be integration between Google and the accounts, though, and some of it might raise concerns among regulators.

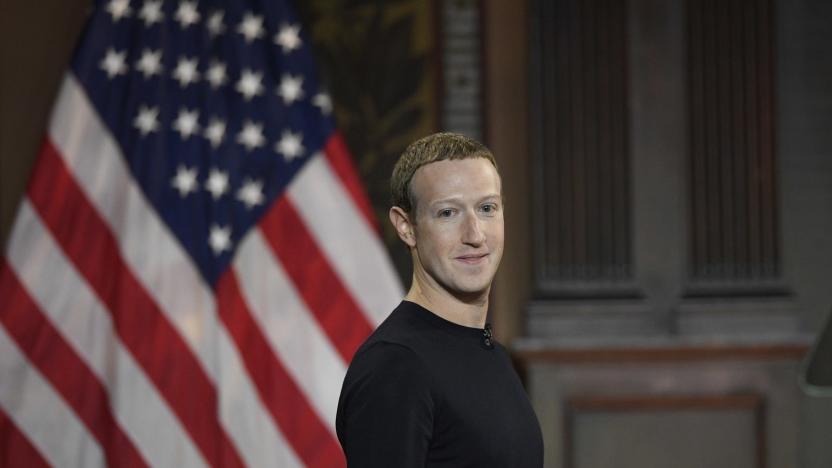

Facebook releases Zuckerberg’s upcoming testimony in defense of Libra

Tomorrow, Facebook CEO Mark Zuckerberg will appear before the Financial Services Committee, where he's expected to be grilled about Facebook's planned cryptocurrency Libra and digital wallet Calibra. Ahead of tomorrow's inquisition, Facebook has shared Zuckerberg's prepared statement. In it, Zuckerberg admits that Facebook is "not the ideal messenger right now" and promises that Facebook will not move forward with Libra anywhere in the world until US regulators approve.

Venezuela reportedly wants its central bank to hold bitcoin

Venezuela may not just be using its own cryptocurrency to dodge the consequences of international sanctions. Bloomberg tipsters say the country's central bank is testing the possibility of holding on to cryptocurrencies in order to help the state-controlled oil company Petroleos de Venezuela SA. The firm reportedly has troves of bitcoin and ethereum, and moving that money to the central bank might let it pay suppliers and avoid "potential blocks" from conventional channels that would come with either direct crypto payments or regular money.

Alleged JPMorgan hacker set to plead guilty

Andrei Tyurin, one of the key suspects in the huge JPMorgan Chase hack in 2014, is set to plead guilty, according to a court filing obtained by Bloomberg. The Russian reportedly struck a deal with federal prosecutors and will appear at a plea hearing next week in New York.

Central banks to question Facebook over Libra cryptocurrency

Facebook is about to undergo further scrutiny of its Libra cryptocurrency, and it may have to answer some difficult questions. Officials speaking to the Financial Times said that Libra representatives are meeting with officials from 26 central banks (including the Bank of England and the US Federal Reserve) in Basel, Switzerland on September 16th. The European Central Bank's Benoît Coeuré is expected to chair the gathering, which will question Facebook over the digital money's "scope and design."

Apple’s credit card could arrive in the first half of August

In March, Apple made a fuss over its plans to introduce a credit card. But we haven't heard much about Apple Card since. Now, Bloomberg reports that the card will reportedly launch in the first half of August. The update suggests that the card is on track, as Apple initially said it would be ready this summer.

Monzo's app-only banking is coming to the US

You might not have heard of Monzo in the US, but there's a good chance your British friends have when the digital bank has racked up over 2 million customers in its short history. And now, it's coming to the US... in a manner of speaking. Monzo has unveiled plans to roll out service to the US in the "next few months," including the mobile app and a Mastercard debit card. It'll build the audience slowly by connecting with hundreds of people at a time at events before it conducts a wider-scale launch. However, don't expect it to function as a bank at first. It'll be closer to a money transfer service akin to Venmo or Apple Pay Cash.

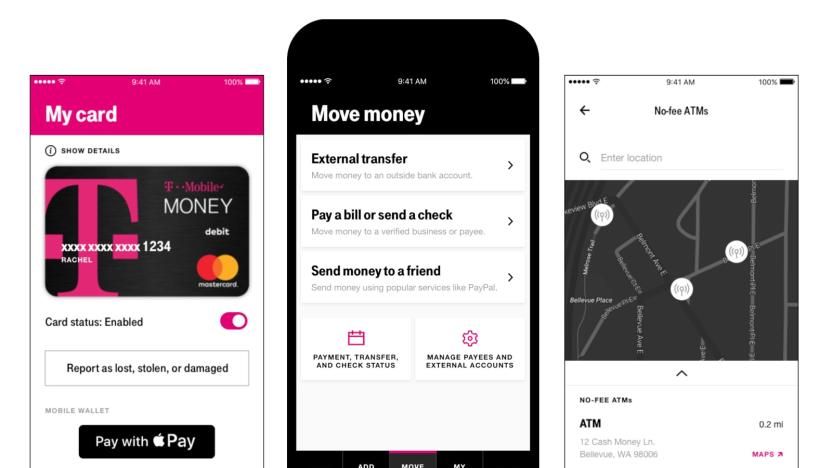

T-Mobile's Money banking app makes its nationwide debut

T-Mobile's entry into the mobile banking game is now available nationwide, a bit over four months after it first rolled out as a pilot program. The mobile-first checking account is called T-Mobile Money, and it comes with some sweet perks for the carrier's subscribers. It has no fees and offers a four percent Annual Percentage Yield (APY) for users' money up to $3,000 -- everything above that will have a one percent APY -- so long as they sign up with their T-Mobile ID and deposit at least $200 each month.

Key suspect in JPMorgan hack is now in US custody

Closure might be coming for victims of the massive JPMorgan Chase hack in 2014. The country of Georgia has extradited the alleged (and until now mysterious) hacker at the core of the crime, Andrei Tyurin, to the US. The Russian citizen pleaded not guilty in a New York court to charges that included conspiracy, hacking, identity theft and wire fraud. He reportedly worked with mastermind Gery Shalon to steal personal data from JPMorgan and other banks for use in a pump-and-dump stock scheme that may have made hundreds of millions of dollars.

Wells Fargo says hundreds lost homes after computing 'error'

Software mistakes are normally little more than inconveniences, but they had particularly serious consequences for some Wells Fargo customers. An SEC filing from the bank has revealed that a "calculation error" in its mortgage loan modification underwriting tool led to about 625 customers either being denied loan changes or not receiving offers when they would have qualified. Roughly 400 of those customers eventually lost their homes to foreclosure, Wells Fargo said. The bank stressed in a statement to CNN Money that the bug didn't necessarily cause the foreclosures, but it certainly didn't help.

Chase now offers phone-based withdrawals at 'nearly all' ATMs

It took a long, long time, but Chase's phone-based ATM withdrawals are finally widespread. The bank has expanded its card-free access to "nearly all" of its ATMs across the US, giving you one less reason to panic if you leave your wallet at home. As before, you can get in by tapping a device with a Chase debit or Liquid card linked to Apple Pay, Google Pay or Samsung Pay, and then entering your PIN code. It's functionally equivalent to using your regular card, so you're not facing the usual limits that come with making tap-to-pay purchases.

You can't buy bitcoin with Wells Fargo credit cards anymore

Wells Fargo is pumping the brakes on customers using their credit cards to buy bitcoin -- the bank has banned credit card cryptocurrency purchases. However, this isn't a permanent measure, as Wells Fargo will monitor the crypto market and reassess the issue as needed, Bloomberg reports. Wells Fargo joins Bank of America, JP Morgan Chase and Citigroup, along with some UK banks, in banning credit crypto purchases.

What to keep in mind before switching to a mobile-first bank

The day I got my first-ever paycheck, I scrawled my signature on the back, went to the bank, dropped it off with a kindly teller and left with a deposit slip and a smile on my face. A few years after that, a Canadian financial titan bought my bank and started managing it differently. That made the decision to embrace an upstart, mobile-first bank -- Simple, in this case -- that much easier. I can't pretend that the idea of trusting my money to a startup wasn't a little worrisome, but the appeal of novel features and Silicon Valley speed quickly won me over and I haven't looked back. You might enjoy making the switch too, but before you pull the trigger, here are a few questions to ask yourself.

Senate set to approve bill that would make credit freezes free

In the aftermath of last year's Equifax data breach, a handful of Senators led by Elizabeth Warren introduced a bill that would allow consumers to freeze their credit at any time for free. Now the Senate appears to be set to approve a broader banking bill that includes that stipulation, the Wall Street Journal reports. Currently, eight states and Washington DC require credit-reporting agencies like Equifax, Experian and TransUnion to provide credit freezes at no cost to the consumer while the other 42 states allow those companies to charge fees in most cases. But this bill, on track to be approved by the Senate next week, would make it so all consumers across the country could request and end a credit freeze without having to pay any fees to do so.

Amazon might introduce its own branded checking accounts

It turns out that healthcare may not be the only new sector that Amazon is venturing into. According to The Wall Street Journal, the online retail giant is in talks with J.P. Morgan to building a product similar to a checking account for Amazon's customer base.

ATM 'jackpotting' hacks reach the US

For some ATM thieves, swiping card data involves too much patience -- they'd rather just take the money and run. The US Secret Service has warned ATM makers Diebold Nixdorf and NCR that "jackpotting" hacks, where crooks force machine to cough up large sums of cash, have reached the US after years of creating problems in Asia, Europe and Mexico. The attacks have focused largely on Diebold's front-loading Opteva ATMs in stand-alone locations, such as retail stores and drive-thrus, and have relied on a combination of malware and hardware to pull off heists.

Open Banking is here to change how you manage your money

After completing a review of the retail banking sector back in the summer of 2016, the UK Competition and Markets Authority (CMA) concluded that stagnation had set in. It found that hardly anyone switches banks each year, and the huge financial institutions don't put a lot of effort into retaining or competing for business. Among a number of reforms the CMA put into motion was "Open Banking," which requires all the big banks to make your financial data accessible in a standard format. The deadline to comply with the open banking initiative passed over the weekend, and several key names have missed the launch. It's now officially up and running, however, and it promises to completely change how you choose and use all kinds of financial services.

Digital bank Monzo now supports Android Pay

Monzo, the British "bank" with a coral-coloured card and a clever savings app, has added support for Android Pay. It's only available for users with current accounts, however. Monzo started with a simple pre-paid card, forcing customers to transfer money from an existing bank account to take advantage of its app-based smarts. In April, however, it was approved by the UK authorities to act, well, like a real bank and offer proper accounts. Since then, it's slowly been inviting pre-paid card owners to switch over (the company says all users should be transferred in the next six weeks.)