finance

Latest

Elon Musk buys his old X.com domain from PayPal

Elon Musk is without a doubt the most famous single-letter domain owner ever, as his company X.com eventually became PayPal. Unfortunately, when Musk was pushed out, the domain (with its aught-tastic logo, above) stayed behind with PayPal. However, the SpaceX and Tesla CEO has bought it back for an unknown sum, according to Domain Investing and a tweet by Musk. Nobody's saying how much he paid, but as a term of reference, Z.com sold for around $6.8 million three years ago.

Zelle takes on Venmo from within your bank's app

From Venmo and PayPal to Facebook Messenger, Google Wallet and even iMessage, there are plenty of ways to send money to your friends online. But these all require your contacts to have accounts set up to receive funds, which often causes friction when you're using different services or they don't want to download new apps. A new tool called Zelle should solve that problem. It works with more than 30 major US banks to allow interbank transfer from within each company's app, so you or your friends don't have to set up new profiles or crowd up your already-cluttered phones with more downloads.

A major investment company is taking bitcoin very seriously

Many predicted that the world would soon lose interest in bitcoin. Yet, eight years after its inception, its surprisingly robust Blockchain tech and prominence on the darkweb has led to the cryptocurrency trading at an all time high. This success hasn't gone unnoticed in the financial world, and now bitcoin is being integrated into one of America's largest brokerage company -- Fidelity Investments.

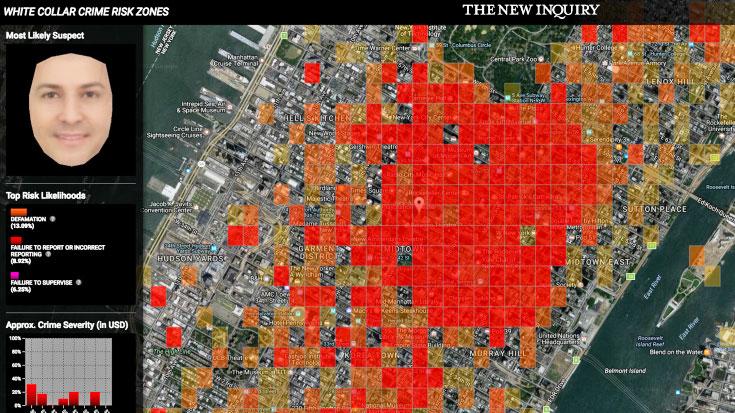

'White Collar' crime tracker mocks police profiling bias

As Police forces edge ever closer to realizing the plot of Minority Report, a new art-slash-research project aims to point out inequality in our society. With White Collar Crime Risk Zones, three artists come researchers are reworking predictive policing tech to highlight police bias. Instead of utilizing heat maps to predict where street crime could occur, this software flags potential financial crime hotspots. Using an algorithm based on historical white collar offences committed since 1964, it assesses the risk of financial crime in any given area, even predicting the most likely offense.

Monzo is now a proper digital bank

UK banking startup Monzo has been given the green light by the Prudential Regulation Authority and the Financial Conduct Authority to operate, well, like an actual bank. Until now, the company has been working with a restricted banking licence, which meant you had to have a connected, external bank account to use its pre-paid card and money-saving software. The mobile-first approach attracted plenty of fans, but there were limitations to the setup -- Monzo could only hold deposits up to £50,000, for instance. For years, the plan has been to become a proper digital bank.

Mint adds payment tracking so you'll never pay a late fee again

Missing even one bill payment can have serious repercussions for your credit. Not only does doing so ding your score, it can also invoke penalty and overdraft fees, as well as boost the interest rates on your account. In fact, Americans on the whole spend more than $77 billion in penalties annually for missing their Due By dates. Mint, the personal finance management app from Intuit, aims to reduce those costly mistakes with a helpful new update for its mobile users: unified bill and payment tracking.

HSBC trialling app that automates your savings

While all the major banks have pretty good online facilities, there's a whole breed of nimble startups using mobile apps and bank account data to create new, more personalised money management services. Hoping to learn some new tricks, HSBC announced today it has partnered with one of these fintech pups, Pariti, to launch a standalone iOS app geared towards "micro-savings." The SmartSave app, which you can link to any bank account HSBC or otherwise, will automatically transfer money into savings or investments accounts based on user-defined rules.

Wells Fargo will use 'robo-advisers' to dish out investment help

You won't have to go to a dedicated, tech-focused firm to get investment help from machines instead of humans. Wells Fargo has revealed that it's using SigFig's "robo-advisers" to offer guidance to investors. The sometimes troubled bank will launch a pilot program for the AI helpers sometime in the first half of 2017. It's not certain when you could see it widely available, but that will likely depend on the test's success.

Trader pleads guilty to sparking stock market 'Flash Crash'

If you were trading on an American stock market on May 6th, 2010, you probably had a minor heart attack: the "Flash Crash" that day sent the Dow Jones Industrial Average down 1,000 points (600 in the first 5 minutes) and recovered virtually all its value in the space of just 15 minutes. However, investigators eventually discovered that the crash was the result of intentional manipulation... and now, investors are getting some justice for that manufactured crisis. Navinder Sarao (above), a British trader extradited to the US, has pleaded guilty to charges of both wire fraud and spoofing that came from using automated trading software to make "at least" $12.8 million in illegal profit from the crash and beyond.

New York proposes online security rules for banks and insurers

New York state isn't happy that banks and insurers are falling prey to hackers with alarming frequency, and it's determined to do something about it. Governor Cuomo has unveiled proposed regulations that would set online security standards for those industries. All companies covered by the rules would have to establish online security programs and policies. They'd have to limit access to sensitive data (say, social security numbers) to only those people that need to know, and require multiple steps when checking user identities.

New stock exchange fights unfair online trading

Some (such as The Big Short author Michael Lewis) see high-frequency, algorithm-based stock trading as a serious threat to the economy. There's a concern that big trading firms are cornering the market by paying for ultra-fast connections that give them unfair advantages, such as front running (exploiting knowledge of advance orders from customers) and otherwise closing transactions before most rivals. Those financial heavyweights might not get to abuse the system if IEX has its way, though. It just opened a US stock exchange that aims to prevent these computer-driven attempts to game the system.

Experts think bitcoin's tech is the future of finance

Even if bitcoin fades into obscurity, finance experts believe that the technology behind it will live on and even change how financial services work. According to a study conducted by Swiss non-profit World Economic Forum, the blockchain, which is the public ledger that makes bitcoin transactions possible without a central infrastructure overseeing them, has the potential to "reshape financial services." The forum is known for holding an annual conference that brings business and finance experts together.

'Open banking' data will help Brits compare and switch accounts

Just as Ofcom is making it easy to switch broadband and mobile providers to inspire us to hunt for the best deals, the UK's Competition and Markets Authority (CMA) wants us to be similarly proactive about our bank accounts. Having completed a lengthy probe into retail banking, the CMA believes the secret to a more competitive industry lies in our data, and the sharing of it.

Monopoly money is no more in the new Ultimate Banking edition

Hasbro has released a new edition of Monopoly called Ultimate Banking, that should help keep familial infighting to a minimum. Instead of paper money, which can easily be laundered or stolen when you aren't looking, this new edition uses debit cards. It also does away with the easily-corrupted Banker position, replacing the human with an electronic card reader (aka an ATM).

PlayStation sells well (again), but mobile is hurting Sony

Sony made money. Again! The company saw in tiny increase (0.5%) in sales compared to the same quarter last to 2,581 billion yen (or $21.5 billion), but income now stands at $1.69 billion. This quarter's financial results was yet more balancing (and canceling) out of Sony's many moving parts -- profitable and not. Gaming and Motion Picture arms saw increases in sales, but these were cancelled out by woes in Mobile and Devices arms. Once a positive part of the company's earnings sheets, Sony's smartphone camera sensors saw a decrease in sales -- reflecting the tough times that all companies are experiencing with phone sales. The company seems to be stabilizing its giant electronics ship.

Amazon UK begins offering loans for pricier purchases

In a bid to put an even bigger squeeze on its brick-and-mortar competition, Amazon is now offering its customers instalment plans to help them buy the more expensive items on its website. According to The Guardian, Brits can now select Amazon's Pay Monthly option at the checkout, letting them pay for orders totalling more than £400 over a series of instalments. These loans, which are only provided once a customer passes an online credit check, can be spread over two, three or four years depending on the order amount and are charged at a current interest rate of 16.9 percent.

Amazon's Echo speaker guides you through workouts

Amazon must want to help you fulfill your New Year's resolutions, since it just updated the Echo speaker with a handful of features meant to get your life in shape. To begin with, you can ask Alexa to start a 7-minute workout -- the voice-guided cylinder will coach you every step of the way. You can also get your investments on track thanks to a Fidelity feature that tells you how individual stocks are doing. And if you're more interested in how political leaders fare this year, you can ask the Echo when the next Democratic or Republican debate will take place. The additions won't change your life, but they're definitely cheaper than visiting the gym or a financial guru.[Image credit: AP Photo/Mark Lennihan]

PayPal, Square and big banking's war on the sex industry

For nearly a decade, PayPal, JPMorgan Chase, Visa/MasterCard, and now Square, have systematically denied or closed accounts of small businesses, artists and independent contractors whose business happens to be about sex. These payment processing authorities have also coerced websites to cease featuring sexual content under threat of service withdrawal, all while blaming ambiguous rules or pressure from one another.Monday a federal appeals court ruled that pressuring credit card companies like Visa and Mastercard to stop doing business with speech-protected websites violates their First Amendment rights. Specifically ones that feature content from sex workers. And in June, the FDIC clarified that it's against the rules for businesses like PayPal, Chase and Square to refuse business or close accounts based on "high risk" assessments related to human sexuality. But it may not be enough to stop what's become an entrenched pattern of systematic discrimination by payment processors -- one that disproportionately denies financial opportunities for women.

Shift is a debit card for your bitcoin wallet

Even though the banking industry and US regulators are getting on board the bitcoin train, actually spending your hard-mined bitcoins can be a bit tricky. Luckily, Coinbase debuted a solution on Friday: the Shift debit card. It's the first such bitcoin-based debit card issued in the US and is backed by VISA. With it, bitcoin users will be able to shop at both on- and offline stores -- basically anywhere that VISA is accepted. The card is linked to your Signing up for the card simply requires filling out this form and paying the $10 issuance fee (in bitcoin of course).

Square bets big on payments as it becomes a public company

It's a big week for Jack Dorsey in more ways than one. The new Twitter CEO's other company, the payment service Square, has filed for an initial public stock offering that's tentatively worth up to $275 million. It's not certain just when shares will be available. However, the move shows a belief that Square's hopes of reinventing the purchasing process (through everything from readers to food delivery) have legs. As it stands, investments might be necessary in the short term. While Square's bottom line is improving, it continues to lose money -- $77.6 million just in the first half of this year. Going public gives the firm more breathing room, and may sharpen its focus. After all, it's about to have the expectations of many, many people riding on its shoulders.