bitcoin

Latest

Federal Reserve has no authority to regulate Bitcoin, according to Chairwoman

Well, it doesn't appear that the Federal Reserve will be stepping in to regulate the volatile virtual currency Bitcoin any time soon. According to the new Fed Chairwoman Janet Yellen, the central banking system has no authority over Bitcoin. In testimony before the Senate Banking Committee she said that, "this is a payment innovation that is taking place entirely outside the banking industry." Without a central issuer or operator it's incredibly difficult to successfully regulate and supervise these types of currencies. Don't think that Bitcoin is untouchable, however. Yellen went on to say that, "it certainly would be appropriate, I think, for Congress to ask questions about what the right legal structure would be for virtual currencies that involve nontraditional players." Legal efforts to restrict Bitcoin have already taken off in other countries, and Senator Joe Manchin (a Democrat from West Virginia) has suggested banning the crypto-currency in the US. While an outright ban of Bitcoin seems unlikely given its growing acceptance, Japan's Ministry of Finance has indicated that it could work with other nations to establish a set of international regulations. If a set of rules could be agreed upon at an international level, it could prevent people from taking advantage of loopholes that only serve to encourage instability and abuse. The public posturing and legal wrangling is hardly surprising following the shutdown of Mt. Gox, the largest Bitcoin exchange in the world. The firm currently holds 744,000 Bitcoins (roughly $423 million), and the future of those funds is shaky at best. Whether or not the currency continues its ascension to legitimacy may rest on the results of the Fed's investigation into Mt. Gox. But it seems increasingly likely that the government will step in to put some restrictions on Bitcoin, sooner rather than later. (Photo by George Frey/Getty Images)

US Senator asks for a Bitcoin ban, but don't hold your breath

Many will tell you that Bitcoin stands on shaky legal ground. Senator Joe Manchin, however, believes it's outright dangerous -- to the point that he has sent a letter to regulators asking them to ban the digital currency. There's no regulation, he says, and Bitcoin's mix of anonymity and irreversibility is appealing to a shady crowd; the Senator believes that black markets and thieves operate with relative freedom. Manchin also points out that the digital cash is prone to both deflation and surprises that risk creating chaos, such as the recent shutdown of the Mt. Gox exchange. Don't cash out any virtual savings just yet, though. The letter doesn't pay much attention to legitimate commercial uses or those countries where Bitcoin is legal. It also plays up the "disruptive" effect on the economy; as Business Insider notes, the currency's worldwide market cap has never ventured beyond a comparatively small $14.5 billion. Whether or not you believe the new currency is safe, we'd add that the letter doesn't automatically translate to new regulations. Even if officials agree to Manchin's request, it could still be a long while before any Bitcoin ban takes effect. [Image credit: Third Way Think Tank, Flickr]

Mt. Gox reportedly subpoenaed by the feds, CEO confirms leaked proposal was legit

The strange days of (former?) Bitcoin exchange Mt. Gox continue. In a conversation with an industry consultant posted by Fox Business, its CEO Mark Karpeles confirmed that a PDF leaked by The Two Bit Idiot is "more or less" legitimate. According to Karpeles, it was a "bunch of proposals to deal with the issue at hand, not things that are actually planned and/or done." The Wall Street Journal reports its sources confirm that federal prosecutors sent a subpoena to Mt. Gox earlier this month, requiring it to preserve documents. Since the exchange turned out the lights last night, the price of Bitcoin has actually risen again, and is currently showing a buy price of $581 on Coinbase. While the digital currency itself seems to be moving on, what's next for Mt. Gox is unclear. Karpeles sent an email to Reuters indicating an official statement will come "soonish," -- not too soon, we expect, for those waiting to find out what's happened to their funds.

Daily Roundup: Mt. Gox goes offline, OS X update, Disney's new app and more!

You might say the day is never really done in consumer technology news. Your workday, however, hopefully draws to a close at some point. This is the Daily Roundup on Engadget, a quick peek back at the top headlines for the past 24 hours -- all handpicked by the editors here at the site. Click on through the break, and enjoy.

Bitcoin and other cryptocurrencies compromised by Pony botnet

It looks like the Pony botnet that stole two million passwords in December has an even more egregious sibling galloping around. According to security firm Trustwave, this more advanced botnet has compromised 700,000 various online accounts up to date (it's been active since September), including 85 Bitcoin and other cryptocurrency wallets mostly from Europe. In the months since the equine-loving hackers got the wallets' private keys, a total of $220,000 have been transferred into and out of the accounts. Because anyone can take over a wallet with the appropriate private key (and cryptocurrencies' transactions go through anonymously), it's unclear whether that much money was actually stolen. Some of those transactions could very well be performed by the original owners themselves. Still, add this incident on top of the $1.2 million Input.io Bitcoin heist in 2013, and it's clear users need to start using (strong) transaction passwords and store their wallets offline. Those who've sadly been negligent in the security department can use Trustwave's Bitcoin tool to check if they own one of the 85 accounts. Considering popular Bitcoin exchange website Mt. Gox just went dark, as well, we hope nobody's retirement funds got wiped out.

Bitcoin exchange Mt. Gox goes dark (update: site issues cryptic statement, could still relaunch as Gox)

Less than a year ago when we took a long look at Bitcoin, exchange Mt. Gox reportedly handled some 80 percent of global traffic in the digital currency. Tonight however, the exchange's website is offline, all tweets have been deleted from its account, and customers are unsure what will happen to fiat currency (cash) or Bitcoin that it holds. There were signs of trouble before this however, as Mt. Gox hasn't been the leading Bitcoin exchange since late last year, and it halted customer withdrawals on February 7th. The Bitcoin Foundation, which advocates for the digital currency, announced that Mt. Gox CEO Mark Karpeles resigned on Sunday. A price index from digital currency tracker CoinDesk currently shows the value of Bitcoin has dropped $100 in 12 hours to $463, while Coinbase lists a buy price of $448. Prices for Bitcoin on Mt. Gox had fallen as low as $135, as the exchange issued a statement on the 17th that it had halted withdrawals while dealing with security issues. Rumors have flown about what's going on, and Reddit poster relliMmoT, who posted the screenshot above, reports trading halted at 8:59PM ET before the site went offline. Several other companies involved in digital currency including Coinbase, Blockchain.info, Circle, Kraken, Bitstamp.net and BTC China have issued a joint statement in response, decrying Mt. Gox's "tragic violation" of user trust. They're also promising to reassure customers and the public about their security, and to "lead the way" in consumer protection measures. Curiously, the statement originally referred to the exchange as insolvent (and still does on Circle), but that reference has been removed. According to Re/code a spokesman for the group stated that the troubled exchange has informed others that it will file for bankruptcy, but that can't be confirmed at this time. Update: Several Twitter users have noticed a change in Mt. Gox's previously DOA website. Instead of simply failing to load, as of 4AM ET or so, it has switched to a blank page with HTML indicating "put announce for mtgox acq here." Is someone about to step in and clean up the mess? If and when we hear something definitive, we will let you know. Update 2 (9AM ET): Coindesk says domain investor Andy Booth has confirmed the sale of the Gox.com domain to Mt. Gox CEO Mark Karpeles. This is particularly notable, because it lends credibility to an alleged pitch document originally posted by "two bit idiot" with an appeal to potential investors for relaunching Mt. Gox. According to the document (here and embedded after the break), the exchange has significantly more liabilities than assets while suffering from "massive robbery and poor Bitcoin accounting." Other than planning for a replacement CEO, it closes by pushing for a transition to "Gox," and offering limited withdrawals as it generates revenue to pay back stakeholders. Update 3 (11AM ET): Mt. Gox has released an official statement saying that it has closed all transactions as a precaution to protect the site and its users. Unfortunately, it's not entirely clear what the team is protecting users from. Perhaps its the volatility introduced by the domain changing hands or an impeding bankruptcy proceeding. Or, maybe, it's somehow related to the more advanced version of the Pony botnet that's been making the rounds -- but that seems unlikely. The entire statement is below. Dear MtGox Customers, In the event of recent news reports and the potential repercussions on MtGox's operations and the market, a decision was taken to close all transactions for the time being in order to protect the site and our users. We will be closely monitoring the situation and will react accordingly. Best regards, MtGox Team

Bing now shows how much your Bitcoin is worth in other currencies

While some may be opposed to the idea of Bitcoin, others are doing all they can to adjust to the recent digital currency rush. Today, Bing, in partnership with Coinbase, announced it has added support for Bitcoin within its currency-conversion tools. Simply put, you can now use Microsoft's search engine to see what the value of your new-age money is in, say, dollars, pesos, euros or any of the other 50-plus currencies Bing has indexed. And it's all done in real time, too. No Bitcoin? No problem -- there's nothing wrong with entering some random numbers for fun's sake.

Blockchain CEO calls Apple a 'gatekeeper on innovation' after Bitcoin wallet pulled from the App Store

Apple last week removed a Bitcoin wallet app called Blockchain from the App Store, prompting Blockchain CEO Nicholas Cary to lay out some harsh words for Apple. In a video interview with CNBC, Cary said Apple was a "gatekeeper on innovation" and that the company removed the app without providing any sort of viable explanation. What Apple ultimately told Cary via a succinct email was that the app was removed "due to an unresolved issue." Cary theorizes that the app was likely removed because Apple is planning to get into the mobile payments space and that they therefore view Blockchain as a competing service. Notably, Blockchain has been on the App Store since July of 2012, which only serves to add a layer of confusion as to the app's abrupt removal. "Apple has telegraphed they'll do something on top of the hundreds of millions of credit cards they have on their system," Cary told CNBC. "Bitcoin represents a major threat to any revenue model they may try to build. Anything they do with credit cards is not going to be innovative. Bitcoin is." In fact, Blockchain isn't the only Bitcoin-based app to have been shown the door in recent months. Bloomberg reports: Applications to monitor the price of Bitcoin or access related news are still available on the store. Coinbase Inc. and Gliph Inc., two San Francisco-based startups that let users transact, are also no longer on Apple's App Store. Fred Ehrsam, the CEO of Coinbase, said the app was removed in November. Rob Banagale, CEO of Gliph, said Apple allowed the the company's app on the store, provided it removed the ability to send and receive Bitcoins. While Bitcoin has a vocal group of proponents, keep in mind that the digital currency is not without its fair share of controversy and practical hurdles. To that end, Apple's wariness of apps that facilitate Bitcoin transactions is not completely surprising or unwarranted. Just this Friday, The Verge reported on a slew of Coinbase thefts that left some Bitcoin users up to $10,000 out of pocket. On a related note, Reddit CEO Yishan Wong, who formerly worked as an engineer at both PayPal and Facebook, eloquently describes two challenges facing Bitcoin in a great post on Quora that's a must-read for anyone with an interest in Bitcoin and its alleged potential to become a viable form of trade.

Russian authorities only accept real money

Now that the good people of Russia have been robbed of untold billions to fund corruption at the Sochi Olympics, their government would like to warn them of a much more serious danger: Bitcoin. The crypto-currency could easily lose its value, according to a statement from the country's central bank, and could draw citizens into unintentionally supporting illegal activity and "financing terrorism." In keeping with the tough stance adopted by China and India, but in contrast to the more laid back attitude taken in some other parts of the world, Russia's General Prosecutor's Office has also chimed in to describe Bitcoin as a prohibited "money substitute." It has reiterated that the country's only officially accepted currency is the rouble, preferably in a plain brown envelope.

Such wow -- First Dogecoin wallet is out on iOS

Cryptocurrencies have exploded over the last few years, creating nongovernmental economies that allow users to buy goods with "money" made from ones and zeros. The craze kicked off with Bitcoin, but other competitors are rising with surprising regularity pulling their inspiration from figures like Kanye West (who sued) and traditional startup ideas alike. Still only one cyrptocurrency has recently been growing in a way that should make cryptocurrency fans say "wow." Or maybe "such wow." That currency is Dogecoin. Inspired by the famous "Doge" meme, Dogecoin was founded out of a desire to have a cryptocurrency that was free from the sometimes shady uses Bitcoin became famous for early in its existence. Currently the fifth most popular cryptocurrency being traded, Dogecoin has been growing steadily. That growth can only be helped with the recent launch of Dogecoin's own iOS digital wallet, MYDOGE. MYDOGE allows users to quickly and easily manage their Dogecoin wallet, while keeping up to date on how the currency is trading on digital markets. While the app currently doesn't allow users to make purchases directly from the wallet, you can still share your wallet's address by scanning your QR code. MYDOGE launched on February 6, so it is still in the puppy stage of its existence. Still this is a big first step for fans the digital currency that will allow its disciples to easily show off and explain Dogecoin to new people using a familiar interface. We're not quite to the "such wow" level of excitement over this app just yet, but MYDOGE is something you should keep your ears open for. This is an important first step. We'll be curious to see if MYDOGE can help dig up new users of the currency. We'll also be curious if Apple keeps the app in the store, considering the final Bitcoin wallet was just removed.

Olympic athletes ordered to cover Apple logos during the games? and other news for Feb. 6. 2014

Update: The story regarding the "request to cover Apple logos" during the Olympics turns out to be a miscommunication, and not an overall instruction. Macworld has the story. The International Olympic Committee is telling all athletes to cover Apple logos on any mobile devices they use throughout the 2014 Winter Olympics. You see, Samsung is a sponsor, and its agreement guarantees that athletes may not mention competitors or display competitors' logos during Winter Olympics. Samsung's request is nothing new. Virtually every Olympic sponsor has similar clauses in their sponsorship contracts. The official Olympic Charter states that athletes must comply or else risk "removal of accreditation and financial penalties" or even disqualifications. The specific clause is known as "Rule 40" and, needless to say, is quite controversial. The International Olympic Committee, however, says Rule 40 is a necessity because without sponsors, the games could not take place. In other news: Square-Enix has launched Final Fantasy VI for iOS devices. Square-Enix says that all the graphics were "painstakingly recreated" for mobile devices. The game costs US$15.99. Apple has removed the popular Blockchain Bitcoin app from the App Store. Blockchain allowed users to send and receive Bitcoins to each other. The developer says Apple told him it was withdrawn "due to an unresolved issue," but notes that Apple did not specify what the issue was and that the app has been in the App Store for two years already. Apple has posted a new video called "On The Runway" on its iPhone page. The video uses re-edited footage that was shot using the iPhone 5s at the Burberry Fashion Show in London last fall. Apple has confirmed on its website that it will open its first retail store in Brazil on February 15. The store will be in the VillageMall luxury shopping center located in the Barra da Tijuca borough of Rio de Janeiro.

Congress' new report tells you where Bitcoin is legal

Unfortunately, you can't assume that Bitcoin is legal everywhere you go -- it's safe to use the digital cash in some countries, but it's mostly verboten in others. However, you won't have to travel blind. The US' Law Library of Congress has just published a report (PDF) that outlines Bitcoin's legal status in 40 countries. In short, the currency mostly exists in a gray area. While countries like Germany and Finland have cleared Bitcoin for legal use in some conditions, most nations either haven't regulated it or see it as too risky. Don't leave your physical wallet at home on your next vacation, then.

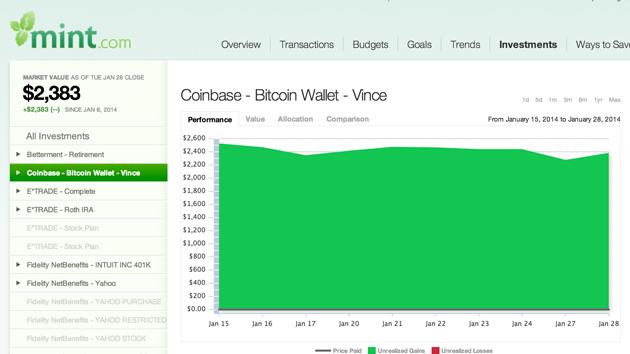

Mint now lets you keep track of Bitcoins with its personal finance apps

Now that Bitcoin has taken root in daily financial transactions, those who fancy the digital currency need a way to easily keep an eye on the tally. Well, for the folks that meet that criteria, Mint now lets users keep track of transactions with the help of Coinbase. This means that Bitcoin Wallet figures can be viewed alongside other banking, credit card and investment accounts. The integration also automatically converts the account balance to US dollars to keep the mental math at a minimum.

Feedback Loop: 30 years of Mac, mechanical keyboards, Bitcoin alternatives and more!

Welcome to Feedback Loop, a weekly roundup of the most interesting discussions happening within the Engadget community. There's so much technology to talk about and so little time to enjoy it, but you have a lot of great ideas and opinions that need to be shared! Join us every Saturday as we highlight some of the most interesting discussions that happened during the past week. This week, the Macintosh turned 30, so naturally, we had to share our fondest memories of our first Mac. We also dove into the complex world of mechanical keyboards, examined the potential health benefits of WiFi-connected LED lightbulbs, discussed the viability of Bitcoin alternatives and asked about the best laptops for software development. Click past the break and read what fellow Engadget users like you have to say.

Sacramento Kings set to broadcast using Google Glass, accept Bitcoins

Watching hoops from the stands or on TV is great, but have you ever wanted to see an NBA game from the perspective of a coach, cheerleader or broadcaster? That's going to happen on January 24th during a Sacramento Kings broadcast vs. the Indiana Pacers, as select players and staff will be decked out in Google Glass -- along with the team's mascot, announcers, dancers and others. All that will be coordinated by a company called CrowdOptic, which will analyze in real time where all the devices are aimed and distill everything to a manageable feed for broadcast. At the same time, the Kings have announced that it'll be the first pro sports franchise to accept Bitcoins, letting fans purchase merchandise and tickets by March 1st using the virtual currency. There's a video after the break to give you a sneak peak at the players-eye-view -- we'll have to see if they're smiling as much after the game.

US Government now owns Silk Road's $25 million Bitcoin hoard

If we're honest, asset seizures are inherently hilarious. After all, for every sports car that's flogged to boost the public purse, there must be an unsaleable giant mechanical heron just gathering dust in a federal warehouse. After shutting down Silk Road, the US has now gained a slightly more useful treasure for its collection: 29,665 in Bitcoin, currently worth around $25 million. The celebrations won't begin just yet, however, since Ross "Dread Pirate Roberts" Ulbricht, Silk Road's alleged founder, is claiming that a further 144,336 BTC (around $120 million) found on his personal computers are not the proceeds of crime, and therefore cannot be seized. What happens to the cash now? It'll go into the pockets of the US Marshals, with some of the cash probably going to pay off the storage costs for that giant mechanical heron.

Live from the Engadget CES Stage: KnCMiner

What better way to send off CES 2014 than with some Bitcoin talk? KnCMiner, the Swedish company behind a number of high profile Bitcoin mining machines will join us for our final on-stage CES interview of the year. January 10, 2014 7:30:00 PM EST

One step closer to legitimacy: Bitcoin payment live on Overstock

While it's legal to pay with Bitcoin in the US, the digital currency hasn't been very useful for mainstream shoppers. However, that's changing today -- Overstock has just become the first major American online retailer to accept Bitcoin. You'll still see prices listed in old-fashioned dollars, but you can choose the newer payment method at checkout. CEO Patrick Byrne tells Wired that he made the move for both pragmatic and idealistic reasons: Bitcoin doesn't cost as much to accept compared to credit cards or PayPal, and its nationless nature reduces the chances that a failed bank or country will create problems. It's tough to tell whether other big e-retailers will follow suit, but we can't imagine that competing shops will want to leave that much virtual money on the table.

Zynga adds Bitcoin to payment options, Bitcoin value soars

Casual games publisher Zynga is now testing the use of Bitcoin in its games, a decision that has had a drastic (if temporary) impact on the overall value of the virtual currency. "In response to Bitcoin's rise in popularity around the world, Zynga, with help from BitPay, is testing expanded payment options for players to make in-game purchases using Bitcoin," Zynga representatives wrote on Reddit. "The Bitcoin test is only available to Zynga.com players playing FarmVille 2, CastleVille, ChefVille, CoasterVille, Hidden Chronicles, Hidden Shadows and CityVille." Despite that relatively short list, the games mentioned are Zynga's most popular, flagship offerings, demonstrating that the company has quite a bit of faith in Bitcoin, an open-source, peer-to-peer substitute for real-world cash that has achieved impressive fame in the wake of numerous international economic catastrophes. Following Zynga's announcement, the value of Bitcoin immediately jumped to a high of $1,093 per Bitcoin, according to the Los Angeles Times. It has since receded to $955.60, and continues to drop, though overall Bitcoin value remains about $50 higher than it was immediately prior to Zynga's revelation. (Image: Coin Desk)

The biggest stories of 2013: Console wars, Bitcoin's boom and the NSA's very bad year

2013 was a bust! Or so we've been told. Whether you follow that line of thinking or reflect on the last 363 days in a more optimistic light, it's clear the year wasn't all big breakthroughs and great triumphs. This was the year of government surveillance revelations, fallen giants and lackluster product releases. But it was also the year Netflix took on the studios, patent reform became a real priority in DC and two new game consoles hit the scene. No, we won't be riding our hoverboards into the sunset at the close of 2013, but the stories that rocked the industry had a profound impact not only on technology, but also on society as a whole. So let's raise those half-empty glasses and make a toast as we recap the year that was: Here's to the glassholes!