venmo

Latest

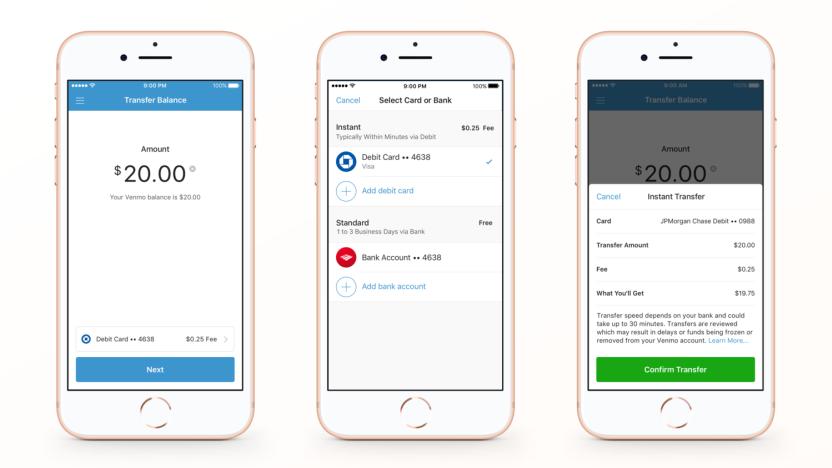

Venmo's 25-cent instant transfers are now available for everyone

Payment sharing services from Paypal, Square and Venmo are great, but it can take some time to move funds from those accounts to your bank so you can use them in real life. Last year, Paypal introduced $0.25 instant transfer fees to make it much faster to move money to your real-life bank. Now Paypal-owned Venmo is doing the same, offering transfers of funds in less than 30 minutes.

Facebook Messenger's money transfer tool is heading to the UK

Back in 2015, Facebook introduced the ability to send money to friends through Messenger and now it has brought that capability to UK users. It's the first time Facebook has launched the feature outside of the US.

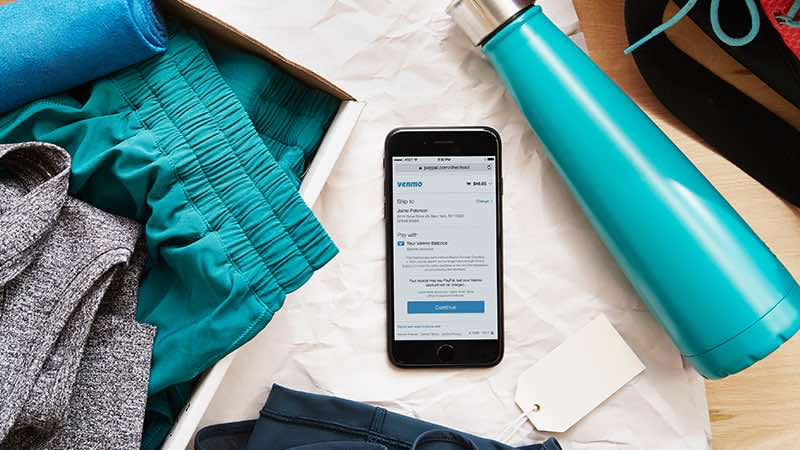

Online shoppers can now use Venmo to pay for their new gear

It's already great for paying back friends and splitting the rent, but Venmo is about to get even more useful. In a bid to court a more youthful generation of online shoppers, PayPal -- the popular app's parent company -- announced this morning that over 2 million US online retailers will accept payments through Venmo.

America’s cash-free future is just around the corner

Shake Shack's next burger joint at Astor Place in NYC doesn't want your money -- at least not the physical variety. In an effort to reduce the "friction time" between paying for your meal and eating it, the company plans to replace human cashiers for automated kiosks which won't accept actual bills and coins, only cards. This move is part of a global trend away from cash-based economies and towards Star Wars-style credits. But could such a monetary revolution actually benefit all Americans? Don't bet on it.

Apple’s Venmo-like money transfers will arrive after iOS 11

A new payment service from Apple is set to launch sometime this fall through iOS 11 and watchOS 4 updates. Apple Pay Cash will allow Apple device users to transfer money between each other within Messages or through Siri.

Venmo invites users to try physical debit cards

Venmo is inviting select users to try out new debit cards that deducts right from their account, TechCrunch reported. This is four months after rival payment service Square started trying out its own card (and two months after its public launch), so Venmo is a little late to the game, but apparently users are already getting their new payment plastic.

Zelle's bank-backed payments app launches September 12th

We've been talking about Zelle, a mobile payments system backed by over 30 major US banks, for over a year now, but the service has yet to release a standalone app. That is, until now. Zelle's app is finally launching on Tuesday, September 12th. It will be available in the App Store and on Google Play.

Venmo adds QR codes to make finding friends easier

Venmo wants to make it easier for you to find your friends. Instead of searching for their exact quirky handle, the payment service just added QR codes to user profiles. Just click the "Scan Code" option in the app's menu, which lets you capture others' codes with your mobile device's camera or display your own for others to scan.

Transfer PayPal funds mid-chat with Skype’s ‘Send Money’ feature

Skype and PayPal have teamed up to make it easier for you to transfer money to someone mid-conversation. If you're talking to a pal through the Skype mobile app and remember you need to reimburse them for those drinks they bought the other night, just swipe right and tap the new "Send Money" feature. PayPal will take it from there.

PayPal taps into your Chase and Citibank accounts

Paypal-owned mobile payment app Venmo opened up third-party app support last year in an attempt to capture more money via more merchant transactions, including those from Poshmark, Parking Panda, and Delivery.com. The service has a competitor, of course, backed by more than 30 major US banks. Zelle promises easy money transfer between the bank's own apps without having to go through a middleman like Paypal or Facebook Messenger. Two of the banks involved with Zelle, Citibank and Chase, however, have just partnered with Paypal.

Square's personalized prepaid card is available to everyone

Digital payment service Square has been inviting customers to sign up for its prepaid debit card since May, and is now opening up the program to everyone. On Thursday, the company announced the Square Cash Card is available to order via the Square app or website.

Venmo reportedly made physical debit cards for a trial run

Venmo is reportedly taking a leaf out of other digital payment services' book and making a physical debit card. According to Recode, the PayPal-owned mobile app created to make going Dutch with friends a lot easier has already begun testing a card that would allow users to spend the money in their accounts in brick-and-mortar stores. Some Venmo employees' feeds show them using the app to pay for purchases from fast-food chains like Taco Bell, confirming that the company is indeed testing something outside its core features. Before this, people could only use Venmo to pay for purchases from partner apps.

Zelle takes on Venmo from within your bank's app

From Venmo and PayPal to Facebook Messenger, Google Wallet and even iMessage, there are plenty of ways to send money to your friends online. But these all require your contacts to have accounts set up to receive funds, which often causes friction when you're using different services or they don't want to download new apps. A new tool called Zelle should solve that problem. It works with more than 30 major US banks to allow interbank transfer from within each company's app, so you or your friends don't have to set up new profiles or crowd up your already-cluttered phones with more downloads.

It looks like Apple is resurrecting its Venmo competitor

Apple began considering its own peer-to-peer payment system back in 2015. Since then, however, nothing seems to have come of it. Today, however, Recode reports that Apple is again in negotiations to launch its own money-transfer system to rival competing services like PayPal's wildly popular Venmo. Apple's new service, likely a feature for Apple Pay, could enable you to send money to a friend's iPhone from your own.

US banks will launch their Venmo competitor in October

In an attempt to add a little hipness to personal banking, a consortium of US banks has been quietly working on its very own Venmo competitor. While the details of the service are currently a little thin at the moment, the Wall Street Journal reports the banks have landed on a name: "Zelle." As in: "Hey, I forgot to bring cash for this pizza, can I just zelle you some dough?"

Venmo opens up third-party app support to all

After allowing a limited number of customers to try out a special beta offering Venmo support with third-party apps in January, Venmo is now allowing all its users to pay for things in the same manner. In fact, starting tomorrow, July 27th, you'll be able to use Venmo for a whole lot more.

Turkish law forces PayPal to suspend operations in the country

Turkey and the tech world's relationship is infamously contentious, and the country has crippled another company: PayPal. Starting this June 6th, the secure payment service is closing up shop, according to a statement (Turkish) spotted by TechCrunch. Paypal users in the country will be able to transfer any balances to a Turkish bank account after that, but that's about it. Sending and receiving money -- you know, PayPal's main attraction -- via the service will be off the table.

PayPal has a Super Bowl ad, too

At the rate companies are releasing their Super Bowl ads prior to this Sunday, it's a wonder why they even spent the millions to air them during the big game at all. The latest in that YouTube-approved trend is none other than PayPal, which is hoping to sell viewers on the idea that it's "new money." The under-a-minute clip has everything an ad needs these days to garner attention amid the cacophony of macro-brewed beer commercials and flashy spots for monsters that reside in red and white spheres.

PayPal's Venmo adds third-party app payment support

After being dogged by scary security concerns last year, PayPal-owned Venmo is focusing on new features for its payment system. The company revealed that it will let you pay for sporting events via Gametime and gourmet meal deliveries from Munchery. The service is only available on iOS for select users to start, but Venmo plans to use the limited rollout to get feedback and will add more folks over time. The service works much as PayPal does -- you just tap the Venmo icon to pay, and will be linked directly to the app for authentication. Payments are automatically added to your purchase history.

Venmo finally gets more secure with two-factor authentication

If you're the type who uses Venmo to pay your buddies back for artisanal cupcakes, congratulations: You're a little bit safer now. Venmo announced the other day that it was rolling out a new two-factor identification feature -- when the service detects a login from a new device, it'll send you an email and a 6-digit pin to your phone so you can prove everything's on the up and up. That might sound like a no-brainer for a financial services company that's (thanks to back-to-back acquisitions) part of eBay's payments empire, and you know what? It absolutely is. The only thing more shocking than Venmo not having something like this in the first place is how long its taken to implement.